Aave’s expansion has increased competition among other DeFi projects.

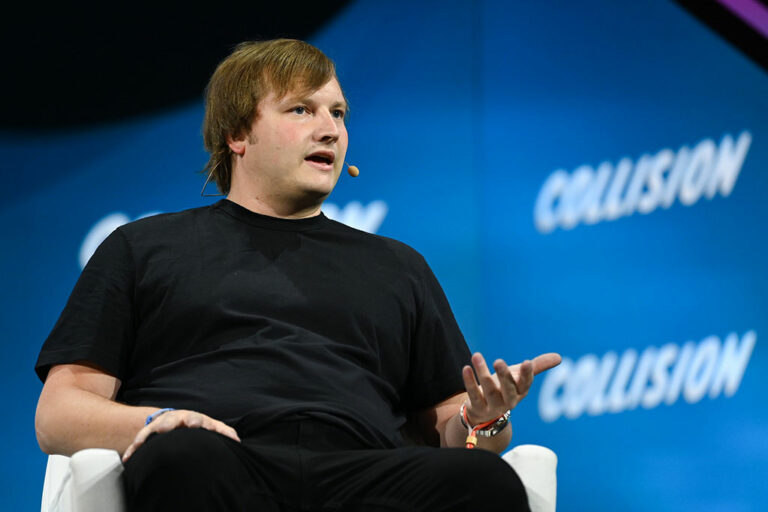

In the past year, Aave, a prominent participant in the decentralized finance (DeFi) space, has experienced a more than double increase in its total value locked (TVL), which has now reached $11 billion. This surge has propelled Aave past MakerDAO, making it the third most valuable DeFi project. In a recent interview, Stani Kulechov, Aave’s co-founder, disclosed that the platform is in the process of evolving into a seamless “DeFi supermarket”.

Aave is expanding its ecosystem with the launch of several new products and services. Its stablecoin GHO is one of them, which is intended to serve as a dependable reserve of value in the volatile phases.

It has also launched a crypto wallet called Family, which is designed for individuals who are new to the crypto world. Additionally, DeFi enthusiasts are drawn to Aave’s Lens Protocol, a social media network that is powered by ZKsync’s technology stack. Notably, the Lens Protocol is currently in the process of raising $50 million from investors.

These ventures are now consolidated under a new parent company named Avara, based in London. Kulechov envisions Avara as a comprehensive solution for all DeFi requirements, suiting both beginner and experienced crypto enthusiasts.

“Every single person on the planet, across every language, every nation, every location has social capital,” Kulechov stated. “If we can solve the idea of owning what’s yours online, that fundamentally unlocks more value.”

Venture studio Number Group’s co-founder Drew Osumi believes that this recent effort by Aave will offer a user-friendly solution to newcomers. He states:

“It feels like the grand plan is to be a permissionless and decentralized Meta, where users are actually valued at market value.”

Competitive Market

Aave’s expansion has increased competition among other DeFi projects. Both Aave and MakerDAO have been foundational to the DeFi ecosystem since the initial coin offering (ICO) era of 2017. Despite their competition, the two entities have occasionally collaborated on various occasions.

The competition further increased with the launch of stablecoins. MakerDAO’s DAI, the oldest decentralized stablecoin in DeFi, now faces direct competition from Aave’s GHO, introduced in July 2023.

Lito Coen, head of growth at Socket Protocol, comments:

“GHO makes a lot of sense, especially when one of the biggest overcollateralized stablecoins directly launched a competitor with Spark.”

Additionally, MakerDAO launched its own lending protocol Spark in 2023, further escalating the rivalry. Aave’s new model has proven highly effective in generating revenue. It has recorded around $101.7 million in revenue in just 30 days by charging fees for borrowing, lending, liquidating loans, and making deposits. Meanwhile, Aave’s native token, AAVE, is currently trading around $77.4, up by more than 6% in the past few hours.

next