Ray Dalio’s comments for Bitcoin came citing the recent inflationary environment wherein the billionaire believes that holding onto cash won’t be the right thing to do.

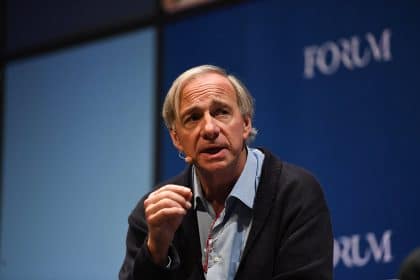

Billionaire investor Ray Dalio has been vocal about his liking for digital assets and sees it as a good hedge against the rising inflation. In his latest interview, Dalio said that it’s reasonable for everyday investors to have some exposure to Bitcoin.

His comments came while speaking at the We Study Billionaires Podcast with co-host William Green. Here, Green asked whether holding 1-2% of one’s portfolio in BTC was reasonable. Responding to it, the billionaire said “I think that’s right”.

Dalio has previously disclosed that he owns “a little bit” of Bitcoin himself. Besides, he also said that Bitcoin has got its own “pros and cons”. Speaking to Green on his latest podcast interview, Dalio said that he still has concerns about the government outlawing the digital asset. Besides, Bitcoin ransomware attacks are getting more common. Dalio said that this is why his stance on the cryptocurrency isn’t “black and white”.

Dalio Views Bitcoin as an Inflation Hedge

One of the biggest concerns among Wall Street investors is protecting their money against the rapidly rising inflation in the US that is why many big investors have considered dipping their toes in cryptocurrencies.

Dalio said that he sees Bitcoin as digital gold and as a hedge against inflation. He compares Bitcoin to Gold due to its inherent design of a limited supply. “I think over time, inflation-hedge assets are probably likely to do better,” Dalio told Green. “That’s why I’m not favorable to cash and those types of things.”

Dalio further stressed the need for portfolio diversification and choosing Bitcoin. Speaking of diversifying from Bitcoin, he said:

“One wonders, when does somebody take the money they made in bitcoin and then diversify that? There are other things that are developing, not only other coins, but non-fungible tokens and other things that become popular with that crowd. Does that diversify [bitcoin]?”

Last month, Ray Dalio also stated that he owns a little bit of Ethereum as a portfolio diversification tool. During one of his recent interviews with Yahoo Finance, Dalio said:

“Well, I’m not going to give the precise amount of Bitcoin, but I do own some Ethereum as well. But, the answer to your question is that I don’t own a lot of it. I view it as alternative money in an environment where the value of cash money is depreciating in real terms. And, I think it’s very impressive that for the last 10, 11 years, that programming has still held up, it hasn’t been hacked, and so on, and it has an adoption rate. So, I’m very big on diversification, and it’s a relatively small part of the portfolio.”.

Bitcoin and the broader cryptocurrency market have entered a strong correction today. As of press time, Bitcoin is down 7.5% to $43,000 while Ethereum has corrected 10% while slipping under $3,400 levels.

next