Charlie Munger was clear that in his opinion: Bitcoin could not become a medium of exchange due to its volatility.

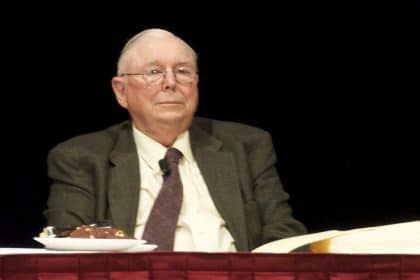

Berkshire Hathaway vice chairman and Warren Buffett‘s right-hand man Charlie Munger has criticized recent developments around Bitcoin, Tesla Inc (NASDAQ: TSLA), SPACs and trading platform Robinhood.

From his comments, it was clear Charlie Munger is not a fan of any of them. In an interview during the Daily Journal’s annual shareholder’s meeting, Charlie Munger on Wednesday condemned the current market frenzy. The long term business partner of Warren Buffet stated that he could not decide what was worse between Tesla reaching a $1T market cap or Bitcoin hitting over $50K. Tesla recorded its gains in 2020 after a 743% surge. Bitcoin on the other hand climbed above $50K soon after Tesla announced it had purchased Bitcoin worth $1.5B. The two assets price performance has been connected in recent months.

When asked about which was worse between Tesla and Bitcoin, the 97-year-old noted:

“Well I have the same difficulty that Samuel Johnson once had when he got a similar question, he said, ‘I can’t decide the order of precedency between a flea and a louse,’ and I feel the same way about those choices. I don’t know which is worse.”

Charlie Munger: I Will Never Buy Bitcoin

When asked about the future of banking, he was hesitant to give a direct answer. However, he was clear that in his opinion, Bitcoin could not become a medium of exchange due to its volatility. He further explained why he would never buy Bitcoin:

“So I don’t think bitcoin is going to end up the medium of exchange for the world. It’s too volatile to serve well as a medium of exchange. And it’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any bitcoin.”

Munger went on to talk about Robinhood blasting it as for luring novice investors. He noted that Robinhood was encouraging investors to gamble on stocks due to the stock market frenzy. In a dire warning, he stated that the activity is regrettable and would see a lot of investors lose money. On the same, he touched on GameStop stock mania that ended with its price rallying by up to 400% in a week. Munger termed it as dangerous and a dirty way to make money.

SPACs Are a Sign of a Bubble

The businessman further touched on the rising culture of SPACs. The new trend has been adopted by companies looking to go public with a guaranteed valuation. This has seen crazy speculations on the first day of trading. On top of confirming his lack of participation, he added:

“I think this kind of crazy speculation and enterprises not even found or picked out yet is just a sign of an irritating bubble…”

These comments come as no surprise. Especially on Bitcoin, as a long-time partner of Warren Buffett, his lack of understanding of the digital asset is in line. Buffett has in the past criticized Bitcoin as risky and worthless. Notably, the two are from the early generations who happen to be most critical of the digital asset. Recent generations, looking for a change in an oppressive system are most receptive to Bitcoin.