At the beginning of the year, as the rest of the world was enjoying a crypto boom that begun in 2020, things had slowed down for Japanese cryptocurrency investors.

Coinbase has been given the go-ahead to operate crypto activities in Japan. The digital assets company has been allowed to indulge in 5 cryptos including Bitcoin, Ether, Litecoin, Bitcoin Cash, and Stellar Lumen. The highest Japanese regulator for financial services also called the Financial Services Agency (FSA) said that Coinbase has been registered in its jurisdiction as a crypto dealer and that the decision was informed by a revision in the country’s Fund Settlement Act.

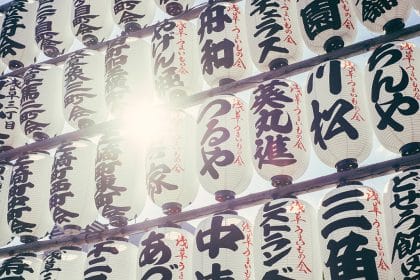

Coinbase Coming to Japan

The authorized company is a Japan-based dealer linked with Coinbase Global which is a public-listed company on the Nasdaq platform. Coinbase’s love for Japan dates back to 2018 when it made clear its intention of entering the Japanese market. Back then, Coinbase was quoted saying that it will work jointly with Japanese authorities and ensure that local compliance and adherence to Japanese laws are observed, every step of the way.

With the authorization, Coinbase has the liberty of joining the Japanese Virtual and Cryptocurrencies Exchange (JVCEA), a group that focuses on self-regulation. After Coinbase’s successful registration and authorization, the Japanese Cryptocurrency Exchange, JVCEA, stated that the company is now one of its prime members. Three years ago, Coinbase membership in JVCEA was considered second class. I know the classification sounds derogatory, however, it’s a categorization for all unregistered members.

Japanese History with Cryptocurrencies

At the beginning of the year, as the rest of the world was enjoying a cryptocurrency boom that begun in 2020, things had slowed down for Japanese cryptocurrency investors, particularly the ones based in Japan. Several events including renewal and unnecessary scrutiny had rocked the Japanese market. Additionally, the massive hacking that almost brought Coincheck on its knees is also to blame. The heist left the Tokyo-based crypto startup ¥58B less. This one hack attack made the Japanese market lose vigor. Back then, the country’s watchdog for financial activities had also intensified crackdown on digital assets, particularly cryptocurrencies, making the situation even worse.

Aftermath of Coincheck’s Cyber Attack

After the bad experience with hackers, the company, Coincheck was greatly criticized for lacking internal controls, amid growth, that could help protect their clients against cyberattacks, and by extension loss of their investment. That single incident exposed the lack of experience and knowledge to run fintech services on the part of most startups (exchange operators).

On this matter of cybersecurity, Yusuke Otsuka, Coincheck’s co-founder was quoted saying that after the cyberattack, each Japanese digital assets exchange had to find ways to shield their clients against hacking, money laundering, and any other financial related crimes.

In Japan, digital assets, particularly cryptocurrencies, aren’t considered as financial assets, but with the emergence of the country from periods of excess scrutiny, market observers believe that the Asian powerhouse has matured enough and is ready to adopt cryptocurrencies in their jurisdiction.

next