Following the recent accumulation, the AAVE whale holds a total of 125,605 Aave tokens, worth about $17 million, with an average purchase price of $134.6.

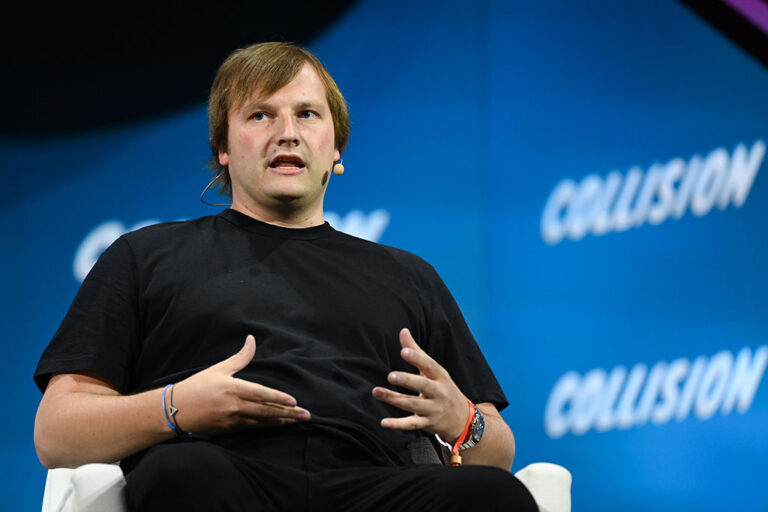

Despite the broader market uncertainty, DeFi protocol Aave’s native crypto AAVE has seen a strong price surge amid key developments. In the last 24 hours, AAVE’s price gained over 10% to $135 with its market cap surging past $2 billion. Aave founder Stani Kulechov is making the most of this opportunity while partially offloading his AAVE holdings.

As per the latest provided by LookonChain, Stani Kulechov sold a total of 55,596 AAVE tokens, worth nearly $6.67 million, from his total holdings. As of now, Kuclechov still holds 243,900 AAVE tokens worth $32.7 million.

Stani Kulechov(@StaniKulechov), the founder of #Aave is selling $AAVE!

Since Feb 26, Stani Kulechov has sold 55,596 $AAVE($6.67M) and currently holds 243,900 $AAVE($32.7M).

Address:

0xe705b1D26B85c9F9f91A3690079D336295F14F08 pic.twitter.com/0D95c6L5xJ— Lookonchain (@lookonchain) September 5, 2024

While on one hand, Kulechov is selling, the AAVE whales are absorbing the supply at the other end. During the recent run-up in the AAVE price, several crypto whales have been making a sneak move grabbing the AAVE tokens and filling their bags.

As per the recent on-chain data, two AAVE whales purchased a substantial number of AAVE coins. Data shows that one whale purchased 9,129 AAVE tokens worth $1.2 million while the other whale purchased 7,462 AAVE tokens worth a total of $1 million.

According to Lookonchain, a major whale executed a single transaction for 50,604 Aave tokens, valued at roughly $6.7 million. This whale previously spent 4,000 staked Ether, around $10.4 million, on August 22 to acquire 77,270 Aave tokens, when the price was approximately $135. The whale now holds a total of 125,605 Aave tokens, worth about $17 million, with an average purchase price of $134.6.

This whale bought 50,604 $AAVE($6.78M) again 20 mins ago and currently holds 125,605 $AAVE($16.9M) with an average buying price of $134.6.https://t.co/Cn5oNqLdqAhttps://t.co/jjJN59HBqF pic.twitter.com/fGPLn8uANu

— Lookonchain (@lookonchain) September 4, 2024

Key Developments within the AAVE Ecosystem

Recently, the AAVE V3 launched on the Era mainnet while utilizing the zkSync technology in order to boost privacy, scalability, and security on the platform. This upgrade also aims to expand the DeFi user base while particularly targeting institutional applications.

On the other hand, Aave Labs also announced its partnership with MakerDAO for a project called Sky Aave Force. This initiative is designed to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). Speaking on the development, Aave Labs said:

“DeFi protocols have matured, showing resilience and market fit. By working together, DeFi can become the backbone of all finance, enabling unprecedented access and propelling new use cases.”

Another significant development for Aave is the announcement that World Liberty Financial, a DeFi project led by Donald Trump, will be built on the Aave platform and Ethereum blockchain.

next