With plans for further expansions in Ethiopia and beyond, BIT Mining is preparing for sustained growth in the global crypto mining industry.

BIT Mining, a leading cryptocurrency mining company, has made a significant move to expand its operations in Africa, successfully completing the first phase of its acquisition in Ethiopia.

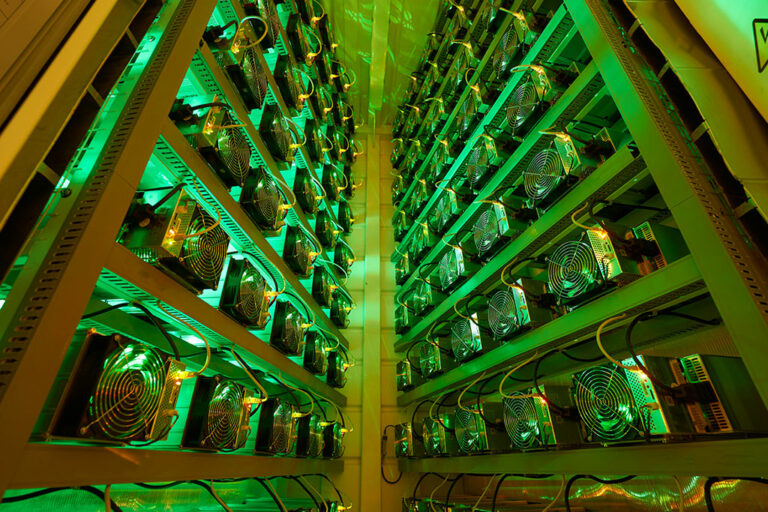

The company announced in a press release that it has acquired a significant stake in a 35-megawatt operational crypto mining data center and 17,869 Bitcoin BTC $68 540 24h volatility: 0.2% Market cap: $1.37 T Vol. 24h: $36.86 B mining machines as part of its ongoing expansion strategy.

BIT Mining to Complete Acquisition Deal Next Year

According to the release, the first phase of the acquisition is valued at $2.265 million in cash, alongside 369,031,800 Class A ordinary shares issued to the sellers. The move marks a crucial step for BIT Mining as it increases its mining capacity and strengthens its presence in Ethiopia’s growing digital asset market, a region increasingly seen as a hub for blockchain and crypto activities.

BIT Mining has made it clear that this acquisition is just the beginning. The company is moving ahead with plans to acquire additional data centers in a second phase, expected to be completed by March or April 2025. This next phase will add another 51 megawatts of data center capacity to the company’s portfolio, further increasing its mining capabilities.

Upon closing the second phase, the crypto miner will issue an additional 45,278,600 shares, making it a substantial deal for both the company and its investors.

BIT Mining Adds LTC and DOGE to Its Portfolio

The new data centers will provide BIT Mining with the infrastructure needed to scale its mining operations. As part of this strategy, the company aims to tap into the growing demand for Bitcoin and other cryptocurrencies globally.

The energy-efficient and operationally optimized facilities are positioned to support BIT Mining’s long-term growth and profitability in the competitive crypto mining industry.

Alongside the expansion in Ethiopia, BIT Mining has also been successful in its ongoing mining ventures. The company has recently ramped up its mining activities for Litecoin LTC $55.01 24h volatility: 0.4% Market cap: $4.21 B Vol. 24h: $332.22 M and Dogecoin DOGE $0.10 24h volatility: 2.3% Market cap: $16.98 B Vol. 24h: $1.32 B with impressive results.

According to a recent announcement, in the past year, BIT Mining reported that it had mined a total of 84,485.42 LTC and over 227 million DOGE, benefiting from significant price rallies in both of these cryptocurrencies. Litecoin and Dogecoin prices have surged by 73% and 117%, respectiQvely, in the past 30 days, further driving the profitability of BIT Mining’s operations.

BIT Mining continues to strengthen its market position amid this crypto rally, expanding its mining infrastructure to capitalize on the sector’s robust growth momentum. In the past week alone, the company’s stock saw a 29% increase, reflecting strong investor confidence in its expansion strategy and its ability to capitalize on the rising value of cryptocurrencies.

Meanwhile, BIT Mining’s expansion efforts come at a time when the global crypto mining industry is undergoing rapid change. Companies are racing to secure mining resources and energy-efficient technologies to stay competitive.

next