Argo plans to use net profits generated from the deal for corporate affairs. The company said that part of the profits will be dedicated to catering to the company’s needs, operations, and other corporate purposes.

Argo Blockchain, a publicly traded Bitcoin mining company, plans to raise £6.5 million (nearly $7 million) from an undisclosed institutional investor to settle debts owed to Galaxy Digital and for other corporate purposes.

On Tuesday, the company, which is listed on both Nasdaq and the London Stock Exchange (LSE), announced that the funds will be primarily raised through a private share placement.

Details of the Private Share Placement

The arrangement includes the issuance of 57,800,000 ordinary shares at a price of £0.1125 per share on the LSE, as well as warrants to buy an additional 57,800,000 shares at the same price. The warrants have an exercise period of five years.

The placement price is set at a premium to Argo’s recent trading averages but comes at a 10% discount to the closing price on July 29. According to the announcement, H.C. Wainwright & Co. is acting as the exclusive placement agent for the transaction.

The company anticipates that the placement shares will be admitted to trading on the London Stock Exchange’s Main Market by approximately July 31, 2024.

Once the shares begin trading, Argo plans to use net profits generated from the deal for corporate affairs. The company said that part of the profits will be dedicated to catering to the company’s needs, operations, and other corporate purposes.

Repaying Galaxy Digital

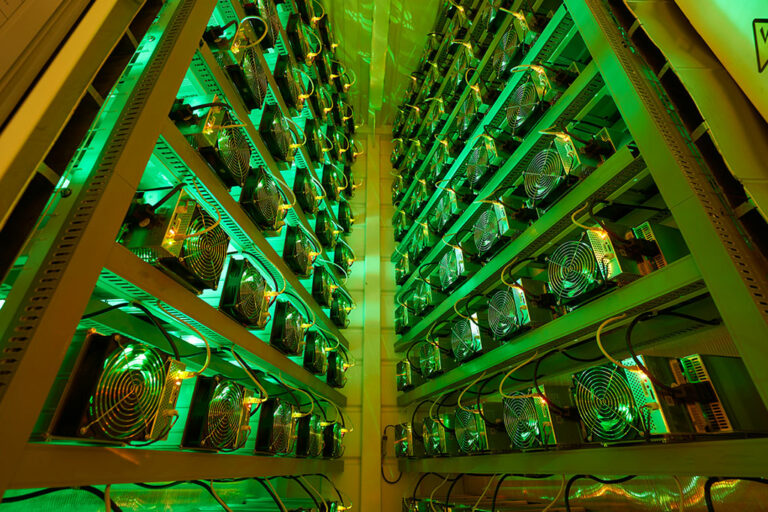

Additionally, Argo plans to repay its loan of $35 million owed to Galaxy Digital. The company obtained a loan from the firm in 2021 to expand its operations without having to sell its Bitcoin (BTC) holdings.

However, troubles began in paradise in 2022 when the industry faced a massive crypto winter, which saw Bitcoin and Ethereum hit new lows after their previous highs of nearly $70,000 and $4,000 the previous year. As a result of the market decline, the crypto mining company failed to generate profits to repay the loan. Since then, Argo has been making efforts to refund the loan and remain profitable for investors who trust in the company’s vision.

Argo Sells Bitcoin Mining Site for Loan Repayment

Before the recent funding, Argo had paid around $4 million to Galaxy Digital in March this year. At the time, its remaining debt totaled around $14 million.

The funds were generated through the sale of one of the company’s Bitcoin mining facilities located in Quebec for more than $6 million. The site, known as the Mirabel Facility with an energy capacity of five megawatts (MW), was sold to an unknown buyer, with some of its staff relocated to the company’s Baie Comeau facility in Quebec.

next