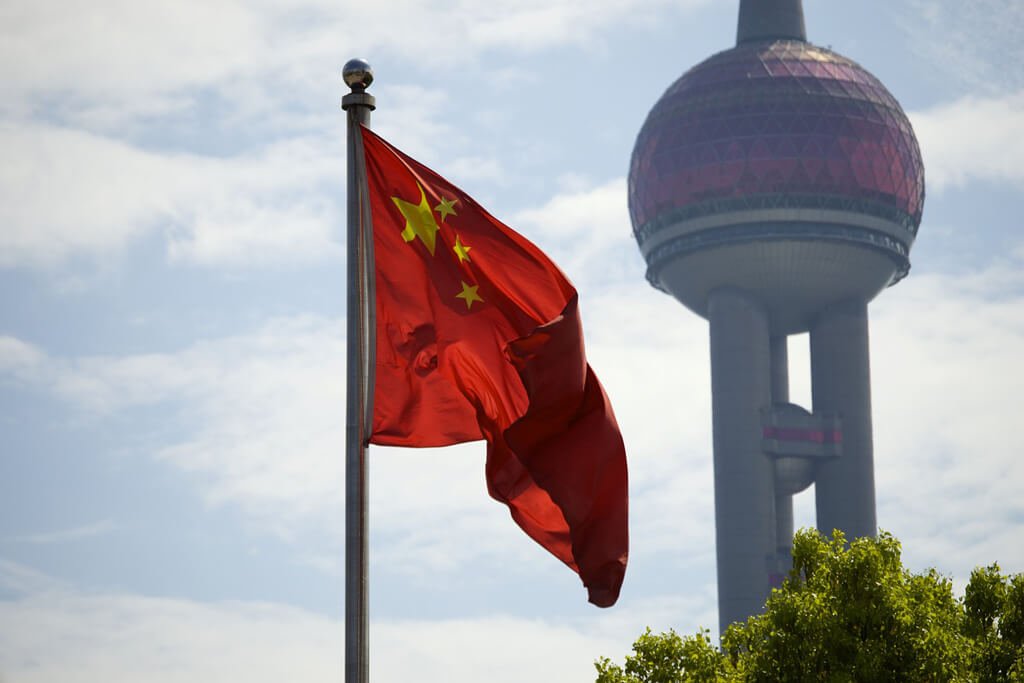

Bitcoin prices surge to a new all-time high above $6250 amid speculations of China lifting ban on local exchanges and resuming trading operations.

The latest rumours of China likely to cancel the ban of local cryptocurrency exchanges operating within the country has ignited new hope and optimism in the cryptocurrency market as the price of Bitcoin surged to an all-time-high value of $6,255.71, according to the CoinMarketCap. Bitcoin is currently trading at $6113.71 per coin.

A sudden increase in the trading volumes for Bitcoin and even other cryptocurrencies like Ethereum and Litecoin was seen following a major breaking news from CoinTelegraph. The reports claimed that Chinese investors can again start trading in cryptocurrencies after the decision to cancel the temporary regulations and policies was taken at the 19th National Congress of the Communist Party of China.

The report has also claimed that ZB.com, a China-based cryptocurrency trading platform, will be launching its trading operations from the 1st of November later this week which will be open to all people from around the world including from the mainland China. This website lists itself as “blockchain asset exchange” shows a listing for crypto trading pairs along with having its own trading app which seems to be under development as none of its features is working at the moment.

This report from Coin Telegraph has drawn the attention of the entire cryptocurrency community. Back in early September this year, the Chinese government had a major crackdown on trading of Bitcoin and other cryptocurrencies by issuing an operational ban on all the local exchanges. One of the major reasons to this crackdown was a high suspicion for fraudulent activities like money laundering as well as other regulatory concerns.

Prior to the ban, China contributed considerably in terms of the trading volumes for Bitcoin and hence the news of ban was followed by a wave of huge pessimism sweeping the markets and thereby creating a negative sentiment in the cryptocurrency-investor community. A huge sell-off was soon witnessed and the markets were bleeding.

However, note that the latest report should be taken with a pinch of salt and nothing can be said with absolute certainty till there is any official word regarding the resuming of Bitcoin trading operations.

Safe Haven in Japan and Hong Kong

In addition to the reports from Coin Telegraph, there is also a news about Chinese Exchanges to move its operations out of China and the scrutiny of Chinese regulatory bodies. After China’s decision to impose ban, other countries like Japan saw this as an opportunity to spread its footprint in the cryptocurrency markets and increase its trading share. As of now, Japan contribute to the maximum trading volumes in Bitcoin.

Having faced harsh ban and restriction on the home turf, the Chinese exchanges are now considering to move out of China and are seeking safe in other Asian Countries like Japan, Singapore and HongKong.

Hong Kong-based Lennix Lai, the financial market director for OKEx, said: “China used to account for a significant share of the cryptocurrency market, so we think the demand is there. As formerly one of the biggest operators in China, we think we have a good chance of competing globally.”

Several of the Chinese exchanges were completely dry out of business in the aftermath of the ban and hence are now forced to shift its resources. The Chinese exchanges are talking with the counterparts in other countries for a possible collaboration.

Mike Kayamori, Chief of the Tokyo-based Quine, who has been recently granted permission to operate a Bitcoin exchange in the country, said: “We’re talking to almost all of those guys. They’re all desperate now. There’s a lot of Chinese retail people reaching out to us, but we can’t handle it. So if a Chinese partner can handle all of those and they connect to us, that will be much easier.” Kayamori expects to sign a deal with a Chinese player by the end-of-the-year.

With Chinese exchanges moving out of the country, it will be interesting to see the expected jump in investor participation as more Chinese investors will be again involved in the trading process. However, Bitcoin and other cryptocurrencies have always stayed highly volatile and are highly sentiment driven.