If the price of Bitcoin rises, MicroStrategy will benefit in various ways. Conversely, if the price of Bitcoin falls drastically or even crashes, MicroStrategy may face challenges in recovering from the debt.

According to a recent report by Bernstein, as reported by Coindesk, MicroStrategy (MSTR) intends to raise long-term debt. However, the company is under pressure as it may need to sell off all its Bitcoin holdings, especially if the price drops drastically. This would be done to protect the company from the adverse effect that a possible Bitcoin price decline could have on its finances between now and 2025 when the debt will be due.

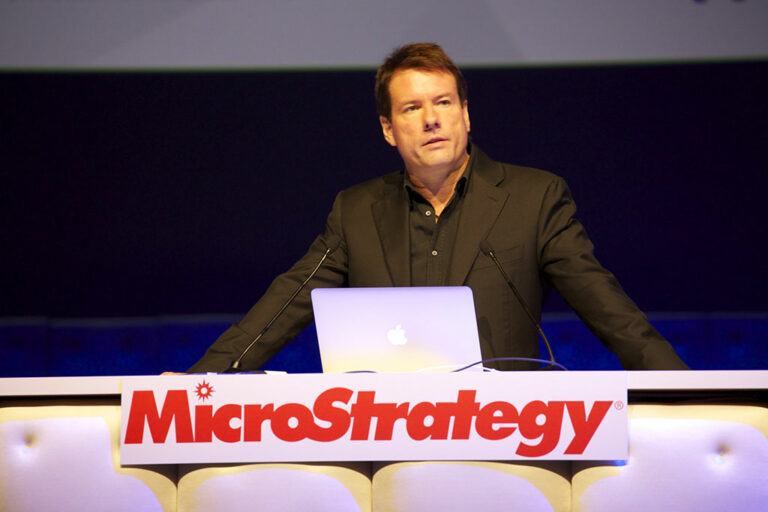

MicroStrategy, founded in 1989, has gained attention for its significant investment in Bitcoin. The company uses Bitcoin as a reserve asset to help protect and enhance its finances in the long run. MicroStrategy owns approximately 152,000 bitcoins bought at an average price of $29,600, totaling $4.49 billion and representing 0.77% of the total Bitcoin supply. With this, the company is one of the largest institutional holders of crypto.

The report highlights that the value of Bitcoin held by MicroStrategy is 95% of its market capitalization. However, when we consider the debt that the company has taken on to acquire BTC, the value of these assets only amounts to 49% of the company’s market cap.

The Potential Effects of Bitcoin’s Exposure on MicroStrategy’s Finances

If the price of Bitcoin rises, MicroStrategy will benefit in various ways. The event will help it to strengthen its financial position, increase share value, and make debt repayment easier. If an increase in stock prices accompanies the rising Bitcoin price, the company will be able to raise more funds for other purposes.

Conversely, if the price of Bitcoin falls drastically or even crashes, MicroStrategy may face challenges in recovering from the debt when it becomes due, as its Bitcoin holdings may not be sufficient to cover the loss. This situation would put additional pressure on the company.

MicroStrategy and Potential Influence of Its Decisions on the Crypto Market

If an institutional holder of Bitcoin like MicroStrategy were to sell off its holdings, it could have various effects on the market. The first impact would be price volatility, as the massive sell-offs and subsequent panic sales due to fear would create downward pressure.

Such sell-offs could also trigger negative sentiment in the market, leading to a lack of confidence among investors. Given Bitcoin’s dominance, the sell-off could also affect other cryptocurrencies, potentially causing another prolonged period of market price decline, often referred to as a “crypto winter”.

However, it’s important to note that the impact of such an activity would depend on various factors and other events occurring in the crypto world at the time it happens.

next