Just like the Dow Jones Industrial Average, the Coinbase’s Crypto Index Fund will reflect all the major trends and shifts in the cryptocurrency market.

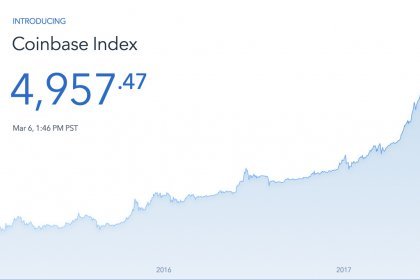

This Tuesday, March 6th, popular cryptocurrency exchange Coinbase officially announced its foray into asset management by launching its first ever crypto index fund. The U.S-based exchange, which is currently the biggest in the world with a valuation of over $1.6 billion, has formed a new subsidiary called the Coinbase Asset Management lead by Reuben Bramanathan who will look after all the functioning of the Coinbase Index Fund.

While appearing on CNBC’s “Fast Money”, Coinbase President and COO Asiff Hirji said: “It’s a very simple to use, easy way to get exposure to the crypto-assets that we offer on our exchange.” Hirji said that he expects investors to get attracted to the fund and thinks that “the investors are not going to want to pick specific winners or losers.”

Product lead Bramanathan said that new index fund will give its investors exposure to all the assets that are listed on GDAX which is Coinbase’s institutional exchange. This means that as and when a new crypto asset get listed on GDAX, it will be automatically added to the fund. Bramanathan said: “We’re seeing strong demand from our customers and the market generally for a passive investment management product.”

The new fund will be quite similar to the Dow Jones Industrial Average. Just like the Dow Jones, comprising of a basket of 30 stocks gives the overall sense of the American economy, this new fund will reflect all the major trends and shifts in the cryptocurrency market.

Currently, Coinbase’s GDAX exchange allow professional investors to trade in four different cryptocurrencies Bitcoin, Bitcoin Cash Ether, um and Litecoin. The newly launched crypto index fund from Coinbase will include all the digital currencies on GDAX, weighted by market cap. This means that the Index Fund will comprise of 62 percent Bitcoin, 27 percent Ethereum, 7 percent Bitcoin Cash and 4 percent Litecoin. The percentage distribution will get automatically rebalanced according to the market-cap weight as and when a new digital coin gets added to GDAX.

Hirji said that Coinbase has been quite particular and cautious while adding new digital currencies to the exchange. He said: “There has been a lot of discomfort from the SEC around a lot of these ICO-based tokens. We’re not going to be the ones operating in the black.”

The Index Fund has a minimum investment requirement of $10000 and the company will be charging a 2 percent annual management fees with no performance fees at all. All the investments can be made through USD or also through digital currencies as long as the investors put a minimum equivalent worth $10000.

Moreover, for now, the fund is available only to the U.S.-resident accredited investors. The company has assured that it is planning to launch more funds in the future which cover a broad range of digital assets and are also accessible by investors worldwide. All the new investments can be made once a month, with a facility of redemptions on a quarterly basis and with no lock-up period involved. All the funds will be held by Coinbase in its cold storage.

next