TeraWulf, which currently mines most of its BTC using nuclear energy, said that it will continue to remain profitable until BTC price stays above $40,000.

Following the Bitcoin halving event, BTC miners have been navigating the sharp drop in profits by making key decisions for future growth. Bitcoin mining company TeraWulf is considering a merger if there’s a potential opportunity for expanding the profit margins.

TeraWulf’s move coincides with other firms undertaking similar merger options to sustain the declining profits. Last month in June, Riot Platforms attempted a “hostile” takeover of Bitfarms with a $950 million buyout, however, it failed eventually. Similarly, on June 27, Bitcoin miner CleanSpark announced its merger with GRIID infrastructure for $155 million. Speaking on the development, Kerri Langlais, TeraWulf’s chief strategy officer said:

“We will certainly consider inorganic growth opportunities through M&A [but] expanding merely for growth’s sake, or ‘empire building,’ without considering profitability makes no sense.”

Several public-listed Bitcoin mining firms such as Marathon Digital have set targets to reach different hashrate milestones. Langlais stated that TeraWulf is prioritizing “organic growth” at its current locations and enhancing shareholder returns. He added:

“Our success hinges not merely on the speed of our expansion but on the discerning allocation of capital to generate sustained returns for our shareholders. This distinction is crucial; it enables investors to differentiate between companies that are growing profitably versus simply growing.”

TeraWulf’s Langlais said that he expects to see more mergers and acquisitions among Bitcoin miners adding that there’s also a “large disparity in valuations” making it difficult to determine which deals are worth pursuing.

“‘Cash is king,’ and metrics like EBITDA, profitability, and free cash flow yield should become the benchmarks for valuing mining businesses moving forward,” said Langlais.

Bitcoin Miner Expansion Won’t Be Easy

As Bitcoin mining activity becomes more competitive and less rewarding, miners have been exploring other avenues of earnings. For e.g. Marathon Digital recently started mining other PoW cryptocurrencies like Kaspa.

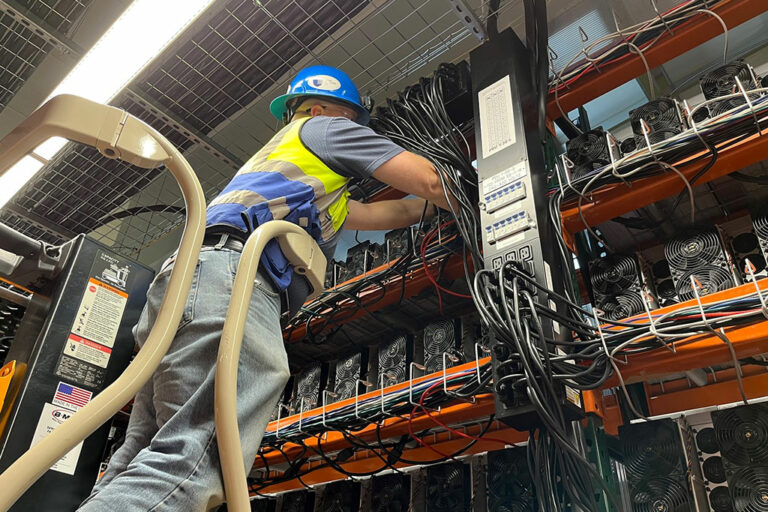

Apart from this, players like TeraWulf are using their hash power for other areas like artificial intelligence (AI) and high-performance computing in order to expand their revenue streams. Langlais stated that Bitcoin miners could be facing substantial hurdles while expanding due to emerging competition for power resources. He added:

“Hyperscalers are quickly securing every available power capacity nationwide, competing for the same locations traditionally sought after by BTC miners. This intense competition is driving up land and power prices, thereby diminishing the profitability of new BTC mining projects.”

TeraWulf currently mines most of the Bitcoins using nuclear energy. The miner stated that it will continue to remain profitable until BTC price stays above $40,000.

next