Nowadays, the Fintech industry is becoming huge. So, the number of Fintech companies with VC investments increased from 276 in 2010 to about 1,000 in 2015.

The modern world is developing and growing, and all the spheres of our life are seeing drastic changes.The FinTech industry is among those fields that has been showing rapid growth over the last year, while the overall investment in the sector has reached millions of dollars.

So, some of the most influential bankers on Wall Street are entering FinTech in an attempt to transform traditional financial businesses. According to the research company Aite Group, banks will spend about $400 million on the technology behind bitcoin by 2019.

This year, financial firms invested $75 million into the blockchain, what is twice the sum they invested in 2014. Such powerful banks as Bank of America, Citi, HSBC, Barclays, Morgan Stanley, National Australia Bank and UBS, have recently joined a project on exploring and developing blockchain applications.

“Bitcoin has been the most visible application of the blockchain, but it and other cryptocurrencies are a tiny fraction of the technology’s potential applications,” says Ben Knieff, senior analyst on the Retail Banking & Payments team. “Many technical details and variations signify different implementations, all of which could mean potentially disruptive applications for these technologies.”

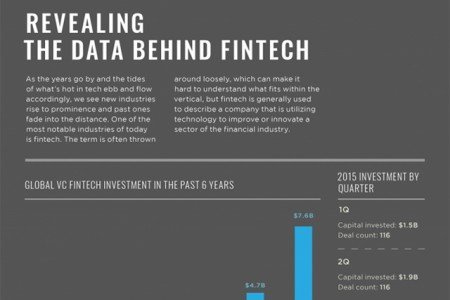

The VC investments in Fintech companies worldwide increased from 0.52 billion U.S. dollars in 2010 to 2.8 billion U.S. dollars in 2014, reads Statista . In general, capital invested in Fintech startups jumped from $1.76 billion in 2013 to $4.74 billion in 2014.

“In an industry that will soon be irrevocably changed by the disruptive effect of innovation, the companies doing fintech best are those most likely to succeed. Already, some of the world’s major financial centres are equally becoming known as centres for fintech innovation: London and New York, and more recently Sydney,” says Toby Heap, founding partner at H2 Ventures.

According to J.P. Morgan’s 2014 annual report, the Fintech industry is going to change a lot in the future. CEO Jamie Dimon warns that “Silicon Valley is coming.” In fact, over the past five years the number of Fintech companies with VC investments increased from 276 in 2010 to almost 1,000 in 2015.

ValueWalk has created a datagraphic overviewing VC investment in the vertical helping to process the activity around fintech. The infographic posted below describes notable financings, top firms and most active investors ranked by the PitchBook Growth Score .

next