Ethereum creator Vitalik Buterin shared his thoughts regarding Bitcoin price movements. He claims the Stock to Flow model doesn’t work for Bitcoin or any other crypto asset.

Vitalik Buterin says that you shouldn’t make financial decisions solely after reading the news. The classic Stock to Flow (S2F) model is not working with Bitcoin. Major news announcements, as well as world disasters such as coronavirus, do not affect the crypto market. Buterin says that there are 95% of the articles on the Web claiming the wrong things:

Nah that stuff is part of the 95%

— vitalik.eth (@VitalikButerin) February 27, 2020

He admits that it is bad that journalists, market whales, and crypto traders are hoping to make money on coronavirus fears. Instead, they could cooperate to help contaminated countries and communities.

Since Monday, Worst Trading Sessions Began

Vitalik Buterin’s Bitcoin price opinion is going against the overall positive notions in the news. He remains neutral to the price predictions as if he is a Buddhist, admits he doesn’t know the future. He says that most of the price prediction models he has seen in the market far from being accurate. Interestingly, some of the crypto investigators from Telegram even claim that price prediction models, signals, stats, etc. are about nothing. According to those theorists, crypto prices move thanks to influencers and secretive deals.

Vitalik didn’t say what market models he used to predict the prices of cryptocurrencies. However, he notes two articles by Billy Bambrough and Jeff Benson claiming the opposite things about Bitcoin and coronavirus.

Stock to Flow Model Is ‘Bullshit’, According to Vitalik Buterin

Historically, this type of price forecast was working well. Now, it says that Bitcoin’s average price should be $8,600.

Buterin sees things in other light:

Your daily reminder that 95%+ of articles of the form "event X will make crypto go (up | down)" are post-hoc rationalized bullshit. pic.twitter.com/KBQps4MF5H

— vitalik.eth (@VitalikButerin) February 27, 2020

Such a model is using many measures to predict Bitcoin’s price and to find its scarcity indicator. However, makes people make controversial claims. The model is based on the works by computer scientist Nick Szabo, who was considered Satoshi Nakamoto in past, and cryptocurrency investigator and author Saifedean Ammous. This was described in details in an article by Trace Meyer from 2015:

“S2F is a measure of scarcity. The power-law relation between S2F and bitcoin price over time captures the underlying regularity of bitcoin’s complex dynamic system of network effects.”

Stocks to Flow Seems Like a Casino, Not Math

This time the model is not as accurate as it seemed, because the prices of cryptocurrencies falling, not rising, during coronavirus outbreak. More than that, the Dow index, S&P 500 and the major stocks fall just like cryptos. Trump’s recent claim that the coronavirus cure is ‘very close’, adds pessimism. Because when White House spokesman Judd Deere claimed 3 days ago that Donald Trump was referring to the Ebola cure, not the coronavirus one, the markets went in an even deeper panic.

By the way, by making such estimates we fall into seduction of using Stock to Flow to analyze price.

Other Experts Share Buterin’s Thoughts on S2F Bitcoin Price Predictions

Analyst Alex Kruger says that the Stock to Flow model is the same nonsense like the ‘Tether Manipulation’ paper. He claims that such investigations are based on an unclear set of shady economical metrics and terms. The market is dependent on much easier, but hidden factors. Such ones periodically bring the ice castles of crypto traders to a grand meltdown.

Charlie Morris from Byte Tree notes that PlanB’s idea of price dependence on mass adoption and network activity is very good. But it has a major flaw: it doesn’t research the demand, only the supply of the Bitcoin market.

This is indeed strange that some experts rush into predictions while they don’t have all the information about how the crypto market works. Many journalists already uncovered secret trails, deals and money flow in the industry. Some observers even claim cryptocurrencies only attract criminals, thanks to high anonymity.

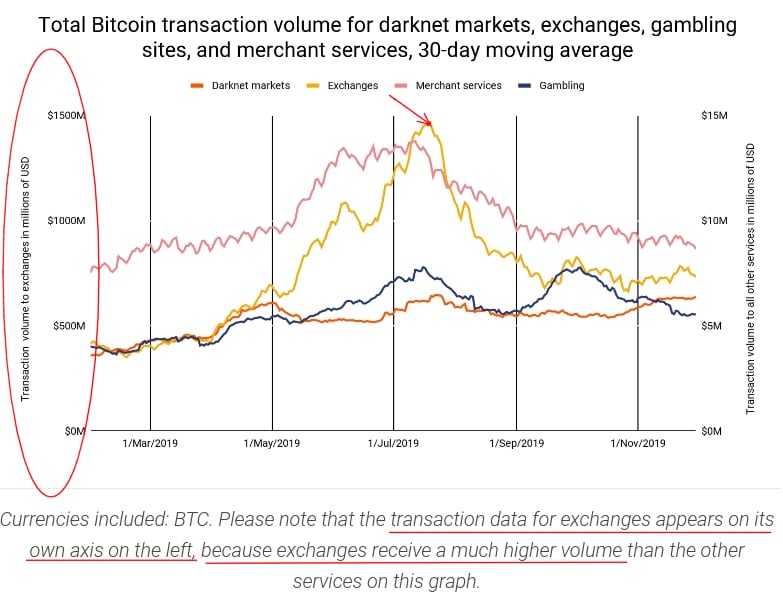

Again, such a claim goes against dry statistics. According to the report by Chainalysis released in January 2020, exchanges, merchant services, and gambling websites make many more BTC transactions than darknet market users.

Photo: Chainalysis

In the long term, Buterin may appear to be the prophet. Because Stock to Flow also predicts that the price of Bitcoin must skyrocket to $100,000, in 1 to 3 years after the next Bitcoin Halving. The halving will occur in the first weeks of May 2020. This estimate seems very unrealistic, but if you feel otherwise, please share your thoughts in the comments.