Apple users will soon be able to transfer money to other people, as the company is reportedly going to launch a new peer-to-peer payment feature later this year.

The iPhone producer is rumored to introduce its own money transfer service like PayPal’s Venmo. The move is expected to drive the growth of Apple’s payment platform and marks the company’s entry into the money transfer sector.

With the new feature, Apple will become a direct competitor to such person-to-person payment platforms as PayPal’s Venmo, and Square Cash. The apps, however, are available for both Apple and Android smartphone users.

The new peer-to-peer payment service will allow iPhone owners to send funds to other iPhone users. According to a report from Recode, the company is in talks with a number of financial firms to release a money transfer service later this year.

The news comes more than a year after the company first discussed the potential launch of the feature with a group of US banks. The introduction of the payment option, which could be called “Apple Cash”, will likely happen at the company’s fall iPhone event.

Apple has reportedly held talks with Visa about developing its own prepaid card that would run on the Visa debit network and would be linked to the new service. Thus, iPhone users will be able to spend money sent to these Apple cards via “Apple Cash”, without waiting for the transfer to be processed.

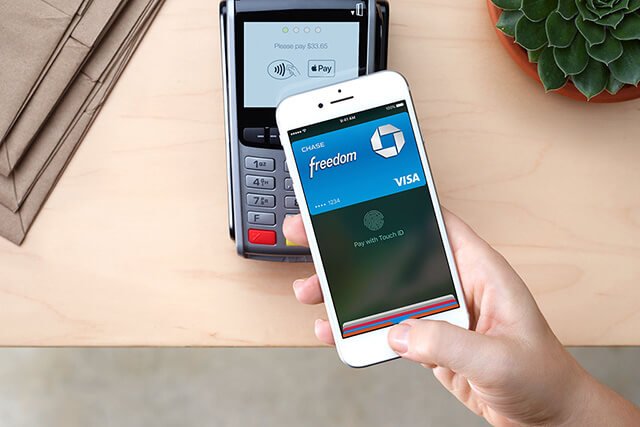

All information about debit cards tied to the service will be stored in the Apple Pay digital wallet. The company’s debit card could also be used on websites and apps.

Some bank executives, however, are concerned about the partnership between the credit card company and Apple and are going to raise concerns that Visa is hosting for its bank partners.

“Banks spent heavily in insuring their cards were top of wallet when they all built and rolled out Apple Pay,” said Cherian Abraham, a digital payments executive at Experian. “So it’s justifiable to be concerned that Apple will have its own card and could potentially be top of wallet. If you are top of wallet, you are top of mind.”

Apple launched its Apple Pay platform in 2014 and also partnered with Visa to enable users pay at stores that accept Visa cards. However, many people haven’t yet adopted the app because of the competition from PayPal and banks.

The new Apple debit card will likely be targeted at millennials, who don’t own a credit card or a bank account, but want to easily spend the money their friends send them via “Apple Cash”.