The Open University together with Innovate Finance and small businesses have started the FinTech courses.

Innovate Finance, a non-profit membership based industry organisation aimed at advancing the UK’s position as a leader in FinTech innovation, has partnered with the Open University, one of the world’s largest distance learning institutions, to launch a course in financial technology aimed at educating top executives.

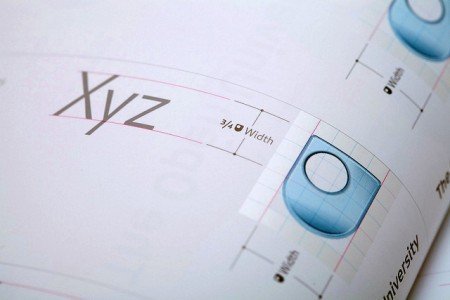

Fintech 101 is a 50-hour course that includes the blockchain software that underpins bitcoin, the evolution of payment systems, digital banking, and cyber security. The course costs £695 ($1080) to do. It aims to educate executives on the new wave of financial innovation that has sprung up in the wake of the financial crisis.

“This new FinTech landscape needs to be understood to fully appreciate its impact to economies and societies. We are therefore thrilled that Open University, one of the world’s most exciting and advanced centres of study, is offering a comprehensive course on this subject,” said Lawrence Wintermeyer, Innovate Finance CEO.

“There is a whole new language emerging when we talk about fintech,” Lawrence Wintermeyer, CEO of Innovate Finance, told CNBC in a phone interview. We felt that it was important to level set the landscape to explain what fintech is,” Wintermeyer added.

Online small business lender iwoca, peer-to-peer lender RateSetter, and social trading platform eToro all helped to shape the course. More traditional names like Lloyds and MasterCard contributed to the programme as well.

“The brief for this course was to demystify a new era of financial services unfolding in the UK. Traditional banking models and financial systems face uncertain futures and startup founders seeking a foothold in the marketplace will be encouraged to think critically about the implications and opportunities of changes happening in the FinTech ecosystem,” said Liz Moody, senior lecturer at the Open University, in the course’s prospectus.

The FinTech course came after the U.K. government last year introduced coding lessons to the national curriculum for children as young as five. Other universities have also tapped into the growing interest in financial technology: in 2013, the University of Nicosia in Cyprus began offering a degree in digital currencies and started accepting payments for the course in Bitcoin.

next