Earlier on September 11, publicly traded crypto and Bitcoin mining firms saw their share price drop in reaction to the first Presidential debate between Kamala Harris and Donald Trump.

On Wednesday, September 11, crypto and Bitcoin mining stocks bounced back strongly following a dip in the early trading hours. The dip occurred following the first US presidential debate between Kamala Harris and Donald Trump.

Earlier on September 11, publicly traded crypto and Bitcoin mining firms saw their share price drop in reaction to the debate. Several opinion polls suggested that Harris was outperforming Trump in this Presidential debate. By the closing hours of trading, share prices of the public-listed crypto firm recovered from their lows.

Following the early dip and making a low of $150, shares of crypto exchange Coinbase Global Inc (NASDAQ: COIN) regained by 5.3% while returning to its pre-debate price at $157. However, on the monthly chart, the COIN share is still trading at 18% down.

Similarly, the world’s largest corporate holder of Bitcoin – MicroStrategy Inc (NASDAQ: MSTR) – saw its share price slip under $125 in the early trading hours on Wednesday. However, by the closing hours, it once again surged to $129.

Similarly, the shares of Bitcoin miners such as Marathon Digital Holdings Inc (NASDAQ: MARA) and Riot Platforms (RIOT) saw early declines but recovered by the closing hours, while closing down 0.94% and 2.07%, respectively. On the other hand, Hut 8 Mining Corp (HUT) was the sole crypto-related stock to end the day in positive territory, rising 1.29% to $10.58 after dipping to a low of $9.76.

The Trump and Harris Debate and Crypto Impact

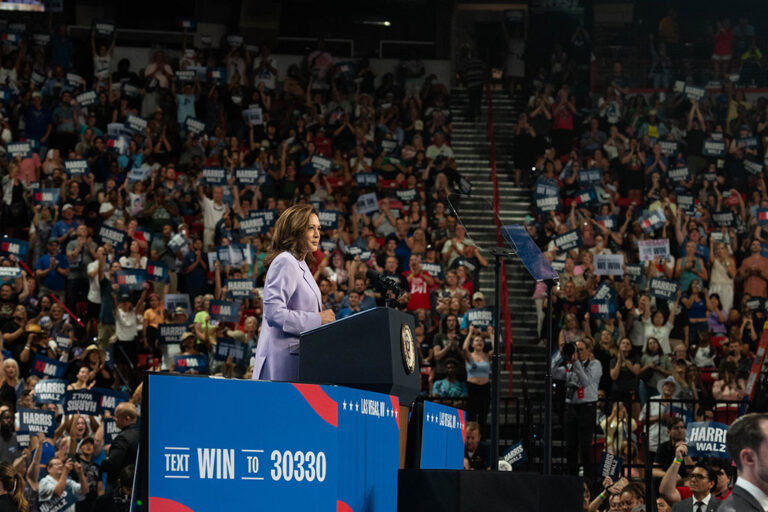

YouGov published a survey on Wednesday, September 11, showing Kamala Harris as the night’s winner with more than 54% of registered users saying Harris won, while 31% of users said that Trump won.

Photo: YouGov

CNN also conducted a similar poll which showed that a majority of the debate watchers believed that Harris outperformed Trump onstage.

The crypto industry has been backing Donald Trump for the upcoming US Presidential Elections 2024. Trump has vowed to bring clear crypto regulations with crypto-friendly policies in place. He has also said that he would support the Bitcoin mining industry while making America the crypto capital of the world. As a result, the Republican nominee has been receiving huge crypto donations for the election campaign.

On September 11, the cryptocurrency markets experienced a $60 billion drop in total capitalization but have since rebounded by 2.3%, returning to pre-debate levels. The Bitcoin price fell 3.7% following the debate, reaching an intraday low of $55,573 before recovering to $57,900 during early trading on September 12.

next