Bithumb eyes US expansion through a potential listing on the country’s stock exchange Nasdaq in 2025.

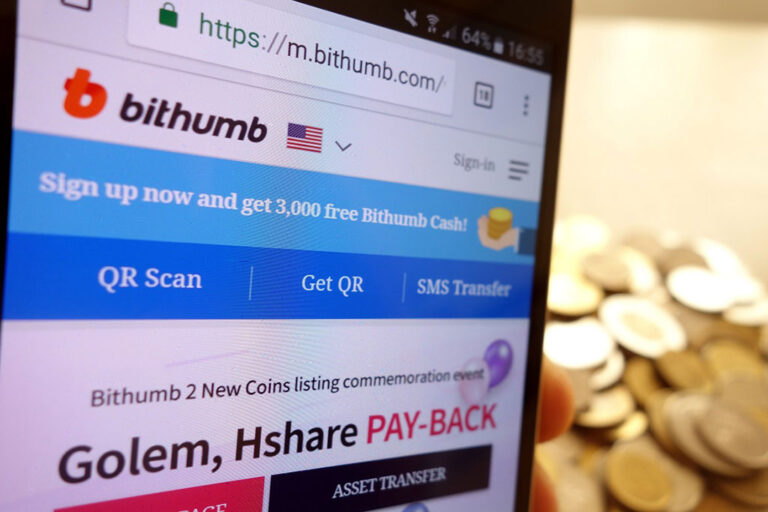

Bithumb, South Korea’s second-largest cryptocurrency exchange, is reportedly gearing up for an ambitious expansion into the United States through a planned initial public offering (IPO) on Nasdaq. The exchange disclosed its intention at an extraordinary shareholders’ meeting on September 30.

As per local media reports, Bithumb has appointed Samsung Securities, the financial services arm of the Samsung Group, as the lead underwriter for the deal which could take place in the second half of next year.

Strategic Move for Global Growth

Bithumb’s leadership considers the IPO an essential milestone in its quest to become a global leader in the crypto industry. The funds raised from the public listing will likely be used to scale the company’s operations, enhance its trading platform, and cater to the growing global demand for digital assets and related services.

Domestically, the company holds a significant market share ranging from 10% to 20%, second only to Upbit, the largest crypto exchange in South Korea. However, a successful Nasdaq listing could dramatically increase Bithumb’s international presence and cement its status within the industry.

According to reports, the exchange first initiated its IPO plans in March of this year when it spun off its Human Resources department to create a new corporate entity. This move was aimed at enabling Bithumb to focus on its core crypto trading business while allowing other business segments to operate under a separate entity.

Bithumb is reportedly considering names such as “Bithumb A” or “Bithumb Investment” for this new entity, which will manage the company’s holding, investment, and real estate brokerage divisions.

Global Expansion on the Horizon

While the Nasdaq IPO is a major focus, Bithumb’s leadership also indicated that they are exploring other potential listing opportunities, both domestically and internationally.

“Regarding the listing, all possibilities are open, not only within South Korea but also overseas,” a company official said during the meeting.

Bithumb had previously attempted to list on South Korea’s Kosdaq exchange in 2020, but those plans were derailed due to regulatory complications.

At the time, the South Korean financial authorities raised concerns about the company’s legal standing after its former chairman, Lee Jeong-hoon, was implicated in an $82 million fraud investigation.

Rebranding Efforts Underway

In addition to the plans for international expansion, Bithumb is also undergoing a brand refresh. The company said during the shareholders meeting that it will change its official name from “Bithumb Korea” to simply “Bithumb”, marking a renewed effort to streamline its corporate identity.

Meanwhile, this is not the first time Bithumb has rebranded. In 2019, the company changed its name from BTC Korea.com to Bithumb in an effort to modernize its brand and align with its evolving business goals.

next