US-based bitcoin startup has announced it will stop bitcoin trading via the platform and will focus on using the distributed ledger technology for mobile payments.

Circle will no longer let its users to purchase and sell bitcoin via its platform, the company announced on Wednesday. Instead, it will focus on a new blockchain-based protocol named Spark.

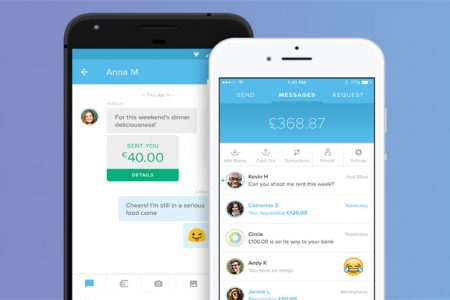

Customers will still be able to keep the digital currency in their bitcoin wallets. Besides, they will be able to convert bitcoin to fiat currency, including dollars and euros, and send funds via social messaging. Money, however, could not be sent to other digital wallets. Those who want to trade the cryptocurrency will be redirected to bitcoin exchange payment processor Coinbase.

As part of the latest update, Circle has also announced higher deposit limits for new users. The company has increased the initial deposit limit which can grow the more you use the app. Meantime, there will be no limits on withdrawals and payments.

“We’re taking another major step forward today with the introduction of Spark, a set of protocol additions that provides a way for digital wallets to exchange value using blockchains, including Bitcoin, as settlement layers,” the company wrote in a blog post.

“We plan to release Spark as an open source project that anyone in the world can use and implement, and intend to work closely with similarly-minded ecosystem participants to advance the technology and integrate it with additional public and private blockchains.”

Circle is now available in the US and several European countries. Earlier this year, the company launched the app in the UK.

The startup has also extended its service to Korea and the Philippines via agreements with Korbit and Coins.ph startups. The feature will allow customers in Europe, UK, and the US to quickly and seamlessly send money to users in the Philippines and Korea.

Last year, Circle became the first company to receive a bitcoin license from New York State’s financial regulator. As Anthony Albanese, the superintendent of the Department of Financial Services, noted, the release of the first BitLicense is “an important milestone in the long-term development of the virtual currency industry.”

The company’s decision to stop trading the digital currency demonstrates that it’s not going to become a cryptocurrency exchange. Instead, it will focus on blockchain, the technology underlying bitcoin. Circle believes the distributed ledger has the potential to enable instant and secure money transfers.

A few months ago, Apple announced the integration of Circle as part of its iOS 10 update. The service is now integrated into the company’s iMessage app.

Circle Pay is one of the best-funded bitcoin startups and has already raised $136 million from such prominent investors as Goldman Sachs, Pantera Capital, Breyer Capital, Digital Currency Group, Accel Partners, and Oak Investment Partners.

next