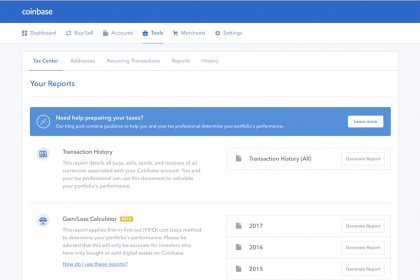

Taxes procedures for digital currencies can be not an easy deal. Nevertheless, Coinbase has found a solution for its customers – a new tax calculator.

Today cryptocurrency startup Coinbase has announced the launch of their new tax tools with a view to make reporting easier for their customers. In the U.S., gains on digital currency sales and exchanges are taxable but tax procedures for virtual assets are quite complicated. That’s why a new gain/loss calculating tool will be fitted well for users to keep up with U.S. tax requirements.

If you need to prepare tax filings Coinbase recommends to follow three steps:

Step 1. Establish a complete view of your trading activity to determine your cost basis

For doing this Coinbase provides its customers with a single report with all buys, sells, sends, and receives of all currencies associated with their Coinbase account. Nevertheless, there is a chance that transactions with payment reversals and refunds won’t be reflected in this report.

It’s also important to remember that this report will contain details only on transactions associated with Coinbase account.

Step 2. Calculate your gains/losses

There are two common approaches. The first-in-first-out (FIFO) accounting method assumes that the first assets you purchased are also the first assets you sold or exchanged. In this case user’s gain/loss is calculated based on the price paid for the oldest assets in the portfolio, and the asset price at the time of sale or exchange.

The Specific Identification (SpecID) method supposes that investors specifically identify the assets they sold or exchanged.

The sum of all the gains/losses from all of the sales and exchanges will present your gain/loss for the year.

Step 3. File your taxes

This is the last step that should be done after calculation of gains/losses on your digital assets investments.

For their customers the company offers Coinbase tax calculator that automatically calculates gains or losses based on a first-in-first-out (FIFO) accounting method.

The team warns that though their tool provides a preliminary gain/loss calculation for customers, this calculation should not be treated as official tax documentation before analyzing and approving the results with tax professionals.

Moreover, there are some factors that limit the target audience of this tool as the calculations will be accurate only for users who do not have any transactions outside of Coinbase.

The application of Coinbase tax calculator isn’t recommended for those who have purchased or sold digital assets elsewhere, who have sent or received digital assets from a non-Coinbase wallet or from other exchanges, who have stored digital assets on an external storage device or have participated in ICOs.

Coinbase team is constantly working on enhancing its clients experience and expanding its capacities. The release of the Coinbase tax calculator just follows the news about the launch of Coinbase crypto index fund that will reflect all the major trends and shifts in the cryptocurrency market.

next