CryptoQuant CEO Ki Young Ju stated that Bitcoin ETFs are slowly gaining maturity and currently contribute nearly 25% of the spot trading volumes in BTC.

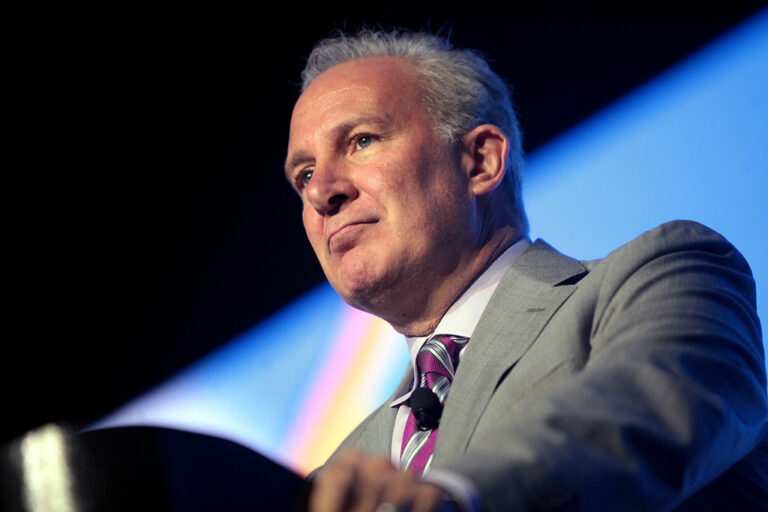

Bitcoin ETF inflows have slowed down significantly in recent weeks as BTC price continues to slide further slipping all the way to $54,000. Renowned Bitcoin critic Peter Schiff has issued a stark warning to Bitcoin ETF investors.

As the Bitcoin price has slipped to $54,000, Schiff said that nearly 70% of those who bought the spot Bitcoin ETFs are likely experiencing losses. Schiff further speculates that if the BTC price drops under $38,000, nearly 100% of the Bitcoin ETF investors would be facing losses. Schiff anticipates that such a scenario will trigger significant selling, as most crypto ETF speculators will abandon their positions for good.

At $54K my guess is that over 70% of those who bought #BitcoinETFs are losing money. When #Bitcoin trades below $38K, 100% of Bitcoin ETF buyers will be losing money. That's when I expect the real selling to start, as most #crypto ETF speculators will throw in the towel for good.

— Peter Schiff (@PeterSchiff) July 5, 2024

On-chain data provider Santiment also reported that there was a significant drop in the trading volumes of the top seven BTC ETFs during the first week of July. Santiment noted that this is a clear sign of trader indecision which can be a precursor to market capitulation.

For bullish crypto investors, this period of low volume may present a strategic buying opportunity. Santiment predicts a potential rebound in trading volumes tomorrow as the market compensates for the US stock market’s closure on the 4th of July holiday.

Photo: Sanitment

When Will Bitcoin ETFs Gain Maturity?

BTC ETFs are relatively new investment products that saw strong acceptance during the first quarter. However, following the Bitcoin halving and the BTC miner capitulation, BTC price came crashing down nearly 30% from its all-time high and the ETF inflows have dried up as well.

However, CryptoQuant CEO Ki Young Ju stated that Bitcoin ETFs are slowly gaining maturity and currently contribute nearly 25% of the spot trading volumes in BTC. If we look at the total BTC trading volume (spot + derivative), the BTC ETF contribution is 5%.

Considering that it’s a relatively new investment product, Bitcoin ETFs would continue to gain significance over a period of time.

This cycle is different. The source of money is different.

This cycle is different. The source of money is different.#Bitcoin spot ETFs now make up a quarter of total spot trading volume.

New money this time is more mature than ever, and I believe there's still much more mature money to come. Mature money usually has diamond hands. pic.twitter.com/l7wAhopa7z

— Ki Young Ju (@ki_young_ju) July 3, 2024

In the first week of July, the Bitcoin ETF trading volumes have dropped significantly showing a clear sign of trader indecision which can be a precursor to market capitulation.