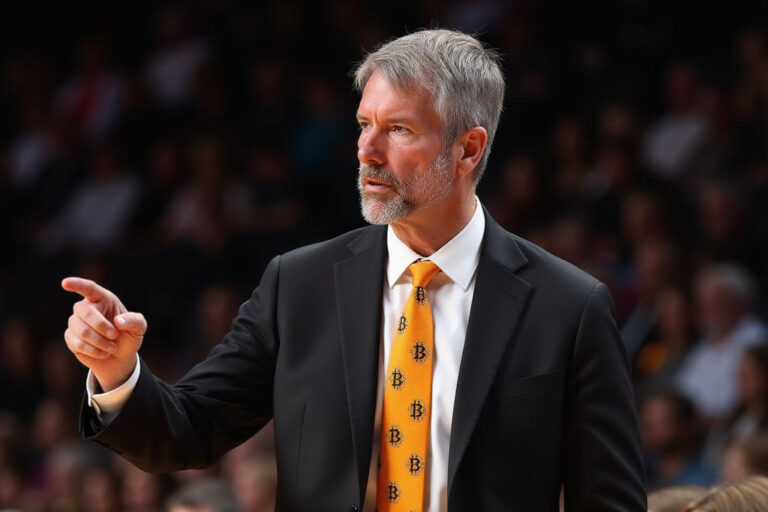

Michael Saylor, once an advocate for Bitcoin self-custody, has now shifted gears stating that “too big to fail” banks should take up the task of Bitcoin custody.

Michael Saylor, the executive chairman of MicroStrategy, has recently faced strong backlash from the Bitcoin community for supporting banking giants to gain control of Bitcoin BTC $67 659 24h volatility: 0.8% Market cap: $1.35 T Vol. 24h: $39.35 B custody. This was basically a pivot from his previous stance of supporting self-custody.

During his interview on Monday, October 21, Saylor made a controversial suggestion noting that Bitcoiners will have nothing by transfering their BTC to institutions. Saylor has been championing Bitcoin over the past four years. However, his recent comments have been in contrast to his previous suggestion of supporting crypto self-custody.

Following the collapse of FTX in November 2022, Saylor stated that Bitcoin self-custody protects the network from being compromised by powerful custodians. “If you can’t self-custody your coin, there’s no way to establish a decentralized network,” Saylor added.

During the interview, financial markets reporter Madison Reidy asked Saylor whether the US government might strip Bitcoin holders of their self-custody rights. Responding to this, Saylor said that anybody thinking about a state-sponsored Bitcoin seizure is possible is a “paranoid crypto-anarchist”. He added:

“It’s a myth and a trope that goes on over and over again. There’s just a lot of fear that’s unnecessary.”

Commenting further, Saylor stated that instead of relying on hardware wallets, it would be better to rely on “too big to fail banks engineered to be custodians of financial assets”.

This was a major trigger point leading to Saylor’s criticism across the crypto market. Sina, the founder of Bitcoin custody and security firm 21st Capital stated that “Saylor is on a mission to relegate Bitcoin into an investment petrock and halt its usage as a currency”.

Michael Saylor, the leading voice and influencer on Bitcoin by a mile, says:

💀You don't need to self-custody

💀You should trust government and institutions

💀Government would never confiscate your custodial Bitcoin

💀You're a "paranoid crypto anarachist, and a profit-driven… https://t.co/mRdgUPgC5n— Joel Valenzuela (@TheDesertLynx) October 21, 2024

In recent times, some of the top Wall Street banks like BNY Mellon have secured licenses to crypto custody.

Community Backlash against Michael Saylor

Popular Bitcoiner Simon Dixon stated that Michael Saylor was undermining the importance of self-custody as it wouldn’t benefit MicroStrategy’s long-term plans of converting itself into a Bitcoin bank and offering collateralized loans. “Bitcoin anarchists: keep helping people gain freedom from banks, governments & central banks,” added Dixon.

John Carvalho, CEO of Bitcoin payments firm Synonym, criticized Saylor’s shift in stance, pointing out that Saylor once promoted the idea that “Bitcoin is hope” for everyone. He added:

“I am curious what exactly that means if we must discount the ‘paranoid crypto anarchists’ and their ‘tropes’ as salesmen with ulterior motives.”

However, others tried to cover up Saylor that the crypto community is stretching his message more than required. Julian Figueroa, founder and host of “Get Based,” noted that Saylor’s message was directed towards institutions rather than individual users.

“Institutions are not and never will be anarchists. Small businesses and plebs can have hardware wallets and sovereignty [but] 200+ employee institutions, pensions or wealth funds will need bitcoin banks,” he said.

next