Check out the report created by OK Blockchain Capital covering main trends of blockchain industry over June 30-July 6, 2018, with strong focus placed on the market overview, analysis of the newly listed and closed public sales projects, along with topical news on global governmental policies.

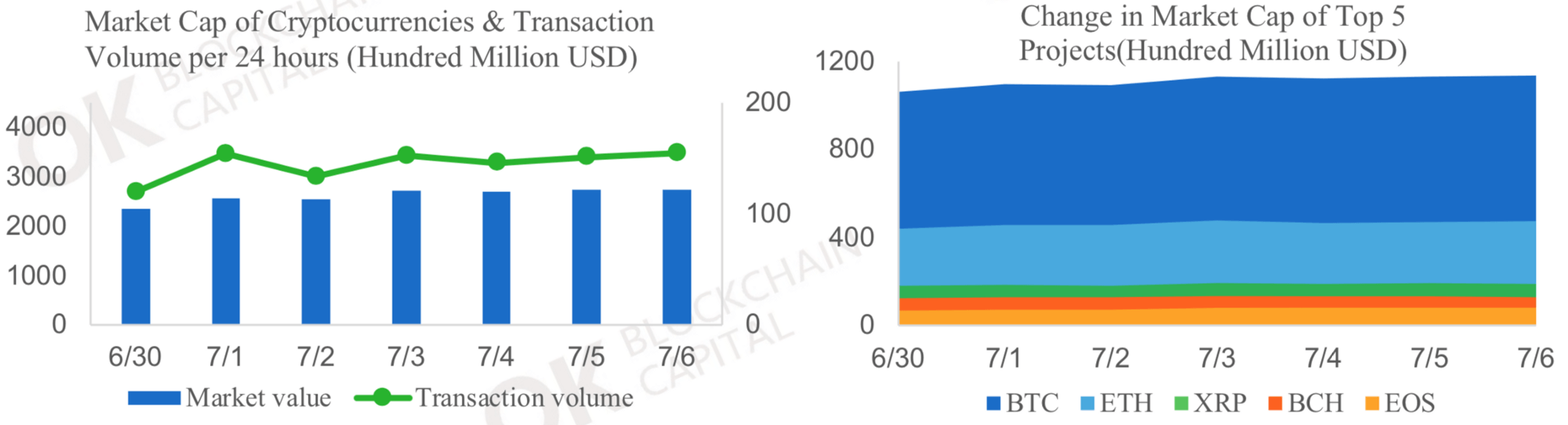

The past week’s daily average global market capitalization of cryptocurrency was $261.95 billion and the daily average transaction volume was $14.47 billion, indicating a decline of 4.91% and 3.02% respectively. The daily average market capitalization of the top five cryptocurrencies decreased by 4.42% from the previous week. Among the top five, EOS has experienced the greatest price increase in the past week with a high of $9.39, a decrease of 21.32%.

Data source:coinmarketcap

Of the top 10 cryptocurrencies that increased, 80% of the tokens were of the vertical industrial application sector. Also, SRCOIN of the cryptocurrency and payment sector experienced the greatest increase in price

Table 1. Tokens with Greatest Price Increases Last Week

| Ranking | Project | Token | Field | Brief description | Trading amount(24h) | Token price | Increase/7d |

| 1 | SRCOIN | SRCOIN | Medical insurance | The basic model of the SRCOIN project is to combine the massage chair subscription business with a decentralized health data platform. | $1,665,020.00 | $0.00 | 57.07% |

| 2 | Dorado | DOR | Consumerism | Dorado is a food delivery platform based on MVP commercialization. | $1,997,530.00 | $0.03 | 45.88% |

| 3 | AI Doctor | AIDOC | Medical insurance | AI Doctor is a private AI doctor who can provides general help. | $5,048,460.00 | $0.03 | 33.69% |

| 4 | MARK.SPACE | MRK | Entertainment | The world’s first VR/AR platform based on blockchain technology. | $3,055,790.00 | $0.06 | 33.06% |

| 5 | NaPoleonX | NPX | Asset management | The NapoleonX project aims to provide investors a new way to invest by creating a cryptocurrency fund (DAF). | $622,455.00 | $0.28 | 28.42% |

| 6 | GoChain | GO | Public chain and protocol | GoChain is a high-speed, low-cost Ethereum expansion network. | $4,069,160.00 | $0.06 | 28.04% |

| 7 | ODEM | ODE | Education | ODEM is an on-demand education platform built on the Ethereum blockchain. | $970,245.00 | $0.36 | 26.31% |

| 8 | Solaris | XLR | Cryptocurrency and payment | Solaris is a cryptocurrency that uses the POS consensus mechanism. | $82,911.00 | $3.75 | 25.73% |

| 9 | Delphy | DPY | Gambling | Delphy is the first distributed forecasting market based on blockchain in China. | $2,987,620.00 | $0.82 | 24.52% |

| 10 | AdHive | ADH | Advertising | AdHive is a marketing platform that uses artificial intelligence and blockchain technology to control market traffic. | $281,552.00 | $0.05 | 22.61% |

Data source:coinmarketcap;retrieved at 12:00 on July 6th, 2018

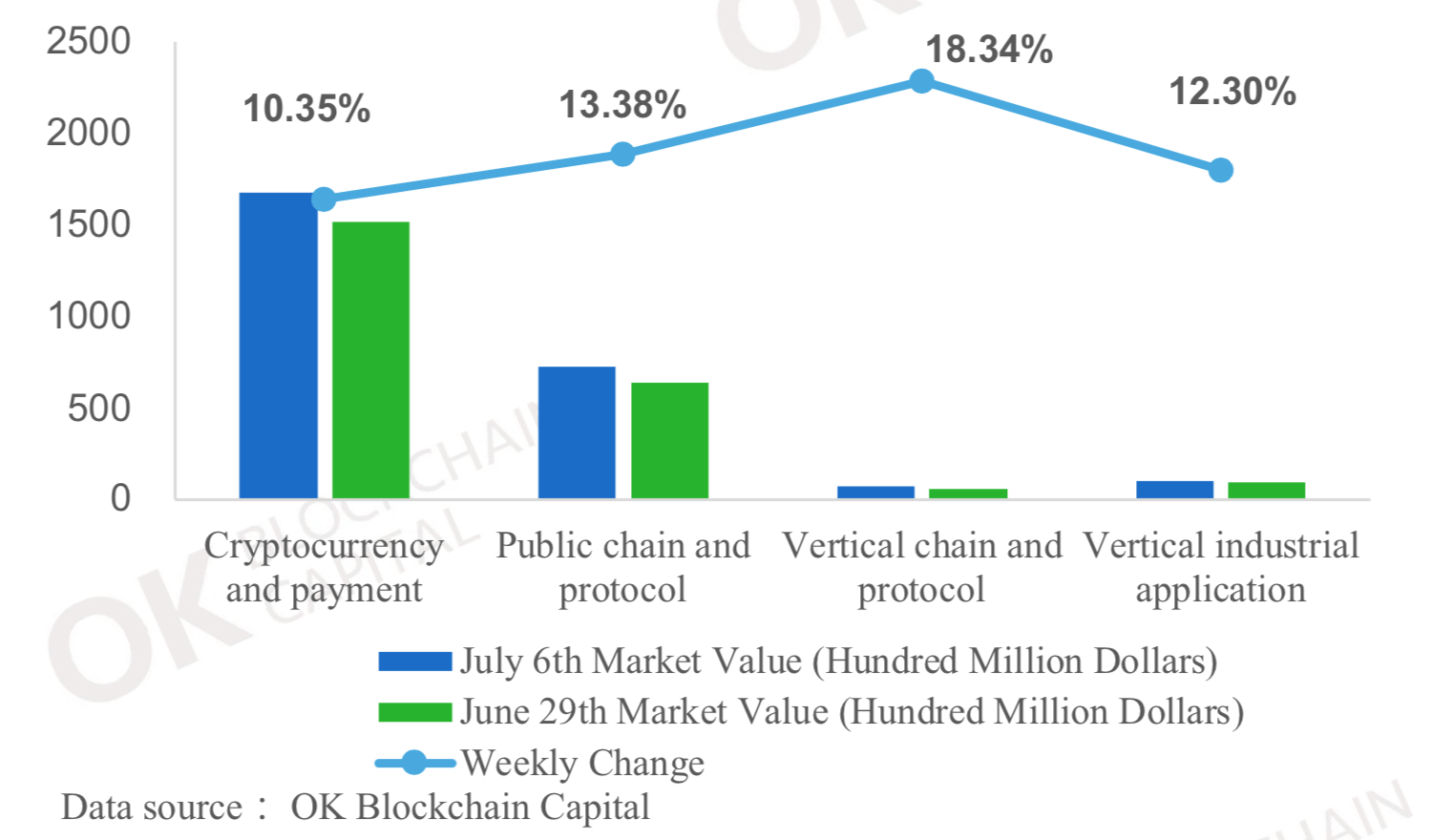

1. Analysis of Top 200 Market Cap Projects

The market capitalization of top 200 projects increased by 11.47% compared with that of last week. Based on the main categories of cryptocurrency and payment, public chain and protocol, vertical chain and protocol, and vertical industrial application, the vertical chain and protocol sector increased the most, increasing by 18.34%.

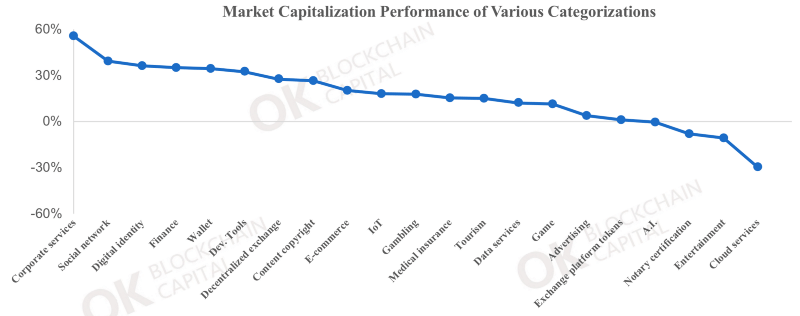

Through further classification of the vertical chain and protocol, it was found that this week’s corporate services and social network verticals were on obvious increases at a rate of 55.62% and 39.24%. Cloud services and entertainment verticals experienced the greatest decreases with a rate of 29.70% and 10.81% respectively.

Data source: OK Blockchain Capital

2. Analysis of Newly Listed Projects

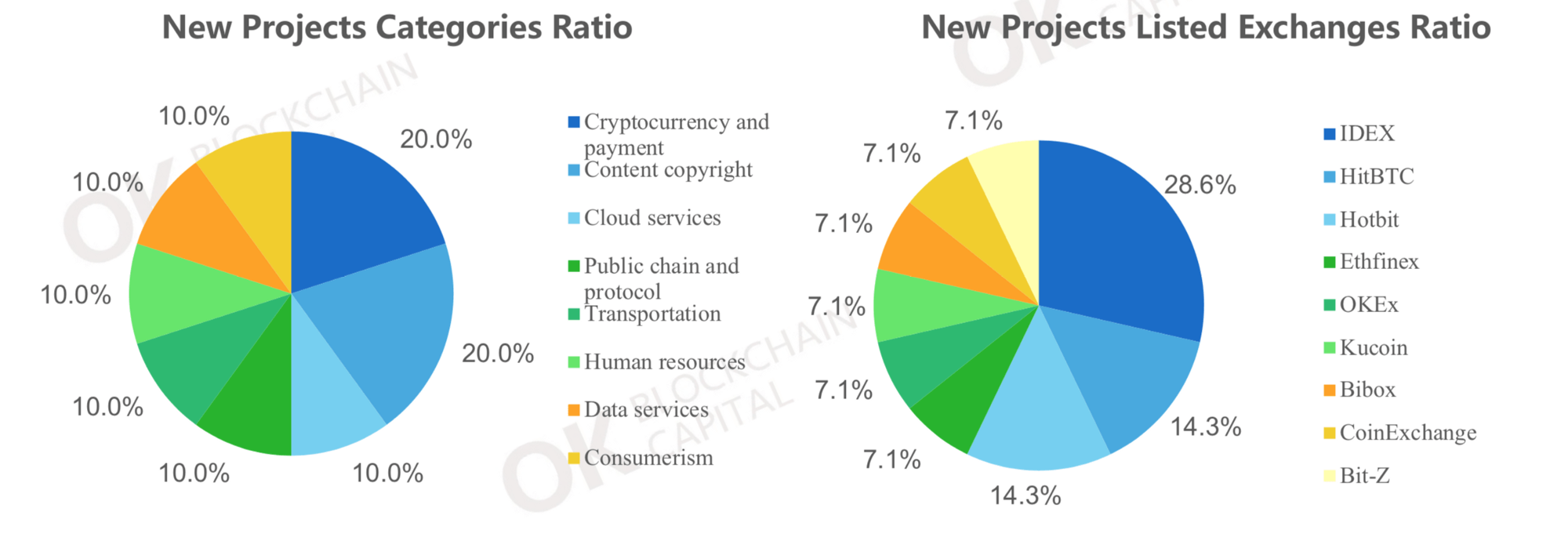

There were 10 new projects in the market last week (mainly of the content copyright vertical), 90% of which dropped in price within 24 hours of listing. Most of the newly issued tokens were listed on IDEX and HitBTC.

Data source:Coinmarketcap,feixiaohao,OK Blockchain Capital analysis

Table 2 . Newly listed projects

| Project | Token | Field | Exchange Platform | Initial Listed Price($) | Current Price($) | 24h Trading Volume($) | Launch Date |

| 0chain | ZCN | Cloud service | Ethfinex、IDEX | 0.496757 | 0.514678 | 272,596 | 7/3 |

| Egretia | EG | Public chain and protocol | OKEx、Hotbit、IDEX | 0.009094 | 0.008900 | 324,066 | 7/3 |

| TaTaTu | TTU | Content copyright | HitBTC | 0.595679 | 0.554663 | 98,558 | 7/3 |

| Dorado | DOR | Transportation | HitBTC | 0.011696 | 0.015109 | 784,331 | 7/3 |

| ZINC | ZINC | Human resources | Kucoin | 0.164451 | 0.195345 | 3,155,520 | 7/4 |

| CarBlock | CAR | Data services | Bibox | 0.038657 | 0.028182 | 642,723 | 7/4 |

| Bob’s Repair | BOB | Consumerism | Hotbit、IDEX | 0.024513 | 0.023844 | 447,692 | 7/4 |

| KanadeCoin | KNDC | Cryptocurrency and payment | CoinExchange | 0.000264 | 0.000260 | 42,004 | 7/4 |

| Cardstack | CARD | Cryptocurrency and payment | IDEX | 0.006403 | 0.006556 | 524,788 | 7/4 |

| Wowbit | WWB | Content copyright | Bit-Z | 0.265396 | 0.263429 | 413,667 | 7/4 |

Data source:Coinmarketcap, Feixiaohao

3. Analysis of Closed Public Sales Projects

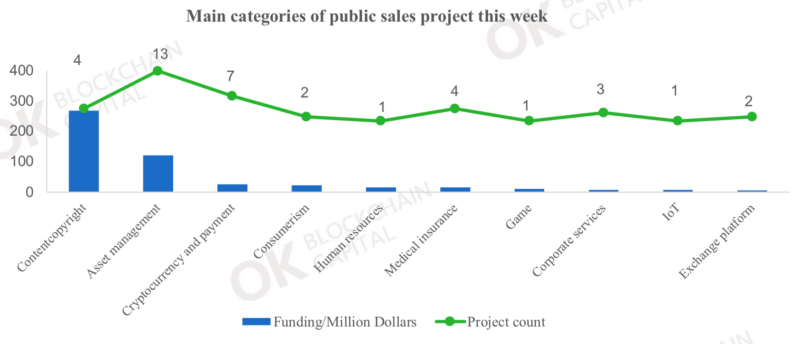

There have been 43 closed public sales projects this week, totaling nearly 510 million USD. Among these projects, projects of the asset management field received most funding. This was closely followed by projects of the cryptocurrency and payment field.

Table 3. Closed public sales projects (6.30-7.6)

| Project | Token | Field | Platform | Soft Cap/$10K |

| PORNX | PORNX | Cryptocurrency and payment | Ethereum | 1500 |

| Robo Advisor Coin | RAC | Asset management | Ethereum | 900 |

| Robo Advisor Coin | DUCAT | Data services | Ethereum | 381 |

| TaTaTu | TTU | Content copyright | Ethereum | 25000 |

| ProKareX | PKX | IoT | Ethereum | 750 |

| FENIX.CASH | FENIX | Content copyright | QTUM | 1000 |

| Globatalent | GBT Token | Asset management | Ethereum | 500 |

| PlayBets | PLT | Game | Ethereum | 100 |

| Bryllite | BRC | Game | Ethereum | 1000 |

| Caerus Connections | CAER | Human resources | Ethereum | 1500 |

| Lattice | LTI | Cryptocurrency and payment | Ethereum | 100 |

| Nuggets | NUG | Consumerism | Ethereum | 150 |

| Wixlar Coin ICO | WIX | Exchange platform | Ethereum | 400 |

| PRETHER | PTH | Cryptocurrency and payment | Ethereum | 30 |

| Equadex | EDEX | Asset management | Ethereum | 500 |

| The Freedom Coin | TFC | Asset management | Ethereum | 2500 |

| SleekPlay | SKP | Content copyright | Ethereum | 210 |

| RECORD Foundation | RCD | Content copyright | Ethereum | 600 |

| Cardium | CAD | Medical insurance | Ethereum | 500 |

| Sandblock | SAT Token | Corporate services | Ethereum | 200 |

| DigiDex | DGX | Cryptocurrency and payment | Ethereum | 240 |

| Kurecoin | KRC | Cryptocurrency and payment | Ethereum | 200 |

| Globatalent | GBT Token | Asset management | Ethereum | 500 |

| GladAge | GAC | Medical insurance | Ethereum | 200 |

| Global REIT | GRET | Asset management | Ethereum | 500 |

| DarcMatter Coin | DMC | Asset management | NEM | 5000 |

| CMBT | CMBT | Corporate services | Ethereum | 370 |

| Tradingene | TNG | Asset management | Waves | 400 |

| OptiToken | OPTI | Asset management | Ethereum | 22 |

| RankingBall | RBG | Game | Ethereum | 300 |

| VISO | VITO | Cryptocurrency and payment | Waves | 300 |

| CookUp | CHEF | Consumerism | Ethereum | 2100 |

| Monaco Estate | MEST | Asset management | Ethereum | 600 |

| BitScreener | BITX | Asset management | Ethereum | 300 |

| Utrum | OOT | Asset management | Komodo | 100 |

| Whalesburg | WBT | Asset management | Ethereum | 300 |

| Tokpie | TKP | Exchange platform | Ethereum | 150 |

| Safe.ad | SAFE | Cloud services | Ethereum | 300 |

| WELL | WELL | Medical insurance | Ethereum | 300 |

| Kurecoin | KRC | Cryptocurrency and payment | Ethereum | 200 |

| Sandblock | SAT Token | Corporate services | Ethereum | 200 |

| Cardium | CAD | Medical insurance | Ethereum | 500 |

Main data sources: Icobench, Foundico, smith and crown, icodata, icodrops, coinschedule, icoadvert

Secondary data sources:Project website

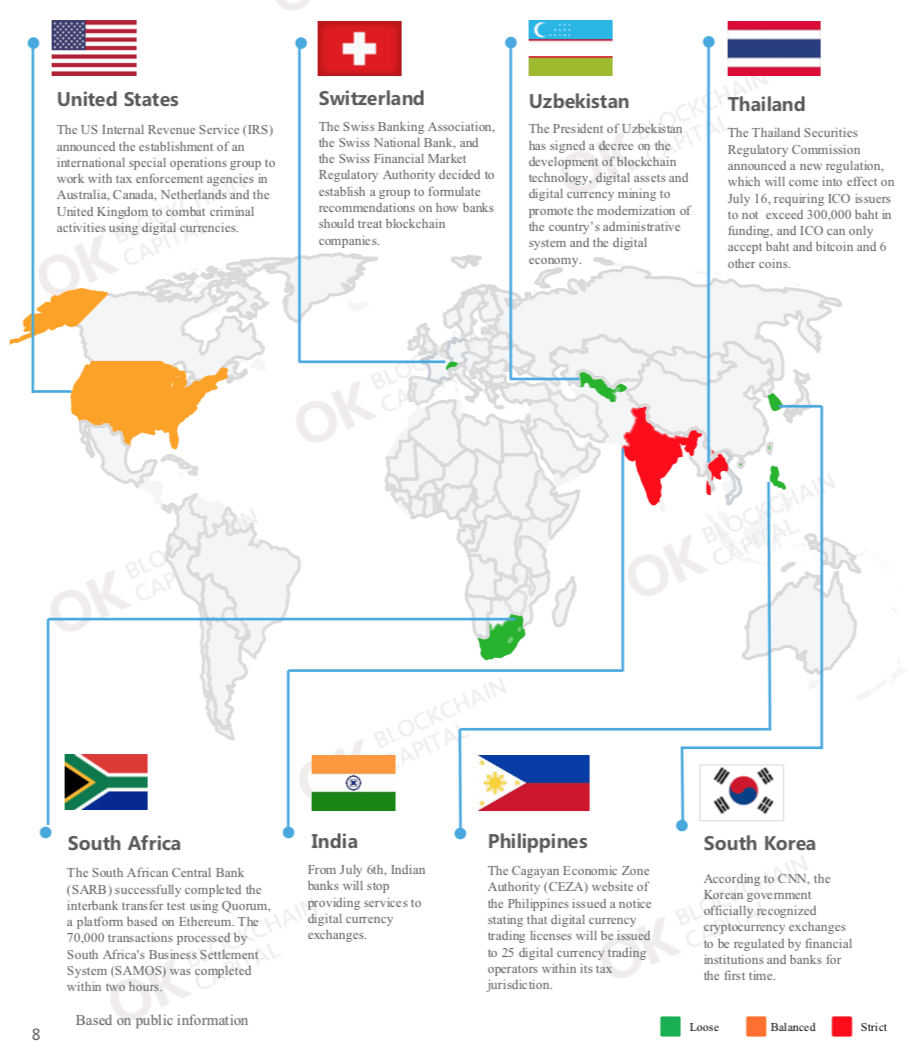

4. Important News on Global Governmental Policies this Past Week

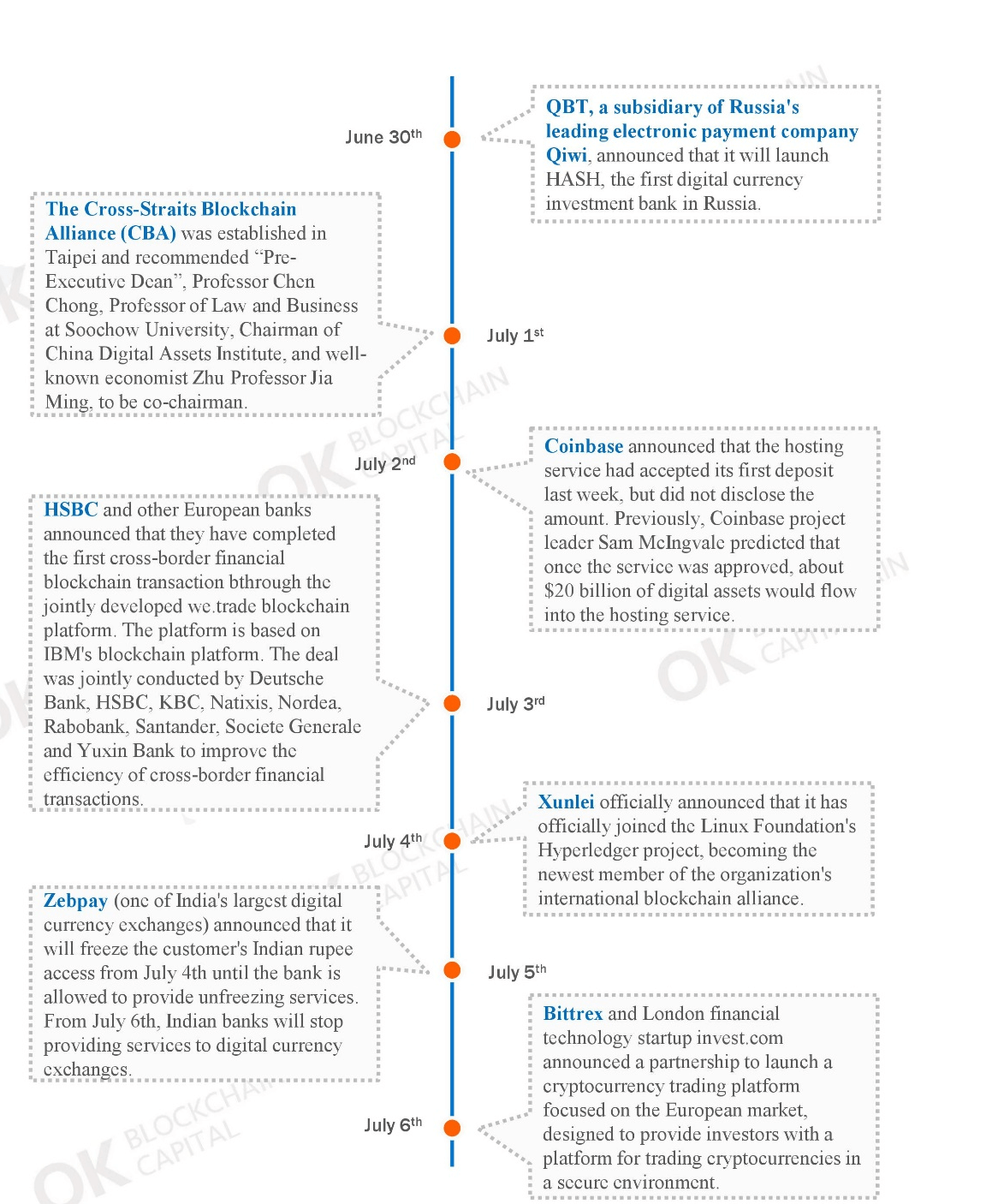

5.Keeping Up with the Blockchain Giants

6.Hot Topic of the Week: Binance was attacked by hackers, and the SYS coin increased in price by 3.2 million times

At about 4:18 am on July 4, 2018, some Binance users reported that the SYS transactions displayed abnormal trading behavior. At about 4:30 am, the price of SYS/BTC on Binance was increased to around 1SYS=96BTC, which was the highest price of SYS. The previous price of SYS was about 0.00003BTC. The price was increased 3.2 million times. Binance issued an announcement at 8:00 am on July 4th: announced temporary maintenance, suspension of trading and withdrawal.

On the evening of July 4, Binance issued an announcement stating that the incident was due to some API users. The API is an interface that can perform automated transactions. By controlling the API interface, the hacker manipulated the user’s account trading, thereby manipulating the price. The purpose of the hacker was not to steal the BTC from the Binance platform. Instead, their purpose was to increase the price of a coin, and then sell it at a high price on other trading platforms for profits.

It can be seen that the 24-hour volume of SYS has surged since the early morning of July 4. On trading platforms other than Binance, SYS’s trading volume reached hundreds of million dollars, and hackers were very likely to buy SYS ahead of these trading platforms, waiting for the opportunity to sell at a high price.

- Binance’s plan for this abnormal trading event is as follows:

- Binance deleted all API records and users can recreate and keep their API KEYs. Transactions that involved abnormality were rolled back.

- Transactions that involved active participation from users who experienced great loss will be exempt from handling fees from 2018/07/05 to 2018/07/14.

- The Binance Investor Protection Fund (SAFU) was established. From 2018/07/14, 10% of the transaction fees will be used as the investor protection fund, and the platform will pay the users first.

The issue Binance experienced has always been one of the most concerned topics for the users of the blockchain space. As the global transaction scale of digital assets continues to expand, the risk of hacker-attacks on cryptocurrency trading platforms are also increasing, and the current security incidents are frequent. The trading platforms must prevent hacker-attack and ensure the security of user assets through a series of risk control measures and security systems. Strengthening transaction security should be the primary task of cryptocurrency trading platforms and should be an important goal for the long-term development of the blockchain industry.

Appendix

Table Upcoming Crowdfunding Projects(July 7-July 13)

| Project | Token | Public offering launch date | Public offering close date | Field | Token Quantity | Public offering percentage* | Hard cap |

| Letsbet | XBET | 2018/7/7 | 2018/8/8 | Gambling | 100M | 77% | 10000 ETH |

| Iagon | IAG | 2018/7/7 | 2018/9/7 | Cloud services | 1B | 70% | — |

| Zodiaq | ZOD | 2018/7/8 | 2018/8/7 | Finance | 300M | 80% | 24.54M USD |

| REPU | REPU | 2018/7/8 | 2018/8/8 | Consumerism | 250M | 80% | 3000 ETH |

| BotGaming | BOT | 2018/7/9 | 2018/8/6 | Gambling | — | 60% | 5M USD |

| OBSERVER | TED | 2018/7/9 | 2018/7/30 | Consumerism | 10B | 40% | 4,000 ETH |

| XBIT | XBIT | 2018/7/10 | 2018/7/24 | Corporate services | 1B | 30% | — |

| Smart City Enterprise | CITY | 2018/7/10 | 2018/9/2 | Consumerism | 220M | 50% | 48M USD |

| MYDFS | MYDFS | 2018/7/10 | 2018/8/10 | Entertainment | 125M | 40% | 4M USD |

| WallChain | WALL | 2018/7/10 | 2018/7/30 | Cryptocurrency and payment | 15M | 60% | 3M USD |

| iShook | SHK | 2018/7/10 | 2018/12/31 | Content copyright | 1B | 57% | 20000 ETH |

| PearlPay | PRLPAY | 2018/7/10 | 2018/8/30 | Cryptocurrency and payment | 500M | 35% | — |

| XRT | XRT | 2018/7/11 | 2018/8/30 | Consumerism | 500M | 51% | 40000 ETH |

| Plentix | REFER | 2018/7/11 | 2018/7/24 | Consumerism | 400M | 70% | 3M USD |

| OkeyDokey | OKEY | 2018/7/11 | 2018/7/31 | Consumerism | 750M | 60% | — |

| JSEcoin | JSE | 2018/7/11 | 2018/10/1 | Cryptocurrency and payment | 40B | 50% | — |

| Gnome Invasion | GIT | 2018/7/11 | 2018/9/28 | Game | 50M | 78% | — |

| EtherAce Speculation Platform | ACED | 2018/7/12 | 2018/8/16 | Gambling | 125M | 80% | 8665 ETH |

| HELIX Orange | HIX | 2018/7/12 | 2018/7/27 | ICO platform | 5B | 70% | — |

| BiteCoin Network | BiteCoin | 2018/7/12 | 2018/8/30 | Consumerism | 7B | 70% | 50000 ETH |

| Block66 | B66 | 2018/7/12 | 2018/8/1 | Lending | 310M | 50% | 3M USD |

| ALLUXE | LXC | 2018/7/12 | 2018/8/16 | Consumerism | 222M | 50% | 27500 ETH |

| Sports Ledger | SPSL | 2018/7/12 | 2018/7/26 | Entertainment | 417M | 60% | 194,000 ETH |

| Lamoneda | LMDA | 2018/7/13 | 2018/8/30 | Notary certification | 500M | 72% | 10M USD |

| Tip Blockchain | TIP | 2018/7/13 | 2018/8/17 | Cryptocurrency and payment | 100M | 60% | 46450 ETH |

| ValPromise | ValPromise | 2018/7/13 | — | Asset management | 5B | 15% | 20000 ETH |

*The ratio between public offering Token quantity and the total Token quantity of the project.

Main data sources Icobench, Foundico, smith and crown, icodata, icodrops, coinschedule, icoadvert

Supporting data source: websites of the projects

![Weekly Blockchain Industry Report [June 30th–July 6th, 2018]](https://www.coinspeaker.com/wp-content/uploads/2018/07/blockchain-industry-report-july-2018.jpg)