Despite what many have observed as a sell-off trend among several major holders like Sun, his explanation suggests a different story entirely.

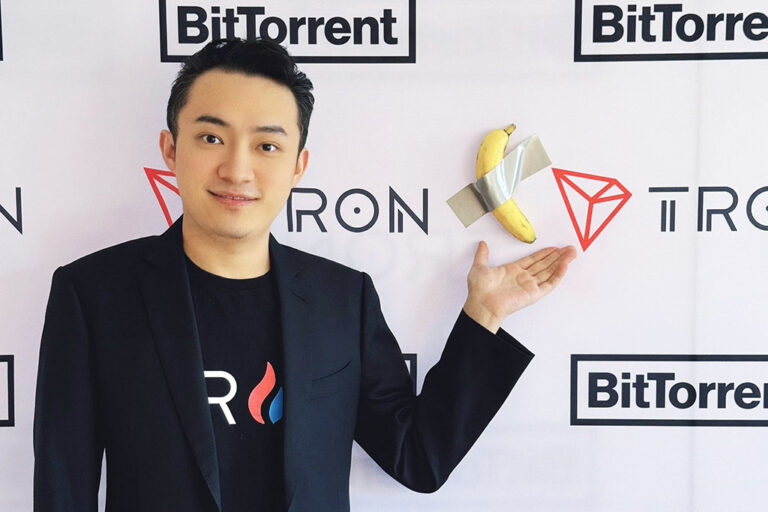

Justin Sun, the founder of TRON (TRX), has responded to a recent report about him selling off his Ethereum ETH $2 108 24h volatility: 7.5% Market cap: $254.64 B Vol. 24h: $53.73 B holdings. Earlier on Monday, news circulated that Sun had liquidated a significant amount of ETH, sparking fears within the Ethereum market.

Sun has, however, denied those claims. Taking to his X (formerly Twitter) account, he explained that the transactions being reported were simply wallet-to-wallet movements and so should not cause any panic.

Recall that earlier, Coinspeaker quoted blockchain analytics firm Spot On Chain as saying that Sun had sold off 50% of his remaining ETH over the past week. The transactions were valued at around $143 million, raising concerns among keen observers of the market.

Adding more fuel to the fire of speculations, Ethereum also continued to struggle, with its price dipping 17% during the same period.

TRON Founder Labels Transfers as Routine, Stays Bullish on Ethereum Ecosystem

Despite what many have observed as a sell-off trend among several major holders like Sun, his explanation suggests a different story entirely. His post reads:

“The rumours circulating online about us liquidating ETH are false. This is simply a transfer of ETH between our different wallets. We remain long-term bullish on the Ethereum ecosystem.”

ETH Under Pressure

As earlier noted in this publication, the timing of these speculations may be having damning consequences on Ethereum. That is, as its price continues to struggle with stability.

After failing to breach the $4,000 resistance level, ETH has been falling steadily, only just recently gaining 2.91% in the past day. Yet, it remains 14.8% down on the seven-day chart and 0.70% on the 30-day chart. As of publication, ETH is exchanging hands at $3,404.

Notably, questions remain about the token’s near-term prospects. However, Sun’s insistence that his confidence in its long-term trajectory has not wavered shines hope and optimism on Ethereum.

As a prominent figure in the crypto space, his support would go a long way for Ethereum’s potential despite its ongoing challenges.

next