Core’s Seed Abstraction offers a seamless cross-chain experience. Users can employ Core-generated seeds across a spectrum of blockchains.

In a groundbreaking move for the crypto space, Core Wallet has introduced an innovative approach to wallet creation with its Seed Abstraction feature. According to a press release shared with Coinspeaker, this pioneering technology eliminates the need for cumbersome seed phrases, providing users with a more accessible and user-friendly experience without compromising on security or custody.

The Core Seed Abstraction Innovation: Universal Solution

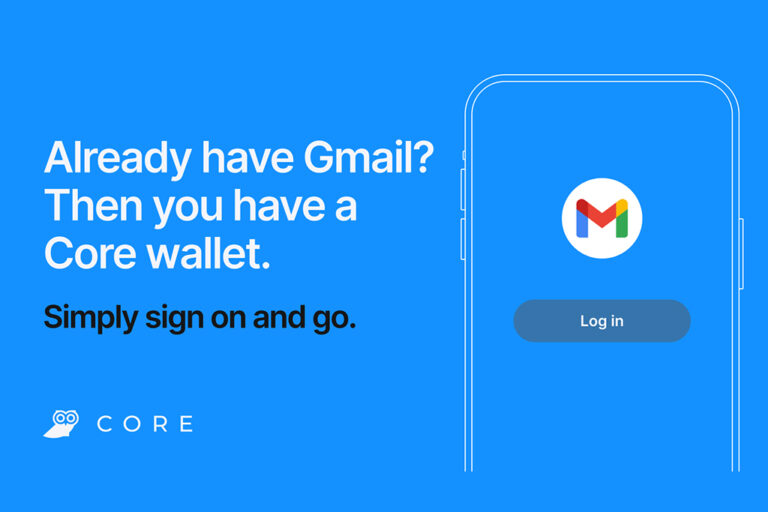

Traditionally, seed phrases have been a fundamental aspect of crypto wallet creation, serving as a backup and recovery mechanism. However, the complexity and potential risks associated with seed phrases have often deterred mainstream users from fully embracing Web3 technologies. Core’s Seed Abstraction addresses this issue by allowing users to generate and manage keys through familiar Web2 methods like Gmail and Apple logins.

By addressing one of the major pain points for everyday users regarding seed phrases, Core contributes to the ongoing mission of making blockchain products as seamless as their Web2 counterparts and supporting the widespread adoption of Web3 technologies.

Per the release, Core noted that existing wallet creation options will remain in place for those who prefer traditional seed phrases but for those seeking a more intuitive and secure experience, Core’s Seed Abstraction offers a compelling alternative.

What sets Core apart is its universality. Unlike other solutions limited to specific blockchains or Virtual Machines (VMs), Core’s Seed Abstraction offers a seamless cross-chain experience. Users can employ Core-generated seeds across a spectrum of blockchains.

The ease of cross-chain use distinguishes Core’s Seed Abstraction from existing offerings such as ERC-4337 (account abstraction), which confines users to EVM chains with deployment restrictions. Core empowers users to transact confidently and securely across diverse environments, including Bitcoin (BTC), Avalanche C-Chain, X-Chain, P-Chain, and any EVM.

To achieve this unprecedented level of security and usability, Core leverages Cubist’s CubeSigner non-custodial signing service. This service enables secure social logins, and handling keys within secure hardware. Core generates keys and signs transactions remotely, ensuring that private keys remain confidential. The combination of extensive encryption methods and secure enclave technology further fortifies the security of the entire process.

Core Enhances Security Measures

To access a Core account, Decentralized Finance (DeFi) users must provide both their login details and a physical authentication device, reducing the risk of phishing and unauthorized access. CubeSigner’s protocol for exporting keys introduces additional steps and waiting periods, safeguarding against potential threats like SIM swapping. This multi-layered security approach ensures that only the rightful owner can export their keys, enhancing the overall security of the Core platform.

Notably, Core’s innovative approach aligns with the key tenets of Web3, prioritizing simplicity, frictionless onboarding, and self-custody without compromising security.

“Core unifies the key tenants of Web3 by enabling simple, frictionless, and seedless onboarding while preserving self-custody and high security. Core’s users are free to choose their favorite form(s) of sign-up, login, and recovery without any trepidation or anxiety,” says Akash Gupta, Head of Consumer Products at Ava Labs.

next