“Bitcoin is a highly speculative, volatile asset. But with 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years,” said Gensler.

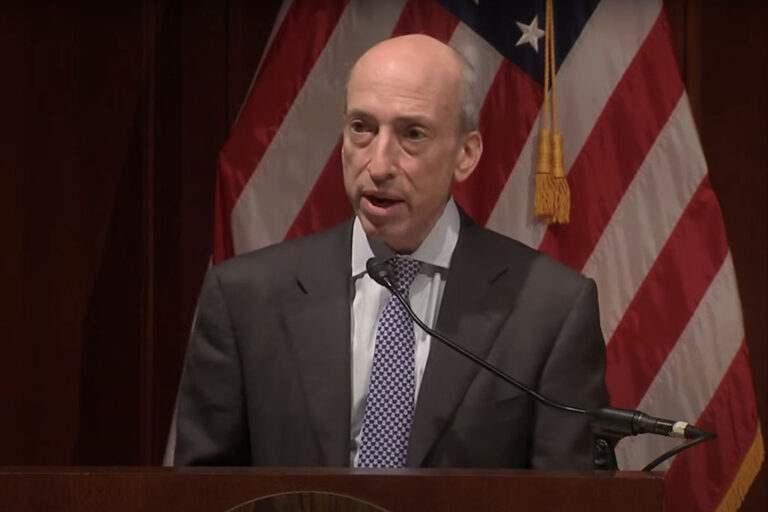

As Gary Gensler steps down from his post as Chair of the Securities and Exchange Commission (SEC), his tenure is marked by robust crypto debates, securities laws, and significant reforms in traditional markets. Gensler, known for his stringent regulatory stance, defended his approach in a January 14th candid interview on CNBC’s Squawk Box.

Reflecting on the crypto sector, Gensler characterized it as a “highly speculative field” rife with noncompliance, particularly among the thousands of tokens that fall under securities laws. He emphasized that Bitcoin, while volatile, stands apart from other tokens. “We at the SEC have never said it’s a security,” he reiterated, labeling Bitcoin as a unique asset akin to gold in its global appeal.

“Bitcoin is a highly speculative, volatile asset. But with 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years,” said Gensler.

Bitcoin ETFs and Regulatory Debates — Gensler’s Take

Despite facing criticism for his strict crypto stance, Gensler pointed to early efforts to enable Bitcoin futures-based exchange-traded funds. He referenced launching Bitcoin exchange-traded funds tied to futures shortly after taking office, emphasizing his belief in proper regulatory frameworks to protect investors. However, he acknowledged Bitcoin’s speculative nature, comparing its volatility to the historical tulip mania.

“Within the first few months in the job, we had Bitcoin exchange traded funds based on futures,” he noted.

His leadership faced scrutiny over the SEC’s litigation-heavy approach to crypto regulation. Judges, in some cases, demanded clearer explanations from the SEC, with one describing the agency’s responses as part of “a long line” of insufficient clarifications. Gensler stood firm and asserted that Congress has passed laws, and we’ve acted to enforce them. Many projects in the crypto field fail to comply, and investors deserve protection.

While crypto issues drew attention, Gensler took pride in reforms in the equity and treasury markets, which he described as the bedrock of the financial system. One significant achievement was reducing the trade settlement cycle, allowing everyday investors to receive funds in a single day instead of two.

“That market is so much more critical to you and the American public than crypto, the $60 trillion equity markets,” he stated.

Gensler also collaborated with key financial figures like Janet Yellen and Jay Powell to fortify the $28 trillion US Treasury market. He highlighted bipartisan reforms to reduce risks and ensure smooth operations as the market is projected to grow to $36 trillion in the next four years. “Taxpayers must trust that their government can borrow in liquid, resilient markets,” he said.

SEC’s Narrow Focus on Investor Needs

On broader regulatory concerns, Gensler addressed evolving climate disclosure rules, emphasizing the SEC’s focus on material information required by investors. He noted the agency’s role is limited to investor-relevant matters, countering criticisms tied to ESG and DEI initiatives.

“We’re not a climate regulator and we’re not a workforce regulator. We’re a securities regulator. […] I’ve been consistent since my confirmation that we would ground it in just what’s material to investors,” he explained.

When asked about future risks, Gensler pointed to artificial intelligence as a transformative yet risky development. He also expressed concerns over pockets of leverage in capital markets, which could create instability if left unchecked.

next“I do think that artificial intelligence is transformative, already has affected productivity in a positive way. But there’s still risk out there on the horizon,” Gensler remarked.