The Lightningbox by Storm Partners will support large-scale web3 adoption in Geneva backed by top investors led by Circle.

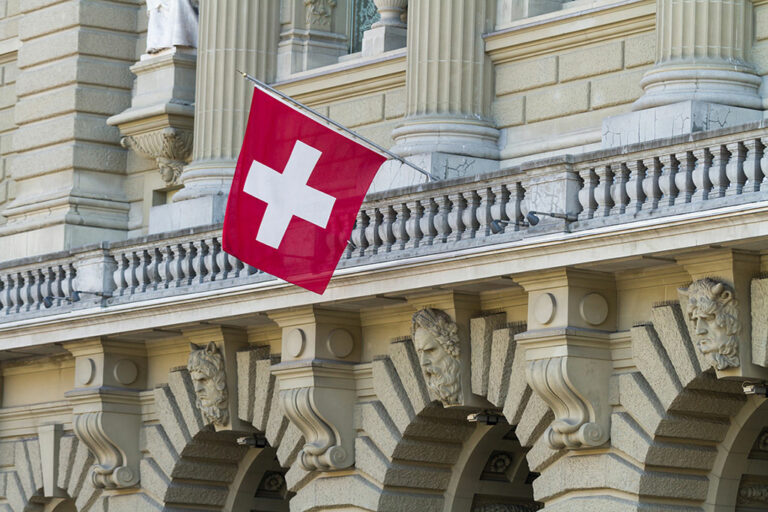

Storm Partners, a Switzerland-based blockchain solution provider, announced a new initiative during the Decentral House’s Web3 Corporate Innovation Day in Geneva. The new initiative by Storm Partners is a web3 innovation Sandbox dubbed Lightningbox to foster a seamless adoption of blockchain technology in Geneva.

Some of the early contributors of the Sandbox include Hacken cybersecurity firm, MutliversX, and Circle Internet Financial – the issuer of the USDC stablecoins.

However, the company did not reveal the exact amount of cash raised for the new initiative. Notably, Lightningbox intends to grow as an innovative web3 hub, with three initial pillars including impact, consumer, and finance. Moreover, the market demand for these pillars remained high in different jurisdictions.

“We are witnessing a major technical revolution, driven primarily by advancements in emerging technologies, which is reshaping industries on a global scale,” Sheraz Ahmed, the managing partner of Storm Partners, noted.

Ahmed further noted that the strategic location of Geneva makes it ideal for web3 innovation and development. Moreover, Geneva has over the years attracted notable attention from major institutions such as top-tier private banks, the United Nations, and the World Economic Forum (WEF).

“Giga is very pleased to see more corporate interest in innovation and blockchain in Geneva. We think that the blockchain ecosystem can help propel Geneva to new heights in finance, international relations, and technology,” Chris Fabian, the co-lead of Giga, noted.

Storm Partners and Web3 Industry

Over the past few years, Storm Partners has established itself as a go-to comprehensible blockchain solutions provider in Europe. The Storm Partners brings together innovators across different fields needed to grow a blockchain project including legal experts, investor relations, marketing team, and business development leads.

As a result, Storm Partners has worked together with dozens of Web3 projects such as OKX, Diablo, Nested, DAO Maker, Elrond, Vodafone, and AAVE, among many others.

The Web3 space has reached a flexing stage where clear global regulations have attracted significant attention from institutional investors seeking to diversify portfolio investments. Moreover, the Web3 ecosystem is projected to grow to a trillion-dollar industry in the coming years, amid the mainstream adoption of digital assets.

Market Picture

The Web3 space has evolved in the past few years amid the emergence of dozens of multi-chain blockchains led by Solana (SOL), Binance Smart Chain (BSC), Toncoin (TON), Cardano (ADA), and XRPL, among many others.

The need for seamless tokenization of real-world assets (RWA) on different blockchains has increased the overall cryptocurrency investment. Moreover, blockchain technology seamlessly traverses the traditional borders as anyone with internet access can seamlessly navigate through the web3 space with minimal interference from governments.

According to market data provided by DefiLlama, more than $102 billion has been locked in different blockchains by various web3 projects.

next