Bitwage has released a new bitcoin-based payroll product that allows employers to pay employees outside the US in their local currency.

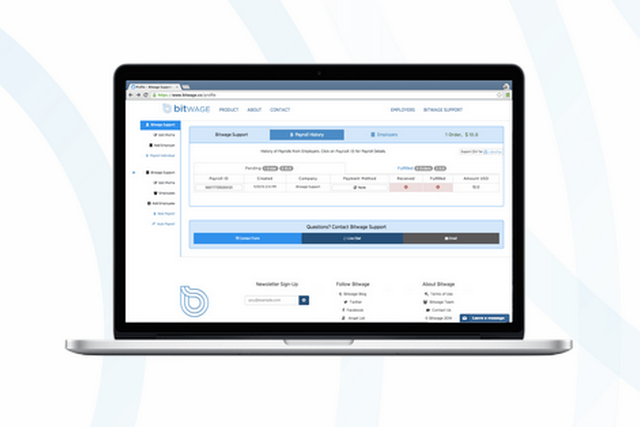

Bitwage, a Californian start-up that promises to make wages easy, secure and fast for its clients, has released a new bitcoin-based payroll product that makes it easy for American companies to pay employees outside the US in their local currency.

Due to the company’s partnership with bitcoin exchange Coins.ph, Bitwage customers can quickly and cheaply pay workers in the Philippines, even if they don’t have a bank account.

The company’s international payroll solution is working in the following way: it accepts money and pays out in fiat currency, but uses digital currency during the process of transferring the value from one place to another.

Bitwage launched in 2013 promoting its service as one that is “Closing the Financial Loop,” giving people the means to pay for living expenses and business operations in an enclosed Bitcoin ecosystem. The company allows employees to both receive a wage and pay for goods and services in Bitcoin through its Bitcoin Payroll service. Employees can choose a Bitcoin payout up to 100% of a paycheck each payment interval.

It was quite easy for Bitwage to integrate with Coins.ph, since the company already has a bitcoin payroll system in the US.

“One of the good things about the system is that, unlike a lot of other wallet providers and exchanges, you’re trusting them to hold on to their bitcoins. We’re just a conduit to make it so USD will flow into whatever wallet you chose,” Jonathan Chester, founder and Chief Strategy Officer of Bitwage, said.

Coins.ph customers can choose to obtain Philippine pesos or use preloaded cash cards, or receive their payments through bank transfers. Door-to-door delivery of cash is possible as well.

Chester told CoinDesk that he considers bitcoin as the singular payment protocol for paying people across the globe:

“The core of our products is basically trying to figure out how to bring modern financial tools around the world. We see bitcoin as a way to facilitate that. Bitcoin is the best way to get cross-border payments into the hands of both banked and underbanked people.”

Bitwage acts as an invisible mediator in payroll transactions. Employer usually asks an employee for bank transfer information when he/she first start working for this or that company.

“They’re just routing the [transaction] to Bitwage as opposed to routing the credit to a bank account,” explained Chester.

A precious metals company named AmagiMetals has announced on January 6, 2015, that they are going to start paying their employees in bitcoin rather than a standard paycheck in U.S. dollars via Bitwage. The company’s CEO Stephen Macaskill considers that the future of money is connected to the blockchain and to currencies outside the hands of central banks and political institutions, so Macaskill is placing his own salary under the new policy and will receive $40,000 per year of his wages in Bitcoin.

“The Amagi Metals team is innovative, not just in the goods and services it delivers, but also in the realm of benefits and payroll. Amagi Metals is leading a new era for Bitcoin adoption as one of the first companies to leverage Bitcoin to improve payroll efficiency while cutting operational costs,” Chester commented on Amagi Metals’ participation.

However, despite the fact that Bitcoin was named one of the worst investment of 2014 and that the price of Bitcoin has recently dropped, fluctuating from $226 to about $170 during the first part of January, 2015, Stephen Macaskill is not the only business owner or financial analyst to think that 2015 will be the year that the blockchain and the digital currencies that function from it will take off in the mainstream. Entrepreneur and economist Reggie Middleton of BoomBustBlog.com and UltraCoin predicted on the first Keiser Report of the year that the collapse of the dollar and other global fiat currencies would lead the blockchain to revolutionize Internet 2.0, and thrust digital currencies as a viable alternative, just as it emerged in Cyprus after the 2010 bail-in.