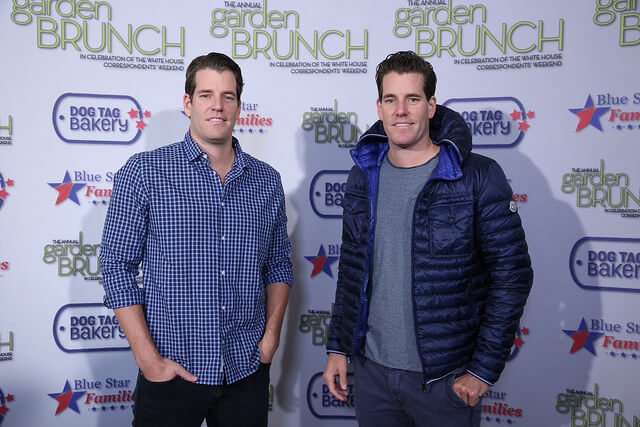

Winklevoss twins predict Bitcoin’s market capitalization could easily skyrocket to over $1 trillion.

As we already know, the twins Cameron and Tyler Winklevoss are not afraid of fluctuating price of bitcoin, since they are building the first regulated Bitcoin exchange in the U.S.

Looking back, the name of their exchange is Gemini. The company’s staff is located in the Winklevoss Capital offices in Manhattan. The team includes Michael Breu, who previously worked as head of information security in the research department at Bridgewater Associates, head of security Cem Paya, who previously held the same position at Airbnb, Katten Muchin Rosenman, a specialist of financial regulations. As for the software, the twins hired a developer from the hedge fund Two Sigma, who is building a system suitable for both small investors and institutions that look for direct access to the trading system.

Winklevoss Twins believe that Bitcoin is the payment network of the future. That’s despite Bitcoin’s 60% plunge in 2014. Now, according to CNNMoney, they predict that Bitcoin’s market capitalization could easily shoot up to at least $400 billion, or approximately the combined size of modern day payments companies like American Express, Visa, MasterCard and Western Union. Besides, the brothers think that Bitcoin could one day transform into a gold-like asset class or even exceed it.

“If Bitcoin is a better gold or seen as a type of gold-like asset, then it could be in the trillions on a market cap. We do feel those are very real possibilities,” Tyler Winklevoss said in an interview to CNNMoney.

Reaching $1 Trillion in market capitalization is hard to believe, especially when Bitcoin’s current market capitalization is just $3,56 billion, according to CoinMarketCap. One Bitcoin is currently worth around $258 – a big drop-off from its peak of $1,300 in late 2013.

“It’s a buying opportunity. We’ve never sold a Bitcoin. We’re in it for the long haul,” Cameron Winklevoss said during a presentation at ETF.com’s Inside ETFs Conference. “People get fixated on the cost. It’s going to have lots of gyrations, but it’s new and you have to bare with it.”

Winklevoss Twins hope Geminy will become the “Nasdaq of Bitcoin.” However, on Monday, Coinbase opened a U.S.-based Bitcoin exchange with backing from the likes of the New York Stock Exchange. Besides, there is no doubt that 2014 was a great year for Coinbase: the company managed to land different large retail associates, such as Mozilla, Overstock, Square, Dell, and Wikipedia.

Tell us what you think about the story – comment & share your opinion bellow!