It is now a possibility that there is a postponement of the final deadline for a SEC decision.

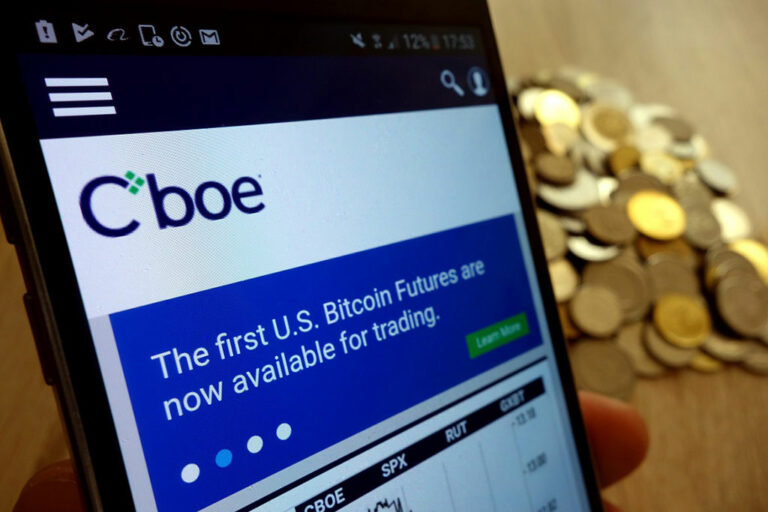

Following an earlier withdrawal, the Cboe exchange has refiled an updated application for options trading on spot Bitcoin exchange-traded funds (ETFs) listed on Wall Street. The revised application was submitted on Thursday amid growing demands for spot Bitcoin ETFs even within traditional financial markets. With such high demand, it is no surprise that there now seems to be a concerted effort pushing for options trading for many of these investment vehicles.

According to Bloomberg ETF analyst James Seyffart, Cboe has done well by updating its application. Particularly, in the way it addressed something as vital as the SEC’s apprehension toward position limits and market manipulation.

Exchanges Await SEC Decision on Bitcoin ETF Options Trading

Thursday was particularly an interesting day in the market as Cboe alongside Nasdaq and NYSE withdrew their earlier applications. It is not exactly clear why the three exchanges acted in what seemed like one accord. However, Cboe’s decision to refile suggests the reason behind the decision.

Whatever might be the case, it is now a possibility that there is a postponement of the final deadline for a SEC decision. Initially slated for September 21, the new filing may have just reset the approval timeline.

Meanwhile, Seyffart has weighed in on the new development. He noted that there is no way to confirm whether the regulator is already having talks with Cboe on this. However, he opined that there is reason to believe that the SEC might have given out some sort of feedback.

Seyffart drew his assumption from the fact that Cboe went from a 15-page application to a 44-page one. He concluded on two possible scenarios. If the SEC isn’t engaging yet, the brand new application will likely restart the approval clock. However, if the regulator actually is, then a deadline might not actually matter. He said partly:

“One downside here is that I think this restarts the clock. So deadline would move to some time at the end of April (Apr 25th-ish)”.

Positive Hopes

As Seyffart inferred from Cboe’s refiling, another Bloomberg analyst Eric Balchunas also sees the development as a good sign. Balchunas echoes similar sentiments in that the regulator wouldn’t have bothered engaging at all if they were going to outrightly deny an approval. The analyst also wrote partly:

“Just as “comments from the SEC” was a good sign in our ETF approval odds we think this is good sign here too.”

Earlier this week, Coinspeaker reported about American NYSE filing with the SEC for options trading on three Ethereum ETFs. That is, despite the gloomy state of the market.

next