Marathon Digital said that the company won’t be raising funds to achieve its target of 50 EH/s and that it would be fully self-funded.

Bitcoin mining giant Marathon Digital recently shared its goals for the hash rate that it seeks to achieve this year in 2024. This is the first major update from the company after the Bitcoin halving event last week, which reduced miner rewards from 6.25 BTC to 3.125 BTC.

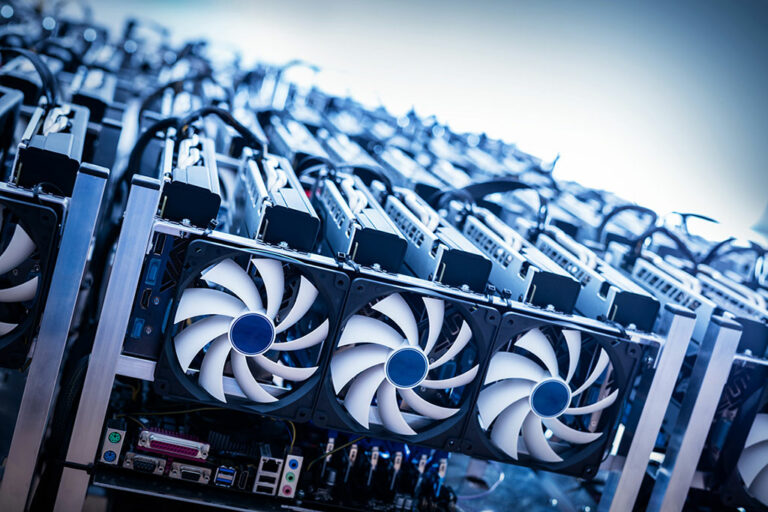

Taking an ambitious goal Marathon has revised its 2024 hash rate goal from 35-37 exahashes per second (EH/s) to 50 EH/s. This comes on the backdrop of the company’s recent acquisitions which helped it expand its overall capacity.

In his statement on Thursday, Marathon CEO Fred Thiel said that the company is planning to double its mining scale this year in 2024, owing to this added capacity. Thiel said that the company wouldn’t need to raise capital in order to achieve these targets and that it would be “fully funded”. Thiel added:

“With our current liquidity position, this growth target is also fully funded and there is no need for us to raise additional capital to achieve our objective. By deploying state of the art equipment and our own proprietary technology, we also believe that we can improve our fleet efficiency and approach 21 joules per terahash as we grow to 50 exahash.”

Last month in March, Marathon Digital acquired a 200-megawatt Bitcoin mining facility for $87.3 million, from Digital Applied. Furthermore, it has acquired an additional two mining sites from Generate Capital for $179 million with a combined capacity of ~400 megawatts.

Marathon Digital (NASDAQ: MARA) stock price has surged by over 25% following the fourth Bitcoin halving event, which occurred at block 840,000 on April 20, a trend observed across other miners in the industry. The surge in demand at block 840,000 was largely fueled by enthusiasts of memecoins and non-fungible tokens (NFTs), who competed to create and embed “rare satoshis” using the Runes protocol.

Bitcoin Hashprice on Downfall

Within a week of the fourth Bitcoin halving event, the Bitcoin “hashprice” has dropped considerably. As per the Hashrate data Index, the Bitcoin “hashprice” has dropped to $57. This figure indicates the earnings potential for a miner utilizing one petahash per second of computing power per day. It reached its lowest point at $55 shortly after the collapse of FTX in November 2022.

Following the halving event, the hashprice surged to $139 momentarily as transaction fees escalated due to heightened activity associated with the Rune protocol, enabling the creation of nonfungible tokens on the Bitcoin blockchain. However, this surge swiftly reversed as fees retreated to pre-halving levels and mining difficulty surged, as indicated by CryptoQuant data.

next