A new Blockchain trading platform is aiming to diminish the power and influence of major financial institutions by offering low commission fees and greater freedom for investors.

TradeConnect claims some of the biggest players in the global markets are putting investors at a disadvantage by levying unnecessarily high fees. The company alleges that other institutions unfairly influence the prices of financial assets and operate without being transparent.

An Ecosystem Where Fees are Returned

With IP and infrastructure licensed from ThinkMarkets, an existing financial group with regulated broker status, TradeConnect plans to create a network where 75 percent of commission from trades conducted on the platform makes its way back into the pockets of active users.

To attract traders with different levels of spending power, the network plans to give people the opportunity to invest in a fraction of a company’s share. Given these can sometimes cost many hundreds of dollars when purchased whole, TradeConnect believes this will deliver much-needed flexibility for those with limited capital.

The company says it has a goal of reducing inefficiencies in the financial sector which often mean it can take days before the settlement of a trade is complete. Smart contracts on its Blockchain-based system mean transactions can clear almost straight away, and TradeConnect believes this subsequently lowers the danger of an investor losing their funds because of a financial institution’s poor management.

Its white paper argues that traders will become less dependent on brokers and intermediaries because of how they can execute trades with other individuals independently. This, when coupled with the fact that a trader retains complete control of their capital, has led the company to claim Blockchain may represent the most significant development in the industry for more than 30 years.

Once TradeConnect launches, users will initially be given the opportunity to trade forex and contracts for difference. By the start of 2019, further services will be incorporated into the network – helping the platform to achieve its stated ambition of becoming a one-stop-shop where any financial asset can be traded.

ThinkMarkets is going to license trading infrastructure, intellectual property and development resources to ThinkCoin.

Platform to Launch with New Token

Only one cryptocurrency can be used for trading on the network. Known as ThinkCoin, it has been specially created for TradeConnect and is currently in the initial coin offering phase.

Billed as “simple, secure and user friendly,” ThinkCoin will be available for purchase at exchanges when it is listed in May – and TradeConnect’s wallet is also expected to support six other major cryptocurrencies including Ethereum and Blockchain.

The first phase of the pre-ICO for ThinkCoin is scheduled to end on April 23, and the second phase on May 14. Its ICO will begin the day afterwards and run until May 25. According to the company, the funds raised are going to help bring new users to its platform and expand trading options. Some of the assets which it hopes to support by 2019 include equities, futures and bonds.

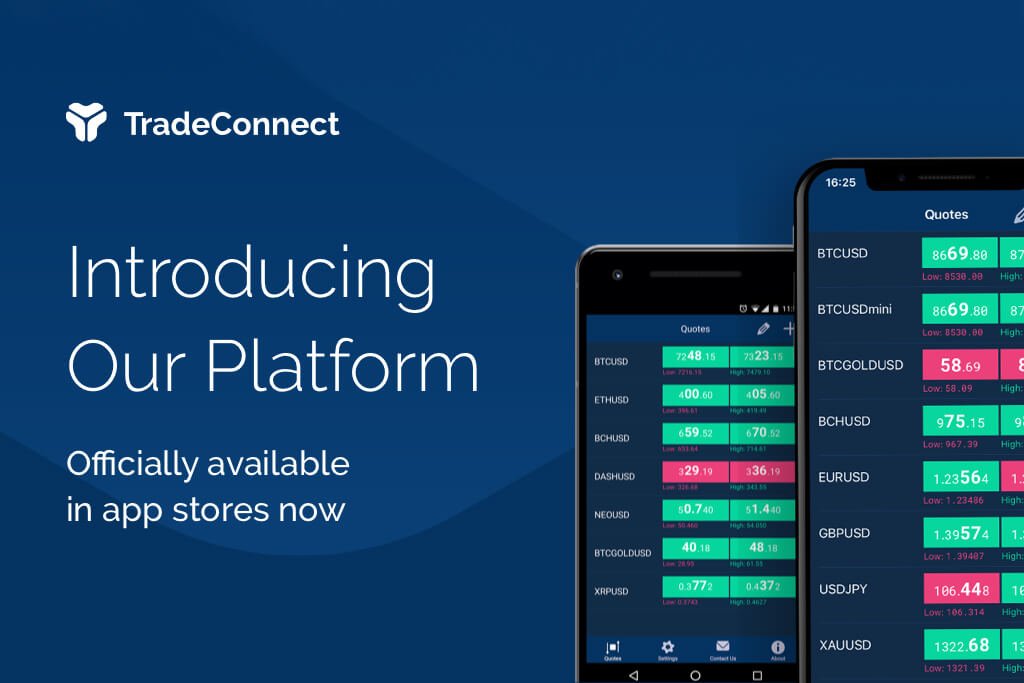

TradeConnect is set to become available in beta by August, with the functionality for forex and CfD trades following in October.

Its parent company, ThinkMarkets, has headquarters in the UK and Australia – and says the new venture will benefit from data accrued over 10 years by analyzing the behavior of thousands of investors on their existing platforms.

Nauman Anees, the co-founder and CEO of ThinkMarkets, has been described as an “industry leader” who has “extensive knowledge in designing and building complex trading systems and applications.” The company initially started life in New Zealand eight years ago.