The Beam wallet has been designed atop Ethereum Layer-2 blockchains such as Coinbase’s Base and Optimism for facilitating faster crypto transactions at low cost.

Money and payments platform Eco announced the launch of its cash-like crypto wallet Beam backed by some of the biggest players and notable digital asset investors. This includes names such as venture capital giant Andreessen Horowitz (a16z) and the investment arm of Coinbase (COIN).

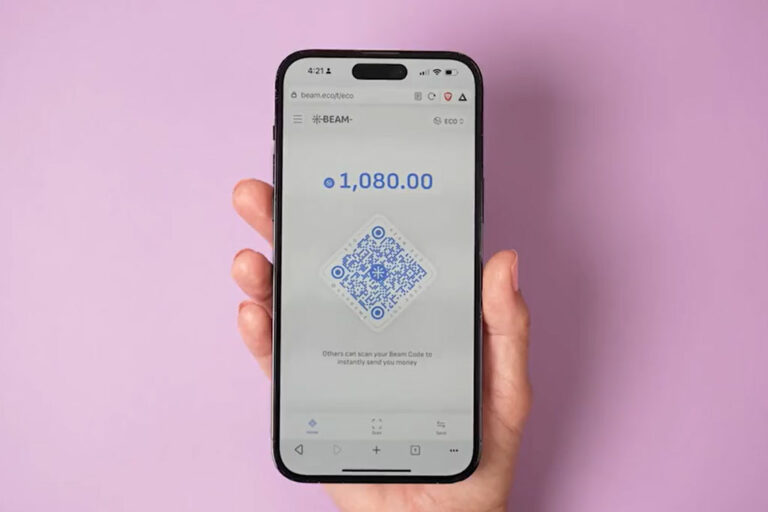

Fintech firm Eco developed the Beam wallet, powered by account abstraction and built atop Optimism and Base. The Beam crypto wallet has a simple UX thereby making crypto payments easier than ever before. It also brings the promises of Web3 such that its permissionless, offers self-custody, and is censorship resistant. It is one of the first self-custody wallets available for use by anyone and everyone.

Beam is different from other crypto wallets available in the market as of date. Many crypto wallets are difficult to use and confusing for regular people. They are designed for professionals and enthusiasts, not for everyday users. But Beam wants to change that. They want to create a crypto payment product that is easy and enjoyable for everyone to use, while still keeping the important features of cryptocurrencies like being secure, private, and not controlled by a central authority.

Users of Beam can quickly pay family and friends by sending them the Beam link or sending money directly to their username. Beam is a crypto wallet that offers low fees and simple pricing on low-fee blockchains. It ensures security and ease of use, so you don’t have to worry about scams or losing access to your account. You can recover your wallet easily with a login and password. Beam is designed specifically for payments and is the first of its kind for mainstream users.

Beam – Built on Ethereum Layer-2 Blockchains

The Beam wallet is built on two blockchains called Optimism and Coinbase’s Base. These blockchains make it easier and faster to send and receive crypto with lower fees. The wallet is also designed to help users recover their crypto if they lose their private keys.

This simplification of the process could lead to more people using crypto in their everyday lives. Other developers are also working on ways to make crypto more accessible, like enabling payments on messaging apps.

Beam has partnered with Stackup to facilitate paymaster transactions. Paymaster transactions enable users to pay gas fees denominated in the currencies they are already sending. Beam also makes those transaction fees fixed, providing an intuitive and predictable pattern for users coming from traditional fintech products.

The Beam design facilitates a limited and specific set of actions users can do with their smart contract wallet. For this limitation, Beam has a whitelist of sponsored smart contract interactions provided by Stackup, the paymaster.

Whitelisting transactions sets boundaries on the types of smart contracts users can interact with, making it much harder for potential theft to occur. It also allows to submit transactions without bytecode approvals, making the interactions similar to that offered by Web2 products.

next