Rhodium said B. Riley Securities and Cowen would act as joint book-running managers.

Rhodium Enterprises Inc, a fully integrated Bitcoin miner, plans to secure up to $1.7 billion in its initial public offering (IPO). According to a US Securities and Exchange filing (SEC) on the 13th of January, Rhodium said it would offer 7.69 million shares at the range of $12-$14 each. Following a successful IPO, the Bitcoin miner will have around $56.8 million in its Class A shares. Also, it will have about $67.5 million in class B shares outstanding. In the end, it will sum up to a market valuation between $1.49 billion to $1.74 billion, and Rhodium will begin to trade on Nasdaq under the ticker “RHDM”.

Rhodium Reveals IPO Plans

Rhodium plans to use the proceeds generated from the IPO to sort its outstanding debt and accrued interest of its bridge loan. As of the 31st of September, the debt and accrued interest were a total of almost $31 million. Additionally, the Bitcoin miner will use part of the process to construct new sites in more locations. Part of the funds will go into general corporate purposes such as buying new mining machines.

For the purpose of the IPO, Rhodium said B. Riley Securities and Cowen would act as joint book-running managers. The lead manager is Needham & Company, while D.A. Davidson & Co. and Northland Capital Markets are acting as co-managers for the offering.

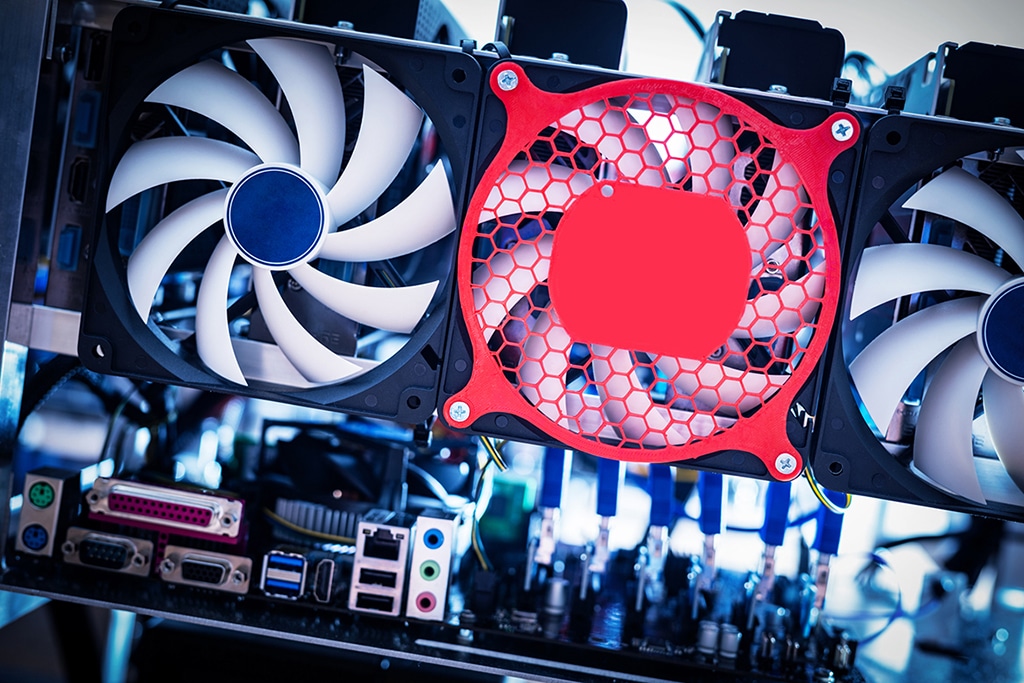

Rhodium had around 125 megawatts (MW) of mining power capacity at its Texas site as of the end of 2021. The MW mining power capacity is capable of running over 33,600 miners with a combined hash rate capacity of about 2.7 exahash per second.

“After giving effect to the offering and the related IPO Reorganization contemplated by this prospectus, Rhodium will own an approximate 45.7% interest in Rhodium Holdings (or 46.2% if the underwriters’ option to purchase additional shares is exercised in full), Imperium will own 67,500, 411 shares of Class B common stock, which will represent an approximate 54.3% interest in the voting power of the outstanding common stock of Rhodium Enterprises, Inc. (or 53.8% if the underwriters’ option to purchase additional shares is exercised in full.”

Rhodium’s IPO Filing

The Bitcoin miner did not plan to make up to $1.7 billion as of October last year. Rhodium’s former SEC filing on the 28th of October 2021 stated that it is looking at generating $100 million. At the time, the company had 80 megawatts (MW) of power capacity. It was enough to run over 22,6000 miners at its initial Texas site. Unlike the current hash rate, the miners have a total hash rate of around 1.8 exahash per second. The company already envisioned its current power and hashrate growth. In the former filing, Rhodium said it generated revenue of $48.2 million. It also made net income of $14.9 million, and adjusted EBITDA of $40.9 million.