The digital currency ecosystem is also seeing a massive bullish correction with Bitcoin (BTC) trailing the broad market indices in the rally post interest rate hike.

The May Federal Open Market Committee (FOMC) meeting has stirred the Federal Reserve to increase the interest rate by 50 basis points, double the 25 basis points increment instituted back in March. The rate hike became more necessary than ever considering the level of inflation with the Consumer Price Index (CPI) pegged at 8.5% as of March’s record.

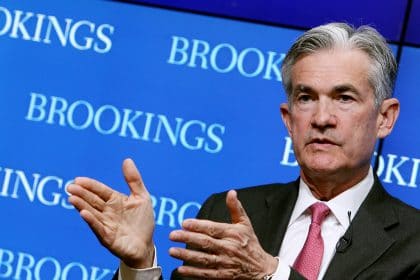

“Inflation is much too high,” Fed Chair Jerome Powell said during a press conference following the release of the statement. “It is essential we bring inflation down if we are to have a sustained period of strong labor market conditions that benefit all.”

Since the Fed started talking about tightening its monetary policies, there has been speculation that there will be at least 4 different rate hikes this year, and the latest increase shows the Fed’s commitment to its projections.

The stock market indices are seeing a rejuvenation in growth today following the interest rate hike as analysts believe the Feds have interacted with the financial landscape with utmost transparency. This takes precedence from Powell’s note that the apex banking is not at any point considering a 75 basis points interest rate hike.

The S&P 500 Index (INDEXSP: .INX) closed Wednesday’s session up 2.99% to 4,300.17. The Dow Jones Industrial Average (INDEXDJX: .DJI) also recorded a 2.81% growth to 34,061.06 while the tech-heavy Nasdaq Composite (INDEXNASDAQ: .IXIC) jumped by 3.19% to 12,964.86.

“50 basis points was priced in the market, so that was expected,” Jeffrey Howard, head of institutional sales and business development at OSL, said. “The market rallied initially and then has sold off just a little bit since then because there are some more hawkish comments coming out regarding a potential 75 basis point hike on the next meeting.”

Bitcoin Trails Market Indices in the Rally

The digital currency ecosystem is also seeing a massive bullish correction with Bitcoin (BTC) trailing the broad market indices in the rally post interest rate hike.

The premier cryptocurrency is up 2.05% to $39,589.04, Ethereum (ETH) joined the rally with a 3.82% growth to $2,934.67 while Solana (SOL) and Avalanche (AVAX) printed 6.83% and 9.28% growth to $93.20 and $66.78 respectively.

Interest rate hikes are particularly a sensitive subject for the digital assets industry as hiked rates are aimed at tapering inflation which typically favors investors’ sentiments who acquired BTC as a hedge against inflation. It is unknown what is stirring the growth of the nascent asset class despite this supposedly bearish fundamental, but the potential outlook of the crypto industry has shown that investors are not going to sit to affect their pace of accumulation of digital currencies in the medium term.

next