Currently, Lightning Labs’ new desktop app, allowing for easy Bitcoin transactions, works on MacOS, Windows, and Linux devices, with applications for mobile devices already being planned.

Lightning Labs, the company behind the network that maintains and contributes to Bitcoin‘s core decentralization property, has announced the launch of the alpha version of its Lightning App for desktop on Bitcoin mainnet.

The desktop application leverages Neutrino that ‘allows non-custodial Lightning wallets to verify Bitcoin transactions with improved privacy, minimized trust, and without needing to sync the full Bitcoin blockchain’.

According to Lightning Labs, the initiative corresponds to the principles of privacy, security, and self-determination.

The company’s blog post reads:

“For that we need to go beyond custodial solutions and enthusiast guides and deliver a great user experience for everyone. Scaling Bitcoin and Lightning to everyone means not requiring people to follow complex setup processes or hand over control of their funds to trusted counterparties.

For everyone to truly explore what is possible with the Lightning Network, we needed to build a wallet that knocks down these barriers-to-entry and demonstrates what is possible when technology fights for the user.”

Initially, the app was already used on the Bitcoin testnet in order to test apps with ‘fake Bitcoins’. But now users are able to really use the services on their real Bitcoins.

The app is fully non-custodial, which means users will have full control over their Bitcoins and will be able to send and receive them easily. Developed by Valentine Wallace and Tankred Hase, the app is still ‘an early version targeted at testers’. Currently, it works on MacOS, Windows, and Linux devices, with applications for mobile devices already being planned.

New App’s Features

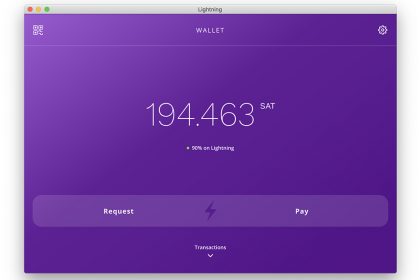

As for features offered by Lightning Labs’ new product, they include background Neutrino sync, unified home screen balance, mainnet by default, and the improved autopilot feature.

Now it is easier for users to keep track of how much Bitcoin they have on-chain or in payment channels, with the latter demarcated by a percentage under the aggregate balance. They will also be able to check how many satoshis are on each channel with the app’s channel page.

But the main update is the wallet’s use of Neutrino.

Tankred Hase, lead application engineer at Lightning Labs, explained:

“Without Neutrino, a non-custodial solution required using the command line interface, setting up your own Bitcoin + Lightning full node and the configuring of a third-party app to connect remotely to your node. That process was very technical and required way too many steps for average users. Neutrino allows us to bundle everything up into one app that users can open with a double click.”

Further, Hase noted that there is still a lot to work on, as the technology is quite young and risky. He said:

“It’s still the very first release and now is the time to iterate and start learning.”

In the nearest future, Lightning Labs is planning to integrate Lightning Loop, the feature that will enable users to receive Bitcoin in increasing quantities without having to close and reopen new payment channels. Alpha release of Lightning Loop took place in March.

Earlier, Lightning Labs launched the beta version of its software called Lightning Network Daemon (LND).

next