Coinbase CEO Brian Armstrong said Bitcoin has no issuer and is more independent than central banks. He called it a check on government spending.

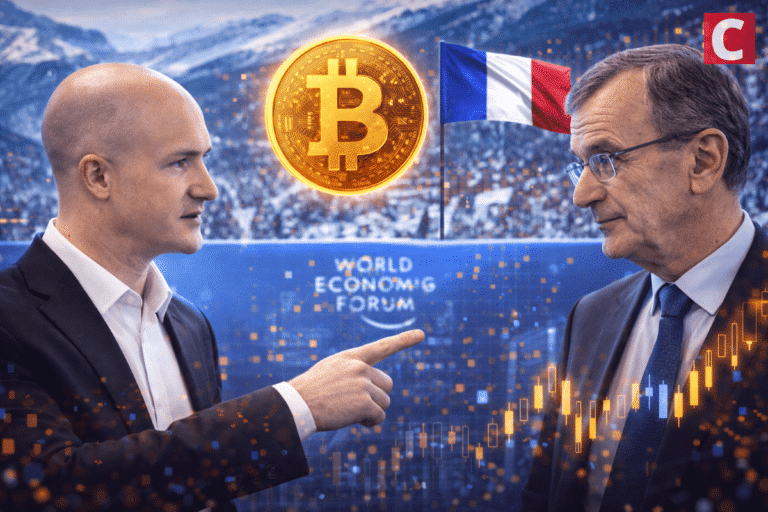

Coinbase CEO Brian Armstrong pushed back against the Governor of the Bank of France during a World Economic Forum panel on January 21 after the central banker expressed skepticism about Bitcoin BTC $67 263 24h volatility: 0.8% Market cap: $1.35 T Vol. 24h: $24.75 B by referring to its “private issuers.”

François Villeroy de Galhau stated he trusts independent central banks with democratic mandates more than what he called private issuers of Bitcoin, according to a video posted on X by Cointelegraph’s Gareth Jenkinson.

Armstrong responded that Bitcoin is a decentralized protocol with no issuer at all.

JUST IN: @brian_armstrong challenges France central bank governor on Bitcoin at World Economic Forum in Davos 🔥

François Villeroy de Galhau says "I trust more independent central banks with a democratic mandate than private issuers of Bitcoin".

Armstrong hits back: "Bitcoin… pic.twitter.com/pZXXveSVGe

— Gareth Jenkinson (@gazza_jenks) January 21, 2026

Armstrong elaborated that Bitcoin is even more independent than central banks because no country, company, or individual controls it anywhere in the world.

The exchange occurred during a tokenization-focused panel at the WEF Annual Meeting in Davos, Switzerland.

Bryan Armstrong deserves an award for evangelizing for Bitcoin at WEF in Davos.

France Central Bank governor says he trusts central banks more than 'independent issuers of Bitcoin'.

Armstrong clarifies: "Bitcoin is a decentralized protocol. There's actually no issuer of it." pic.twitter.com/m9cpkenLRE

— Gareth Jenkinson (@gazza_jenks) January 21, 2026

Bitcoin as Monetary Check

Armstrong framed the dynamic between Bitcoin and government-issued currencies as healthy competition. He argued that people can decide which they trust more. He called this the greatest accountability mechanism on government overspending.

The Coinbase CEO noted that Bitcoin lacks a money printer and has a fixed supply. He stated that people move to it during times of uncertainty, similar to how they historically turned to gold.

Villeroy de Galhau maintained that the guarantee for trust comes from central bank independence combined with accountability to citizens.

Ripple CEO Brad Garlinghouse, who also appeared on the panel, described the session as “spirited dialogue” but noted agreement among panelists that innovation and regulation are not on opposite sides.

Spirited dialogue during today’s WEF session (to say the least), but one important point of agreement across the panelists was that innovation and regulation aren’t on opposite sides.

I firmly believe this is THE moment to use crypto and blockchain technology to enable economic… https://t.co/4d3jNeNC4h

— Brad Garlinghouse (@bgarlinghouse) January 21, 2026

Davos Crypto Agenda

Armstrong arrived at Davos with plans to meet bank leaders and policymakers to advance the U.S. crypto market structure bill.

The meetings come after Coinbase withdrew support from a Senate crypto regulation bill on January 14 over concerns about rules limiting interest payments.

Armstrong said digital versions of real-world assets could expand access to investment products for billions of adults worldwide.

He indicated that the White House has been cooperative and a revised version of the legislation could emerge within weeks.

The full panel discussion is available on the World Economic Forum’s official channel.

Is Tokenization the Future? @cnbcKaren (@CNBC), @brian_armstrong (@coinbase), @bgarlinghouse (@ripple), Valérie Urbain ( @EuroclearGroup), François Villeroy de Galhau (@banquedefrance), Bill Winters (@StanChart) #WEF26 https://t.co/Ob8n7PCh1T

— World Economic Forum (@wef) January 21, 2026

next