XRP Tundra Advances Dual-Chain Ecosystem

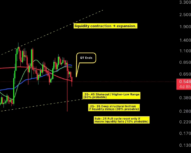

Cardano (ADA) continues to hover near its critical macro support at $0.52, a level it has tested repeatedly since the October 2025 market correction. Each retest has weakened the zone, and traders now question whether buying pressure will hold. Without renewed volume, analysts warn that ADA could break below its long-term floor, triggering a shift toward lower liquidity zones.

Meanwhile, XRP Tundra – a cross-chain ecosystem spanning the XRP Ledger (XRPL) and Solana – is building momentum around infrastructure expansion rather than price speculation. As market leaders face macro headwinds, Tundra’s technical framework and verifiable architecture are drawing increased attention from investors seeking stability in a volatile environment.

Cardano Tests Fragile Macro Support

Analyst Dan Gambardello, known for his long-term coverage of ADA, noted that Cardano’s chart remains closely correlated with Ethereum (ETH) and Bitcoin (BTC) price movements. That correlation has amplified downside risk across the layer-1 sector. According to Gambardello, ADA could find temporary support between $0.35 and $0.45 if the $0.52 level fails to attract buyers. Should liquidity outflows continue, he expects a secondary zone between $0.25 and $0.35 to form – and potentially break again if global inflows into crypto remain limited.

Data from market maker Wintermute reinforces this caution. Its recent commentary highlighted that fresh capital inflow into digital assets has slowed significantly, with liquidity “rotating internally” rather than expanding. The absence of new inflows has made support zones like ADA’s current range more vulnerable to liquidation cascades, especially for leveraged positions.

As of this writing, ADA trades slightly above $0.57, with momentum indicators suggesting indecision. The market’s next move likely depends on Bitcoin’s ability to hold the $97,000–$99,000 region – a structural point that could dictate whether ADA’s support survives or fails.

Analysts Warn of Liquidity Strain

Cardano’s price action has mirrored broader uncertainty in risk markets. Gambardello described the situation as a “liquidity exhaustion event”, where most altcoins are relying on cyclical capital rotation from Bitcoin dominance phases. Without new inflows, that rotation compresses, causing mid-cap tokens like Cardano to underperform even as development continues.

The bearish case remains tied to macro liquidity and the timing of rate decisions in major economies. If those delays persist, Gambardello expects ADA could revisit sub-$0.30 territory before recovering later in the cycle.

Still, Cardano’s technical network updates have helped maintain a baseline of confidence. The project’s Leios upgrade aims to optimize block validation, while Hydra Layer-2 expands throughput by processing microtransactions off-chain. Founder Charles Hoskinson has urged patience, noting that these systems will begin shipping in upcoming months as part of Cardano’s long-term decentralization roadmap.

Network Development Continues Despite Price Pressure

Cardano’s engineers continue refining protocol scalability, yet much of the market’s attention has shifted toward cross-chain ecosystems that deliver immediate interoperability. This is where XRP Tundra has found its niche.

Rather than building a new Layer-1, Tundra connects existing networks. Its structure uses Solana for transaction execution and XRPL for transparent settlement, ensuring that all operations – including staking, liquidity pooling, and NFT interactions – remain verifiable across both chains. The upcoming GlacierChain layer will synchronize these ledgers automatically, eliminating reliance on bridges that often introduce security risks.

Tundra’s architecture is supported by independent audits from Cyberscope, Solidproof, and FreshCoins. Developer identities have also been validated through Vital Block KYC – a transparency measure rarely matched among newer protocols.

In a recent HotCuppaCrypto analysis, the channel reviewed Tundra’s cross-chain logic, calling it one of the few DeFi architectures combining audited smart contracts with dual-chain synchronization.

XRP Tundra Presale Is Heating Up

XRP Tundra’s Phase 10 presale remains active, offering TUNDRA-S at $0.158 with a 10% bonus, and allocating TUNDRA-X at a $0.079 reference value for governance and reserves. Over $2 million has been raised, with more than $32,000 distributed through the Arctic Spinner rewards campaign.

The presale structure ensures that participants automatically receive both tokens – TUNDRA-S for staking utility and yield, TUNDRA-X for ecosystem governance. This design provides an immediate functional role for both assets rather than speculative holding.

Many new investors have been asking “is XRP Tundra legit?” – a fair question in a market crowded with unverified claims. The project answers it directly through publicly accessible audits and KYC documentation that outline every contract and transaction path.

Structure Over Sentiment in 2025

Cardano’s short-term trajectory depends on market liquidity and Bitcoin’s resilience, while XRP Tundra’s growth rests on execution rather than sentiment. Both projects are building toward scalability, yet their paths differ: Cardano refines internal performance, and Tundra expands across networks.

As speculative flows slow, investors are turning toward systems that can document their activity on-chain. XRP Tundra’s architecture – integrating Solana’s throughput with XRPL’s accountability – offers that transparency by design. Whether or not macro liquidity returns quickly, the project’s infrastructure ensures operational continuity beyond price cycles.

Secure your Phase 10 allocation and explore a dual-chain ecosystem designed for measurable performance in a consolidating market.

Learn ho to by Tundra with our step-by-step guide. Join the community on Telegram.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.