Tom Lee’s BitMine Technologies staked an additional $610 million in Ethereum, pushing its total staked ETH holdings to $6.52 billion.

Tom Lee’s BitMine Technologies (NASDAQ: BMNR) has continued staking its Ethereum ETH $2 907 24h volatility: 0.6% Market cap: $350.80 B Vol. 24h: $26.10 B holdings.

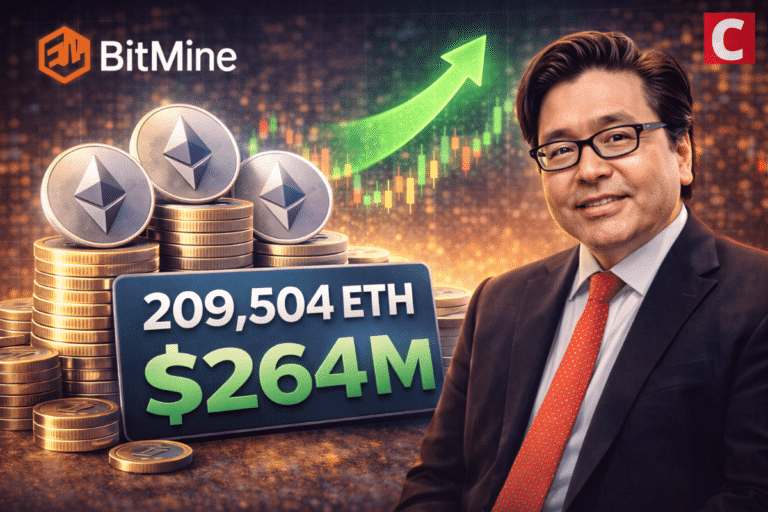

As per the latest on-chain data, the firm staked an additional 209,504 ETH on Jan. 27.

In his latest interview, Lee said that cryptocurrencies could make a comeback after a massive gold rally.

Tom Lee’s BitMine Doubles Down on ETH Staking

In a fresh move, Nasdaq-listed BitMine Technologies staked an additional 200,000+ ETH worth over $610 million.

With this transaction, BitMine’s total staked Ether reached 2,218,771 ETH, valued at about $6.52 billion, representing more than 52% of its total ETH holdings.

Tom Lee(@fundstrat)'s #Bitmine staked another 209,504 $ETH($610M) today.

In total, #Bitmine has staked 2,218,771 $ETH($6.52B), over 52% of its total holdings.https://t.co/P684j5YQaG pic.twitter.com/TsIk5f0x6e

— Lookonchain (@lookonchain) January 27, 2026

Last week, Tom Lee’s firm BitMine acquired a total of 40,302 Ethereum.

This marks BitMine’s largest purchase in 2026 so far, bringing the company closer to holding 5% of Ethereum’s total supply.

After the latest acquisition, BitMine holds 4,243,338 ETH, valued at approximately $12.05 billion. This accounts for 3.52% of Ethereum’s total circulating supply of 120.7 million ETH.

As of now, BitMine is the largest corporate Ethereum treasury firm. It has further consolidated its position with aggressive purchases made over the past year.

Crypto Set to Catch Up as Precious Metals Rally Pauses, Says Tom Lee

Precious metals like gold and silver have recently attracted the majority of capital, causing digital assets to underperform.

However, Tom Lee believes that once profit-taking begins in the gold and silver markets, capital is likely to rotate back into cryptocurrencies.

Speaking on CNBC’s Power Lunch on Jan. 26, Lee said crypto assets would typically benefit from a weaker U.S. dollar and an easing Federal Reserve.

However, he noted that the sector is currently lacking a leverage-driven tailwind after a period of deleveraging.

Lee added that as long as gold and silver continue to rise, investors’ fear of missing out is flowing into precious metals.

This further led to delays in the broader crypto rebound.

next“Because when gold and silver take a break, then and in the past, that would lead to a Bitcoin and Ethereum surge afterwards. I think the precious metal move has sucked a lot of the oxygen out of the room. So, I think crypto prices aren’t quite keeping up with fundamentals, but as you know, when fundamentals go up, and to the right, prices eventually follow,” he added.