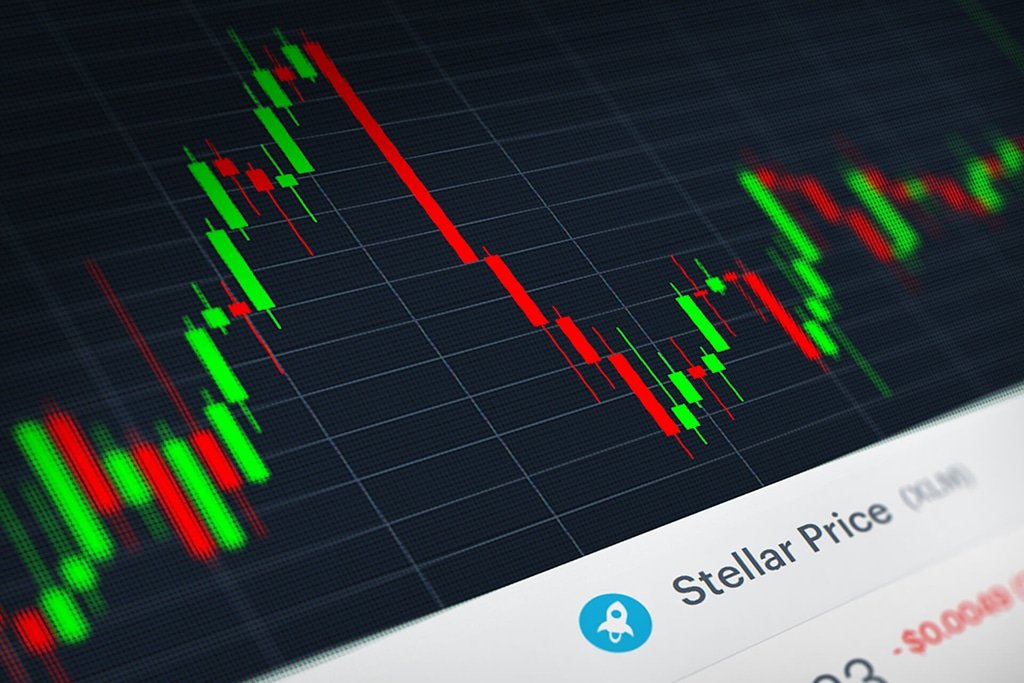

Stellar Price Analysis: XLM/USD Trends of February 28–March 06, 2019

In case the bears increase its momentum the $0.07 demand level will be the target for Stellar price. Should the bears lose their pressure, the XLM price may range towards $0.09 – $0.12 price levels.