The Phoenix public offering comes when the appetite for IPOs in the Persian Gulf region has increased in the past two years due to a number of factors.

Shares of cryptocurrency mining company Phoenix Group soared 50% on Tuesday following the company’s public debut in Abu Dhabi, Bloomberg reported. According to the article, the company’s stock opened at 2.25 dirhams, showing a significant increase from the 1.50 dirhams it sold during the initial public offering (IPO) on the Abu Dhabi Securities Exchange (ADX) under the trading symbol PHX on November 5.

Abu Dhabi’s IHC Acquires 10% Stake in Phoenix

During the IPO, the crypto mining firm raised a total of 1.36 billion dirhams worth around $37 million.

Phoenix said the offering was closed with a massive oversubscription of 33 times more than expected, implying orders valued at $12 billion on November 18. The company had initially estimated a post-IPO valuation of approximately $2.47 billion.

Part of the IPO allocated to retail investors was also oversubscribed 180 times, signaling investors’ confidence in the firm, while professional investors amounted to a 22-fold oversubscription.

Aside from the investors who participated in the public offering, the International Holding Co., Abu Dhabi’s largest conglomerate, controlled by a prominent emirate’s royal family member, acquired a 10% stake in Phoenix in early October before the IPO.

Phoenix described the just-concluded IPO as “more than an achievement; it’s a launching pad for Phoenix Group’s global aspirations.”

According to Bloomberg, the company’s public offering comes when the appetite for IPOs in the Persian Gulf region has increased in the past two years due to a number of factors, including elevated oil prices, government initiatives to privatize state-owned enterprises, and robust demand from investors.

However, the regional boom starkly contrasts with the global listings market, grappling with subdued activity due to aggressive interest rate hikes and concerns about economic growth.

Expansion Plans and Vision

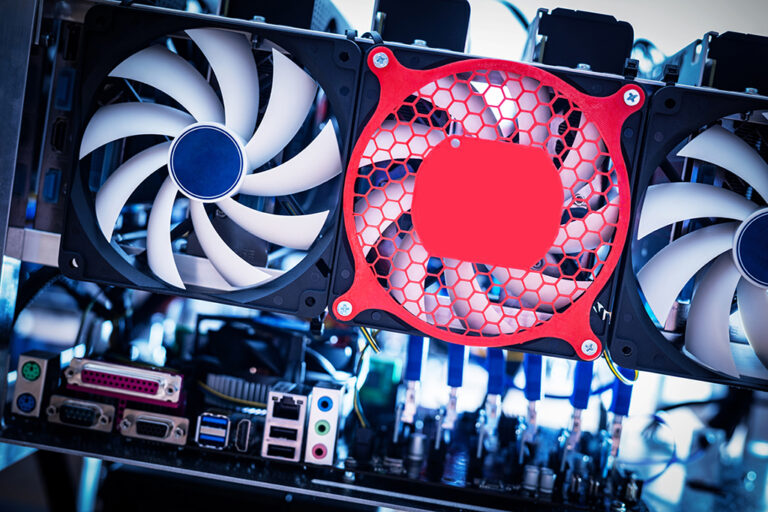

Phoenix said in a press release on December 4 that it will expand its business in the future to focus on innovation in Bitcoin (BTC) mining, renewable energy ventures, and strategic acquisitions.

“As we approach our IPO, we’re thrilled to unveil our ambitious vision for the future. Anchored by four pillars – innovation in Bitcoin mining, renewable energy ventures, advanced manufacturing capabilities, and strategic acquisitions – we’re poised to redefine the technology landscape,” said Bijan Alizadehfard, co-founder of Phoenix Group.

To further expand its footprint in the United Arab Emirates, the company has entered a joint venture with the Abu Dhabi government to exemplify the successful fusion of public policy and private sector innovation.

Launched in 2017 by Bijan Alizadeh Fard and Munaf Ali, Phoenix has become a key player in the crypto mining and blockchain sector, known for its development of innovative solutions that drive the adoption of the emerging economy around the world. The UAE-based firm has successfully developed and implemented proprietary blockchain technologies and advanced crypto-mining operations globally.

The company is currently working on building one of the biggest digital asset mining facilities in the Middle East.

next