Now, people can securely lend Ethereum, which is expected to boom cryptocurrency lending in the next few years.

Experts expect a boom of cryptocurrency lending in the next few years. As Ether’s popularity is growing (this concerns Asian countries like China, South Korea and Japan in particular), this will likely drive the demand for lending Ether up.

People used to avoid Ether lending as well as any cryptocurrency lending, as no one could really ensure that the borrower would pay the loan back. Now, EthLend offers service to change the situation.

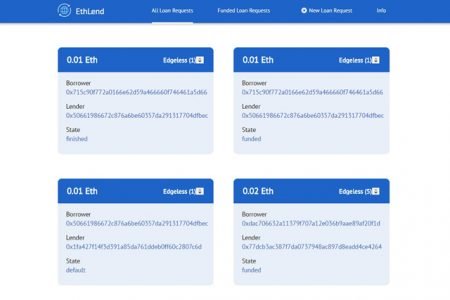

EthLend focuses on the secured lending to Ethereum users. The whole process looks as follows: borrower issues a loan request that creates a Smart Contract on the Ethereum Blockchain. The borrower inputs such data as loan amount, premium (interest rate) and time to borrow, to the Smart Contract.

The borrower then inserts the Digital Token address and the amount of tokens that serve as a guarantee. Once all the necessary data is set, the borrower can transfer the Digital Tokens to the Smart Contract. Now, lenders can fund the loan.

If the borrower breaks the deal and doesn’t pay the loan back, the Smart Contract transfers the Digital Tokens to the lender’s Ethereum address. The lender decides either to hold or to sell the Digital Tokens on Cryptocurrency Exchange to cover any losses.

Thus, EthLend is a decentralized blockchain-based application where data is not stored on centrally located serves. This means that even EthLend cannot move the tokens from the Smart Contract.

Customers can currently get access to EthLend through MetaMask, a Google Chrome Plugin serving as a bridge between Ethereum Network and the browser. There is a fee of 0.01 Ether for each loan request, and 0.01 Ether fee for funding a loan set to further funding EthLend development.

What the EthLend team is working on now is Credit Token System, a reputation management for the borrowers. Both borrowers and lenders receive 0.1 Credit Tokens for every repaid loan that amounts to 1 Ether. This means that active lending would amount to Credit Tokens that can be used as a collateral. Borrowers can “spare” other Digital Tokens and borrow against reputation of repayments.

The company is planning to launch an Initial Coin Offering later this year. It will provide a profit sharing structure for the coin holders and discounts of the loan requests and funding fees.

EthLend was created by Stanislav Kulechov, a law student at the University of Helsinki. Stanislav leveraged his interest in blockchain and provided consulting services to Finnish companies and to the legal industry.

next