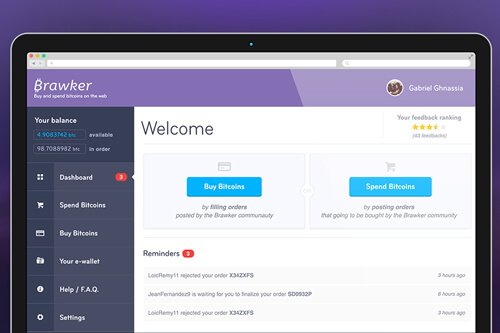

Brawker, the service that allows users to buy anything with bitcoins easily on a peer-to-peer platform, will soon become a lot more decentralised.

Brawker, a Hong Kong-based Bitcoin startup that was launched late 2013, is the first online marketplace that allows users to buy anything online with Bitcoin and easily purchase Bitcoin from other users with Paypal account or a credit card.

Users from all over the world can connect to make everyday transactions and buy Bitcoin easily, bringing the reliability and security of Bitcoin to regular customers who want a simple eCommerce experience.

“People can spend their Bitcoin on anything available online with Brawker, and they have,” said the company’s CEO Cyril Houri.

“From parking tickets to electric and other utility bills, our customers are buying all kinds of things with Bitcoin, and getting a discount on their purchases in the process. We’re excited to give Bitcoin buyers an opportunity to get a great deal, too.”

Dealing with Brawker, Bitcoin spenders create orders and determine what percentage discount they want to receive, from 0% to 20%. The discount is a premium that appreciates the spender, on the current exchange rate between Bitcoin and various currencies.

A Bitcoin buyer purchasing an order with a discount bigger than zero will get fewer bitcoins than with zero discount, and the new counter offer feature allows him/her to negotiate the exchange rate.

Discounts act as incentives for people to spend Bitcoin, while Bitcoin buyers benefit extensively by participating in simple transactions to get Bitcoin using PayPal account or a credit card.

Besides, a Bitcoin owner wanting to purchase any online product or service from a company can create an order on Brawker by listing the item, afterwards the Bitcoin owner places ample bitcoins to cover the item’s price in escrow.

Bitcoin buyers find the orders with a price matching the amount of bitcoins they want to purchase. Afterwards they bid on the orders with the option to make a counter offer on the discount to the spender, and the Bitcoin spender chooses a buyer for his/her order.

After the purchaser with the winning bid buys the order and the transaction is accomplished, the bitcoins are released from escrow and sent to the purchaser’s account.

“The inspiration to create Brawker struck us back in 2010 after hearing about how Laszlo Hanyecz used Bitcoin to buy a pizza,” said Cyril Houri.

“We decided to make that cumbersome process as easy as a regular eCommerce site, and we’re proud to be able to show people how easy it is to buy bitcoins, as well as to buy with Bitcoin online.”

However, Cyril Houri has recently said that Brawker would soon become a lot more decentralised:

“We are currently working on making our site even more decentralized. We realized after the MtGox bankruptcy that this market desperately needed less centralization. So we will soon release a version of our website that goes one step further in this decentralization process by having both the e-commerce transaction and the bitcoin transaction happen OUTSIDE of our infrastructure, without ever having to hold the users’ funds. And the best way to not lose your customers’ funds is never to hold them.”

True to his word, the company has recently implemented multisignature transactions to make Brawker a fully decentralised platform for exchanging bitcoins.

According to the video above, multisignature transactions are secure and rather simple. A bitcoin spender and a bitcoin buyer create a multisignature transaction on the blockchain, outside of Brawker. A spender, a buyer and Brawker each hold a unique key, and two out of the three keys are required to complete the transaction.

If the transaction goes smoothly, a spender and a buyer can use their keys to finalize it without Brawker getting involved. However, if it is necessary, Brawker can use its key to arbitrate. In any case, Brawker does not store any bitcoins or fiat currency.

Decentralisation is becoming increasingly popular with the countless examples of failures in centralised systems. For instance, Cyber-attacks on JPMorgan Chase compromised 76 million households. Besides, MCX’s CurrentC payment system has been recently hacked, resulting in the flow of hundreds of users’ email addresses.

Earlier this year, BTCJam, bitcoin lending site, were hacked and over 26 bitcoins were stolen. With decentralised systems, the only reason of failure is the user, and any successful cyber-attack only affects the user, not everyone who uses the system.

On the other hand, centralisation enables convenience since it puts less responsibility upon the user. Many people argue that traditional banking is safer than using bitcoin since money is stored and insured in vaults, rather than kept on a piece of paper or one’s hard drive.