Bitcoin company Blockstream secured $55 million in its second financing round aimed at expanding its operations worldwide.

Blockstream has closed its $55 million Series A investment round that will allow the company to further improve its sidechain technology. The funding round, led by AXA Strategic Ventures, Digital Garage and Horizons Ventures, brought the company’s overall investment to $76 million.

“I’m excited to announce that we raised $55 million in Series A funding to further enhance our sidechain technology, expand our operations globally, and support new industry partnerships, bringing our total investments in the company to $76 million,” the co-founder and CEO of Blockstream, Austin Hill, said in a blog post.

Other investors include Blockchain Capital, Future\Perfect Ventures, AME Cloud Ventures, Seven Seas Venture Partners, Khosla Ventures and Mosaic Ventures.

During the previous financing round, which was closed in 2014, Blockstream received $21 million from a range of investors, such as Google chairman Eric Schmidt and LinkedIn co-founder Reid Hoffman.

The announcement comes amid the news about the expansion of its Board of Directors. Frances Kang, the Project Director at Horizons Ventures, joined the board.

“Blockchain technology is redefining what is possible within the fintech ecosystem and beyond. The transition to this new world – one that is decentralized, interoperable, secure, and trustworthy – is going to be illuminating. We are excited to be working with Blockstream to see their innovative sidechain technology reach its full potential,” Kang said.

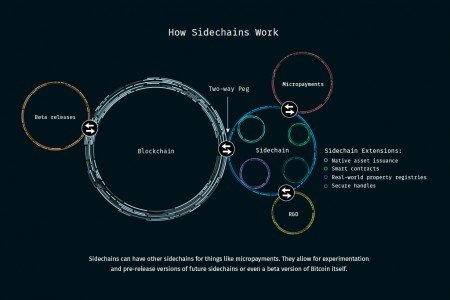

Blockstream is focused on developing the sidechain technology to enhance the blockchain system. The company provides firms with secure and well tested infrastructure to enable more innovation on the distributed ledger technology.

According to Managing Partner of AXA Strategic Ventures, François Robinet, the blockchain has the potential to change the financial sector, as well as other industries.

“We value Blockstream’s open source approach and its sidechain technology, which will allow interoperability between different chains and provide critical long-term success in this sector,” Robinet said.

Last year, Blockstream unveiled its first production sidechain, called Liquid. The solution helps financial companies, such as payment processors and exchanges, to instantly conduct transactions, while ensuring high level of security. Besides, the company teamed up with consulting firm PwC to speed up the deployment of the technology behind bitcoin.

Sidechains allows creating new currency inside the bitcoin network. The issued coins in the sidechains ecosystem are not having their own exchange rate, they are backed by bitcoin. This can be compared to fixed exchange rates between gold and fiat currencies. Some developers even consider the technology could turn bitcoin into the main reserve currency of the Internet.

next