Over the past five years, central banks worldwide have shown significant interest in issuing CBDCs. According to research by the Atlantic Council, as of March 2024, 134 countries are exploring a CBDC, with 38 ongoing pilot projects.

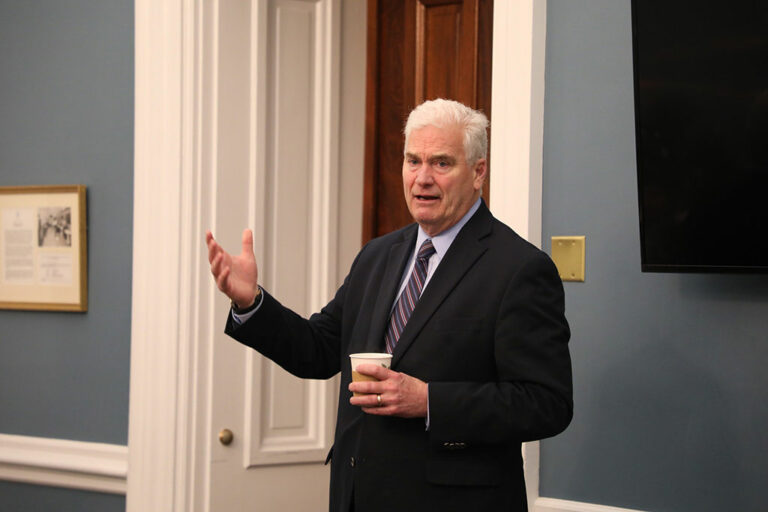

Congressman Tom Emmer recently voiced strong opposition to the Biden administration’s push for a central bank digital currency (CBDC), warning that it could affect American values and citizens’ right to privacy.

During a speech to the House of Representatives, Emmer argued that the Biden administration is eager to trade Americans’ right to privacy for a “CCP-style surveillance tool.” According to the Congressman, this could potentially allow the federal government to access citizens’ transaction data. He states:

“Unlike decentralized digital assets such as Bitcoin, CBDCs are a digital form of sovereign currency designed, issued, and monitored by the federal government.”

An Anti-American Approach

Over the past five years, central banks worldwide have shown significant interest in issuing CBDCs. According to research by the Atlantic Council, as of March 2024, 134 countries are exploring a CBDC, with 38 ongoing pilot projects.

However, Emmer cited recent instances like China, where governments weaponized financial systems against their citizens. Emmer fears that this “anti-American” scenario could happen in the United States if CBDCs are adopted.

“It’s naive to believe that your government will not weaponize the tools that it has to control you. This may be why the Biden administration issued an executive order placing an urgency on CBDC research and development,” he adds.

Federal Reserve’s Direct Control

Notably, the Federal Reserve notes that while Americans often keep their money in digital forms like bank accounts, payment apps, or online transactions, a CBDC would be a liability to the Fed. According to Emmer, this potentially gives the Fed more direct control over individuals’ finances. He revealed that the Federal Reserve has already described CBDCs as “one of their key duties” in a document that was provided to his office.

While there are no concrete plans for a US CBDC launch in 2024, there are several bills and proposals that aim to restrict or regulate the development of a CBDC.

In February 2023, Emmer introduced the CBDC Anti-Surveillance State Act. The bill has impressively garnered support from 165 Republican conference members and aims to ensure that Congress retains authority over the United States digital currency policy. Emmer states:

“This bill ensures that Congress, not the administration, retains authority over the United States Digital Currency Policy so that it reflects our American values of Privacy, individual sovereignty, and free market competitiveness.”

According to Emmer, any CBDC would need to balance safeguarding consumers’ privacy rights with providing the transparency necessary to deter criminal activity.

As the debate over the development of CBDCs continues, Emmer’s warnings highlight the critical need for careful consideration of privacy and individual freedoms.

next