MicroStrategy sets a historic record in Bitcoin purchases during November, acquiring 149,880 BTC for $13.5 billion, while its stock value soars over 500% this year, reflecting the success of its cryptocurrency reserve strategy.

The impressive performance of Bitcoin BTC $69 178 24h volatility: 1.1% Market cap: $1.38 T Vol. 24h: $43.63 B in the past three months has significantly boosted MicroStrategy Inc. (NASDAQ: MSTR), a company focused on enterprise analytics and mobility software. As a reputable holder of Bitcoin, the MicroStrategy stock market has risen more than 500 percent year-to-date (YTD) to trade above $375 on Wednesday, during the mid-New York session.

The $83.9 billion company has attracted investors from all over the world, including central banks in Europe. The undisputed success in the last year has influenced a dozen other companies around the world to follow in the same footsteps to adopt Bitcoin as a strategic reserve asset.

Moreover, nation-states, led by the United States, are preparing to adopt Bitcoin as a strategic reserve asset to fight the menacing debt crisis.

MicroStrategy Record Month of Bitcoin Purchases

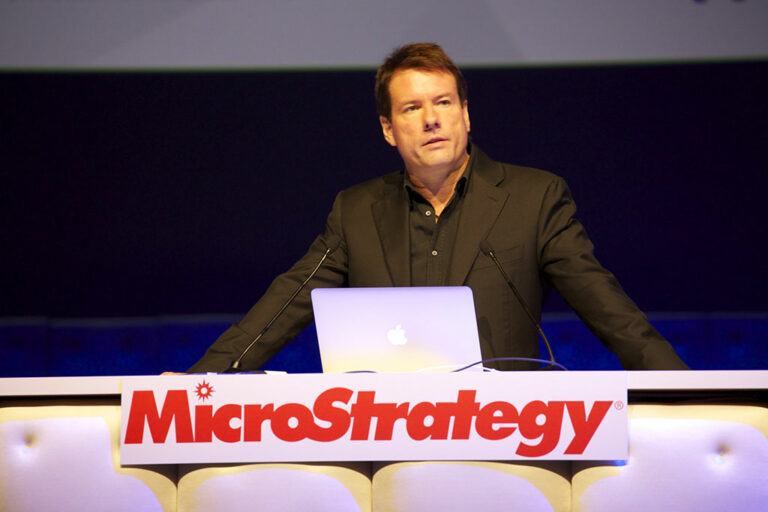

According to an X post by Michael Saylor on Wednesday, December 4, MicroStrategy raised $13.5 billion in November and purchased 149,880 Bitcoins by the end of the month. The record Bitcoin acquisition follows the company’s announcement of an ambitious plan to raise $42 billion in the next three years to strengthen its BTC strategy.

According to Saylor, the company acquired Bitcoins at an average price of about $90,231, thus reciprocating a net benefit of 97,500 BTC to the shareholders by the end of the month. The company has received overwhelming support from institutional investors seeking to diversify into the cryptocurrency industry.

“Creating shareholder value and BTC yield! More companies should consider the benefit of adding BTC as a treasury asset,” Fred Thiel, the Chairman and CEO of MARA Holdings (NASDAQ: MARA), noted.

As Coinspeaker reported, MicroStrategy is committed to holding its Bitcoin for the long haul, with plans to become the largest BTC bank. Furthermore, the company purchased 15,400 Bitcoins on December 2, for about $1.5 billion. Consequently, MicroStrategy now holds 402,100 Bitcoin, thus achieving a 63 percent BTC yield YTD.

The company’s success has, however, been criticized by Peter Schiff, the chief economist at Europac and Schiffgold, who noted that MSTR shareholders have been putting up with the ongoing stock market dilution.

“The next Bitcoin bear market will leave the company and shareholders in a very precarious position,” Schiff noted.

Market Impact

Bitcoin price has been a top performer in the past year, fueled by the periodic purchases by Saylor. The flagship coin has been consolidating around $96k in the last two weeks after an impressive rally in early November following the resounding victory of Donald Trump.

According to on-chain data analysis, 400 new Bitcoin whales, holding between 100 and 10k BTCs, have joined the network in the past two weeks. Consequently, the rally beyond $100k is expected to resume in the near term, majorly fueled by strong fundamentals.

next