Blackmoon Financial Group launches the Blackmoon Crypto Platform, a blockchain-based platform for tokenized vehicles, which allows to create and manage legally compliant tokenized funds.

Blackmoon Financial Group has announced the launch of Blackmoon Crypto Platform, a blockchain-based platform for tokenized vehicles.

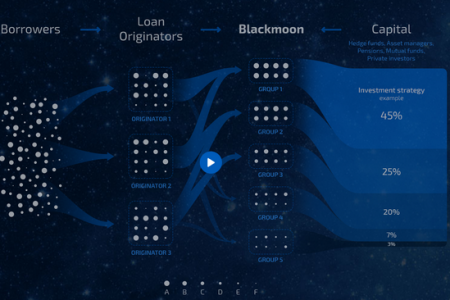

The Blackmoon Crypto Platform is a multipurpose solution for asset managers to create and manage legally compliant tokenized funds which takes care of everything starting from technology and infrastructure ending up with legal framework and corporate structuring. High Blackmoon Crypto Platform’s usability will allow any experienced investment manager to create a fund based on it.

Blackmoon Crypto, the holding company and the part of Blackmoon Financial Group, is responsible for such moments as technical implementation, compliance, licensing, and banks partnerships. It also issues standard tokens of the Blackmoon Crypto Platform, which are based on the Ethereum blockchain.

Blackmoon Financial Group is a financial technology and investment management company that was founded in 2014 and since then exceeded $100M in deals’ volume, while reaching $13M in monthly volumes. The company has offices in Moscow, Limassol and New York and attracted $3.5 million in venture capital investments since 2015.

The investment process is believed to become more auditable, transparent and liquid owing to tokenization of interest in funds. That means investment funds will be an open book for investors.

“Setting up the proper investment structure is a costly endeavour. Not all tokenized funds set up a proper structure, which leads to greater regulatory risk for investors. Now is the time to introduce the industry standard for setting up tokenized investment vehicles that can attract investments from private individuals and institutional investors of any kind. That’s what the Blackmoon Crypto platform does; it reduces the regulatory risk and bridges the gap between the fiat and crypto worlds.” – explained Oleg Seydak, CEO of Blackmoon Financial Group.

Despite Blockchain has been gaining popularity at financial sector since 2009, with Bitcoin and Ethereum becoming something mainstream, the majority of tokenized investment vehicles are still either fully crypto-oriented or pegged to a tradable asset, like the U.S. dollar or gold. Access to fiat investment opportunities retains all the benefits of the crypto universe, such as decentralization, transparency, and exchangeability, and also provides unprecedented diversification in terms of income sources. In addition, the cost-efficient structure of tokenized funds allows traditional investors get higher net return.

“Tokenized funds are more cost-efficient thanks to lower infrastructure and setup costs,” Sergey Vasin, Chief Investment Officer of Blackmoon added. “This economy is transmitted to investors in the form of higher net return. For the cherry on top, fund tokens are also immediately tradable.”

By efforts of the Blackmoon team, which has extensive experience in setting up and managing investment funds, developing automated investment interfaces and asset management tools, the new standard for tokenized investment vehicles may be set. It is to be hoped that this solution will bridge the gap between the fiat and crypto worlds.

The Blackmoon Lending Marketplace now operates in 9 countries and exceeded $100M in deals volume, while reaching $13M in monthly volumes. The company has 19 full time employees, with offices in Moscow, Limassol and New York and attracted $3.5 million in venture capital investments since 2015.

next