Bernstein report states that the decline in difficulty is due to the combination of lower Bitcoin prices and a significant increase in mining equipment costs since the last Bitcoin halving in May 2020.

Bitcoin miners facing squeezed margins, got relief last week. Mining complexity, which measures the computational work needed to validate transactions and create new coins, saw its biggest drop since December 2022, falling around 6%. Broker Bernstein finds this decline in Bitcoin mining as a positive development for Bitcoin miners.

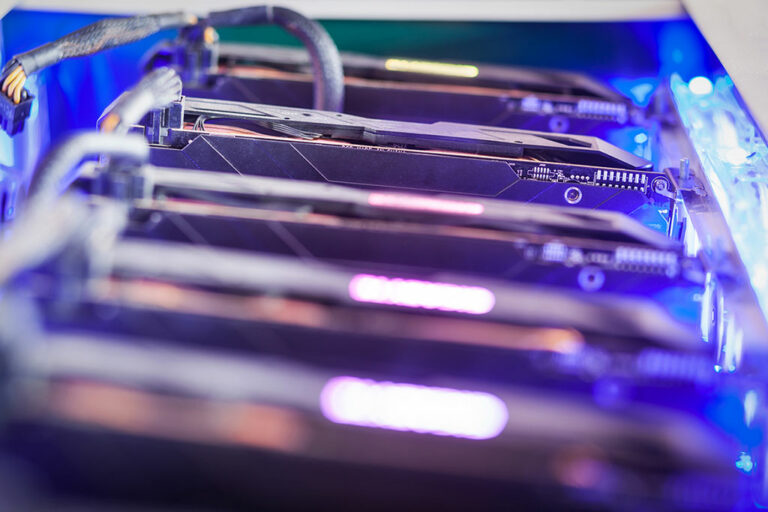

Photo: Bernstein

Bernstein report states that the decline in difficulty is due to the combination of lower Bitcoin prices and a significant increase in mining equipment costs since the last Bitcoin halving in May 2020. This cost pressure led to the closure of high-cost mining rigs, resulting in a decline in the overall hashrate – the combined computing power securing the Bitcoin network.

Bitcoin Mining’s Strategic Advantage

The report identifies Riot Platforms (RIOT) and CleanSpark (CLSK) as the leading Bitcoin miners with the lowest production costs, bolstered by strong balance sheets and cash positions. This strategic advantage allows them to weather market fluctuations more effectively.

“A temporary pause in bitcoin price is actually good for the incumbent lower cost bitcoin miners, as hashrates remain capped and strong miners can execute on their aggressive capex and M&A plans to grow market share,” the Bernstein report highlights. This window of opportunity allows them to expand their operations and solidify their dominance while others struggle.

The report further emphasizes the potential for these miners to capitalize on a future price upswing. “And finally, when bitcoin price momentum picks up, miners can harvest high dollar revenues over higher production,” the report said.

The Key to the Next Bull Run?

While not predicting a major price drop for Bitcoin, Bernstein anticipates a period of consolidation before a potential breakout. According to Bernstein, the key to unlocking the next bull run lies in increased institutional investment. The report specifically mentions spot exchange-traded funds (ETFs) attracting allocations from registered investment advisors (RIAs), wealth platforms, and other institutional funds.

Bernstein maintains an “outperform” rating on CleanSpark and Riot Platforms, anticipating their performance to exceed the overall market. For Marathon Digital (MARA), the report assigns a “market-perform” rating, suggesting it will likely the broader market movement.

Photo: TradingView

According to TradingView, Bitcoin is trading at the price of $62,980, marking a slight 0.42% gain in the last 24 hours, but still 6.26% down in the last month’s timeframe. Bitcoin has broken the crucial support level of $61,000 and could reach 65k if it maintains its upward trajectory.

next