Cuban argued that the failure of the SEC to set “clear regulations” was what caused investors to lose their money in the FTX collapse.

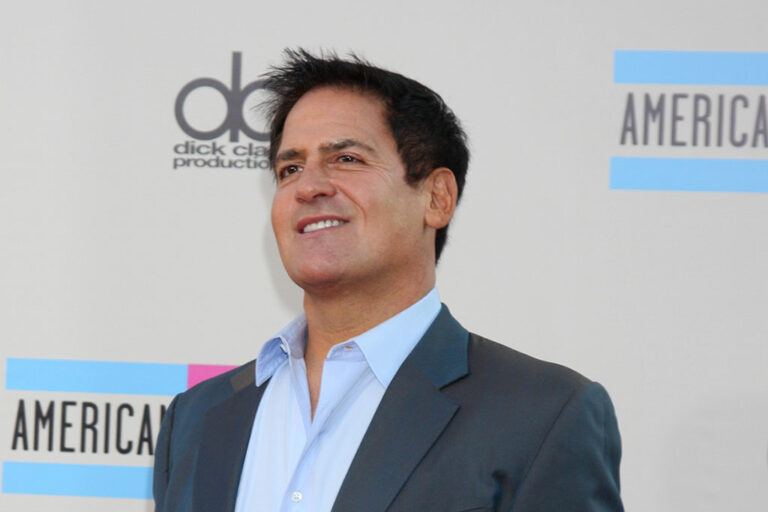

Billionaire businessman Mark Cuban has been seen having a public debate with former SEC official John Reed Stark. The debate which took place on Twitter, bordered on the role of regulators, such as the United States Securities and Exchange Commission (SEC), on the collapse of FTX and the likes.

Crypto Regulation: Mark Cuban Urges SEC to Take a Cue from Japan

Stark had earlier suggested that cryptocurrencies, stablecoins, and even CBDCs do not have any real use. And that, even worse, the industry operates without regulation. This, according to Stark, was always a recipe for disaster as there couldn’t be any proper consumer protection.

Cuban then argued that the failure of the SEC to set “clear regulations” was what caused investors to lose their money in the FTX collapse.

To buttress his claim, Cuban noted how Japanese regulators have shown the world the right way to regulate. He wrote in part:

“When FTX crashed, NO ONE IN FTX JAPAN LOST MONEY.”

Furthermore, Cuban claims that things could have ended better for investors if the USA/SEC had followed Japan’s example by setting clear regulations. That is regulations that will ensure the separation of customer and business funds and clear wallet requirements.

According to the businessman, the SEC took the wrong approach by litigating to regulate, and that has ultimately cost billions.

Stark Replies

Meanwhile, Stark has also fired back. The ex-SEC employee says Cuban might be overreaching by blaming the SEC for the collapses of FTX, BlockFi, Celsius, Terra, and others.

Admittedly, Stark believes the regulator may have made some mistakes in its approach. However, he also insists that the regulator did save investors “millions, perhaps even billions” in crypto losses.

Stark also points to the fact that the crypto industry is undecided in its quest for regulatory clarity. He says that the industry has a tradition of crying foul whenever rules are proposed, often resorting to lawsuits to fight the rules.

For example, Stark mentioned how the recent cases of Binance and Coinbase. He says the SEC made it clear many months ago that they were not in compliance. However, after recently charging them, the crypto industry began wailing again.

Overall, Cuban has suggested what he feels is the “best way” to prevent the insecurities of cryptocurrency. The entrepreneur says that can only be achieved by implementing “bright line investor protection regulations”.

next