Adams said that despite the Republicans’ efforts, Biden can still turn the tables around if he can reverse his stance on crypto and rein in the SEC and Senator Warren’s anti-crypto efforts.

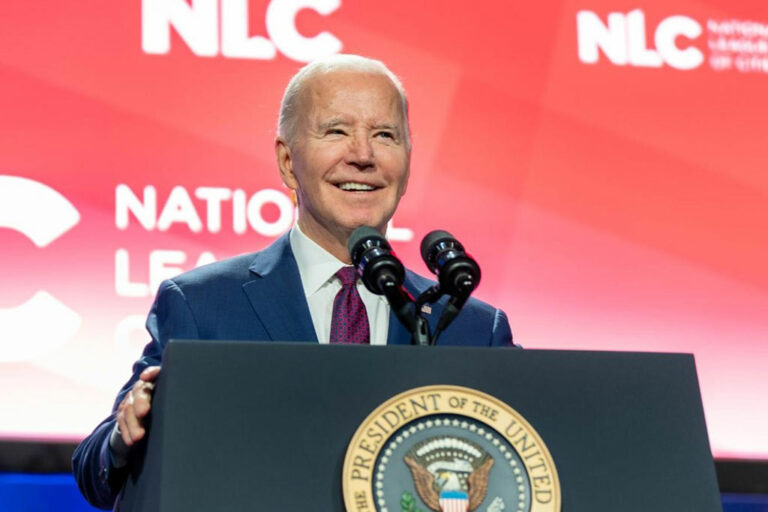

The Biden administration has been under fire, especially after former US President Donald Trump leveraged Joe Biden’s perceived anti-crypto stance as a campaign tactic to sway voters ahead of the November elections.

Last Wednesday, the Democratic government publicly announced its lack of interest in the emerging economy, revealing their plans to overhaul any existing legislation allowing banks to custody cryptocurrencies in the country if re-elected in the upcoming presidential election.

The government’s apparent aversion to the crypto sector has drawn criticism from industry figures like Uniswap founder Hayden Adams. In a lengthy post on X, he condemned Biden’s approach to crypto regulation, likening it to a significant “political misstep”.

Underestimation of Crypto’s Electoral Impact

Adams compared Biden’s approach to crypto regulation to Hillary Clinton’s focus on campaigning in traditionally Republican states (red states) rather than swing states during her presidential campaign.

He argued that the Biden administration underestimates the role crypto will play in the 2024 election, hence their lack of urgency in addressing regulatory concerns.

The Uniswap founder disclosed that while the Democrats are hesitant to embrace crypto, the Republicans are capitalizing on the opportunity to grow their supporters by intensifying their support for the emerging economy. In his words, the “Republicans smell blood in the water and are turning hard towards crypto”.

He further noted that Trump and his Republican party are taking advantage of the Securities and Exchange Commission (SEC) and Senator Elizabeth Warren’s hardline stance against crypto to garner more support from members of the crypto community.

Call for Immediate Action

Adams said that despite the Republicans’ efforts, Biden can still turn the tables around if he can reverse his stance on crypto and rein in the SEC and Senator Warren’s anti-crypto efforts.

He called on those close to the US president and within the Democratic leadership to recognize the seriousness of the issue and advocate for an immediate reversal of Biden’s crypto stance to survive the upcoming election.

“Not much time for Biden to save it. Any one close to him or their leadership should be expressing how serious this is and pushing for immediate reversal on his approach to crypto (public support/plan and reigning in sec + warren),” he wrote on X.

Election Forecast: Trump Leads Biden in Key States

Meanwhile, recent polling data suggests that if the 2024 presidential election were held today, Trump would secure victory over Biden to reclaim the White House.

A report from the New York Times on Monday revealed that the former US president emerged victorious in five out of six crucial US states polled by the news media between April 28 and May 9, 2024.

The polling data, which included registered voters from diverse racial backgrounds, showed Trump winning support from both White and Black Americans in Michigan, Arizona, Nevada, Georgia, and Pennsylvania. In contrast, Biden only managed to secure victory in one battleground state Wisconsin.

next