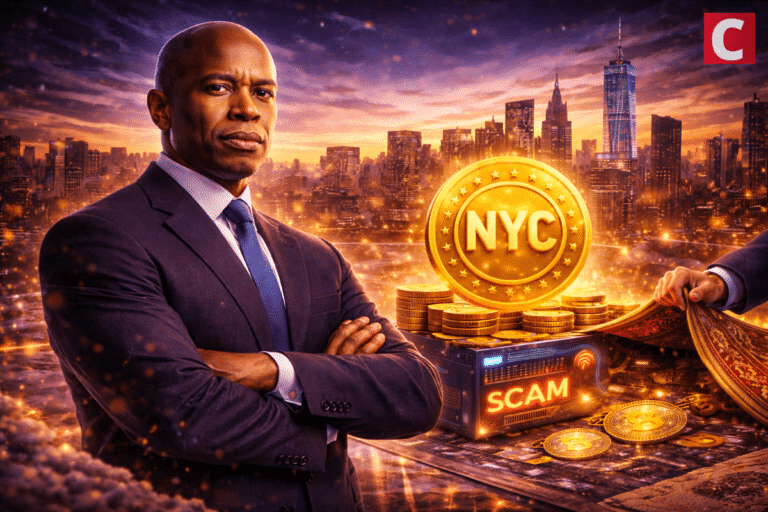

Eric Adams has denied that he conducted a rug pull on NYC Token, which tumbled 80% on the day of launch.

Former New York City Mayor Eric Adams has denied claims that he moved funds or personally profited from the NYC Token.

In a post on X published on January 14, Adams pushed back against the allegations, which surfaced following an 80% drop in the token’s value.

The sharp decline triggered significant losses for investors who held the cryptocurrency during the sell-off.

Eric Adams Denies Profiting From NYC Token After 80% Crash

On January 14, a spokesperson for Eric Adams denied allegations that he withdrew funds or profited from the NYC Token.

The token launched on January 12 and fell by as much as 80% within its first hour of trading.

Many analysts and market watchers suspected that this poor performance was connected to the former NYC mayor.

They described the 80% drop as a rug pull and accused Adams of orchestrating it. Some crypto analysts claim liquidity was removed, with on-chain estimates suggesting investor losses exceeded $3.4 million.

In response to the accusations, Todd Shapiro, a spokesperson for Adams, released a statement.

Statement from Todd Shapiro, spokesperson for former NYC Mayor Eric Adams: pic.twitter.com/kza4UGvApJ

— Eric Adams (@ericadamsfornyc) January 14, 2026

“To be absolutely clear: Eric Adams did not move investor funds. Eric Adams did not profit from the launch of the NYC Token. No funds were removed from the NYC Token,” Shapiro shared on X on January 14.

He described the accusations as “false and unsupported by evidence.” In his statement, he clarified that the ex-mayor’s involvement at every point was never intended for personal or financial gain.

Shapiro blamed the NYC Token crash on market volatility, citing that it was normal with newly launched digital assets.

Rug Pulls Plague the Crypto Market

Several crypto projects have faced rug pull accusations in recent months, including the Trump family–linked TRUMP TRUMP $3.42 24h volatility: 1.3% Market cap: $794.71 M Vol. 24h: $151.59 M and MELANIA [NC] tokens.

In April 2025, the MELANIA token, launched by Melania Trump, drew criticism after on-chain data showed large holders profiting from liquidity withdrawals, raising concerns among investors.

At the time, eight wallets sold 6.72 million MELANIA tokens worth $4.2 million by repeatedly adding and removing liquidity over a 25-day period.

In September, the crypto community also raised concerns about a potential rug pull involving World Liberty Financial (WLFI).

However, no concrete evidence emerged, as the project did not exhibit typical rug pull behavior such as sudden liquidity withdrawals, disabled transfers, abandoned communication channels, or treasury drains.

next